Back in the saddle, here are my morning reads:

• The Market Looks Toppy Fundamentally And Technically (Comstock Funds)

• Following the Investment Herd Isn’t Always a Bad Idea (WSJ)

• Apple v. Samsung: The infringing device scorecard (CNet) see also Triple damages and injunctions: what comes next for Apple and Samsung (Gigaom)

• Obama or Romney? Markets don’t care (Market Watch)

• A Nation Adrift From the Rule of Law (WSJ) see also Why No Prosecutions (Credit Slips)

• Best Buy Wants You to Stop Using Its Stores as Showrooms (New Deals)

• 26 Internet safety talking points (Dangerously Irrelevant)

• Why Serious Talk of Balancing the Budget Went Bust (The Fiscal Times)

• How Long Do You Want to Live? (NYT)

• Law prof: Romney Probably Owes Back taxes Due to Management Fee Conversions (A Taxing Blog)

What are you reading?

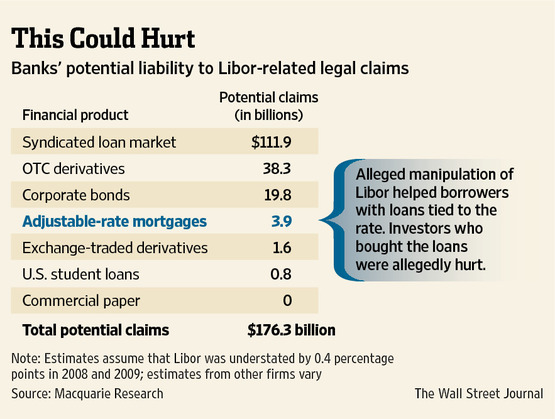

Suits Mount in Rate Scandal: Billions of Dollars at Stake in Claims

Source: WSJ

What's been said:

Discussions found on the web: