My afternoon train reading:

• Investors Prepare for Euro Collapse (Spiegel Online)

• China’s neo-capitalism beating U.S. free markets (Market Watch)

• Down With Shareholder Value (NYT)

• A Market Recovery False Dawn (Bloomberg)

• Dividends Matter!: Part 754. (WSJ)

• Money Market Funds Can Lose Money, Just Not Your Money (Dealbreaker) see also Breaking a Buck, Maybe, but Not Taxpayers’ Backs (NYT)

• World shipping crisis threatens German dominance as Greeks win long game (Telegraph)

• The Ryan Pick: Why Romney Changed to Obama’s Game (New York Mag) see also Romney’s Taxes + Ryan’s Budget = Democratic Delight (Bloomberg)

• Developers dish on iCloud’s challenges (Mac World)

• 2012 Presidential Election Fundraising Race (OpenSecrets)

What are you reading?

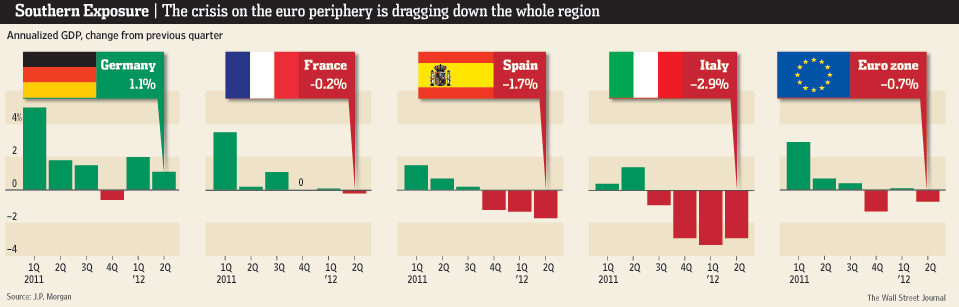

Euro Zone Economy Shrinks, Darkening Outlook

Source:WSJ

What's been said:

Discussions found on the web: