Bloomberg.com – Jackson Hole May Disappoint Investors Primed for Stimulus

Federal Reserve Chairman Ben S. Bernanke — returning this week to the scene of a 2010 speech that foreshadowed a second round of quantitative easing — probably will disappoint investors looking for him to signal new stimulus. Bernanke probably won’t use his Aug. 31 speech at the Fed’s annual symposium in Jackson Hole, Wyoming, to suggest a third round of bond buying is at hand, according to economists including Michael Feroli and James O’Sullivan. Members of the Federal Open Market Committee — who meet next on Sept. 12-13 — are closely monitoring unemployment and other data and have been divided about whether to spur expansion. The U.S. economy also remains beholden to political decisions made in Washington and in Europe, which is struggling to contain its debt crisis

The Wall Street Journal – Bernanke Letter Defends Fed Actions

Federal Reserve Chairman Ben Bernanke, in a letter responding to questions posed by U.S. Rep. Darrell Issa (R., Calif.), chairman of the House oversight committee, defended actions the Fed has taken to support the economy and said there is room for the Fed to do more. “There is scope for further action by the Federal Reserve to ease financial conditions and strengthen the recovery,” Mr. Bernanke wrote in a letter dated Aug. 22, a copy of which was obtained by The Wall Street Journal. The Fed’s “Operation Twist” program—buying long-term Treasury bonds and selling short-term securities—is still “working its way through the economic system,” Mr. Bernanke said. The program was first launched in September 2011 and in June 2012 was extended through the end of this year. Asked by Mr. Issa if it were premature to consider additional monetary moves, Mr. Bernanke said that “because monetary policy actions operate with a lag,” the Fed must make policy “in light of a forecast of the future performance of the economy.” The Fed chairman also said that the Fed’s bond-buying of recent years has “helped to promote a stronger recovery than otherwise would have occurred, and to forestall the possibility of a slide into deflation…by putting downward pressure on longer-term interest rates and contributing to broader easing in financial conditions.” The written comments echo remarks that Mr. Bernanke has made to lawmakers and the media.

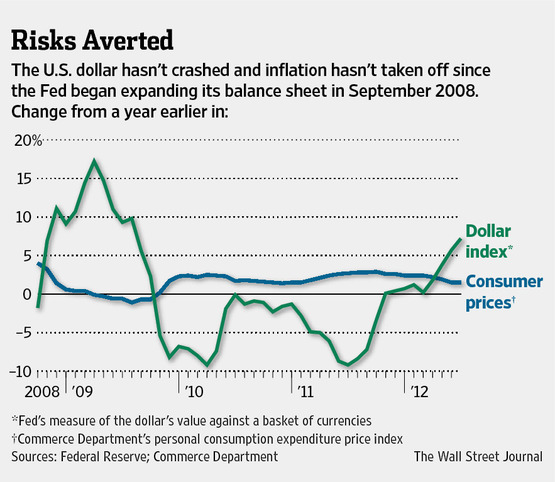

The Wall Street Journal – Jon Hilsenrath: Will Fed Act Again? Sizing Up Potential Costs

Federal Reserve Chairman Ben Bernanke delivers what could be his closing argument in deliberations about launching a new bond-buying program when he speaks Friday at the central bank’s Jackson Hole, Wyo., conference. The argument comes down to weighing costs and benefits. The Fed already has bought more than $2 trillion of Treasury and mortgage bonds to stimulate the economy. The Fed believes this drives down long-term interest rates, elevates stock and real-estate values and softens the dollar. This, Mr. Bernanke has argued, lowers financing costs, increases U.S. companies’ global competitiveness and bolsters household wealth. Most research has focused on calculating purported benefits. Critics warn about costs, but little attention has been focused on measuring them. … Sometimes markets move too quickly for the Fed to make such calibrations. This little-examined risk could one day prove more significant than the inflation and dollar risks that have gotten more attention. But it, too, falls into the category of threats that haven’t materialized. And Mr. Bernanke’s confidence that the Fed can manage it suggests he doesn’t see big costs to taking more action in an effort to boost the economy.

Yahoo Finance – Romney Wants Bernanke to Go but One of His Top Advisers Doesn’t Seem to Agree

He’s been chairman of the Federal Reserve since February 2006, appointed by President George W. Bush and reappointed by President Barack Obama. Some say Ben Bernanke helped to save the U.S. economy during the financial crisis that hit just months after he took over leadership of the Fed. Others say his policy of zero interest rates has failed to revive an economy which continues to grow too slowly to push unemployment below g 8 percent while hurting the dollar and stoking inflation.

Mitt Romney is in that camp, and yesterday he announced for at least a second time that he would replace Fed Chairman Bernanke if he won the presidency. Just two days before Glenn Hubbard, one of Romney’s top economic advisors, said Bernanke should “get every consideration” to stay on at the Fed. Romney “can’t fire the Fed chairman” says Jim Bianco, president of Bianco Research, a financial research firm, “but he can choose to not reappoint him when his term ends.” Bernanke’s term ends on January 31, 2014. Romney told Fox News this week that the Fed’s bond-buying program under Bernanke, known also as quantitative easing, had not been “terribly effective” and he didn’t support the Fed extending the program. “Romney wants somebody like John Taylor (Stanford University economist) who would be more anti-quantitative easing, anti-accommodation….so that this period of extreme monetary policy would come to a close” Bianco says.

Source: Bianco Research

For more information on this institutional research, please contact:

Max Konzelman

max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: