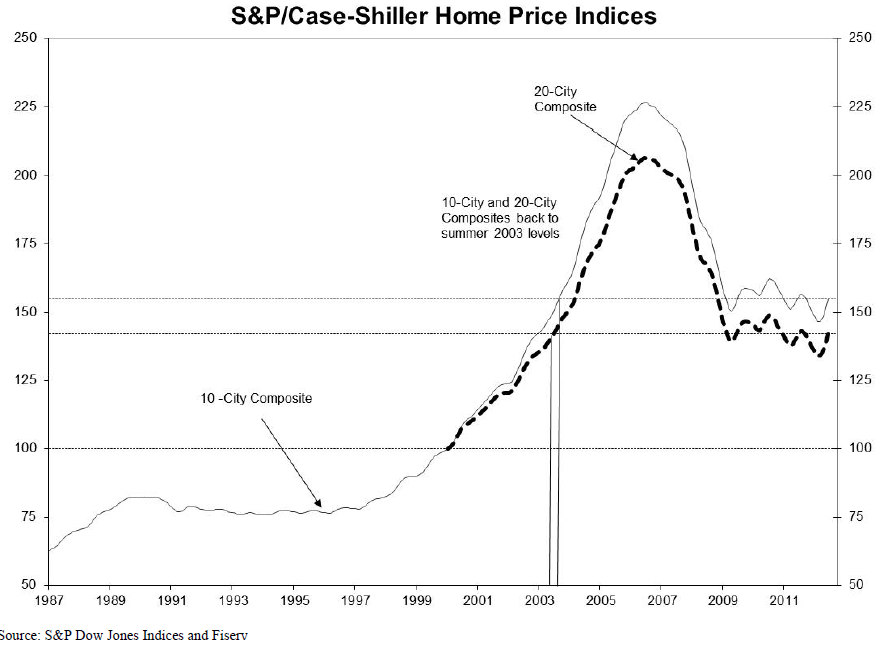

Check out the nice price rise in Q1 2012 versus Q1 2011 for Case Shiller.

As I have been saying for some time, this is an apple to orange comparison — pitting a period of high foreclosures versus a period of voluntary foreclosure abatement by the money center banks.

Distressed sales are 20% < less than non -distressed sales. The NAR has reported that the number of distressed sales has fallen from 38% to 26% of the total basket.

Do the math, and this accounts for nearly all of the price improvement.

˜˜˜

Source:

S&P Dow Jones Indices

Press Release

Home Prices Rose in the Second Quarter of 2012

According to the S&P/Case-Shiller Home Price Indices

What's been said:

Discussions found on the web: