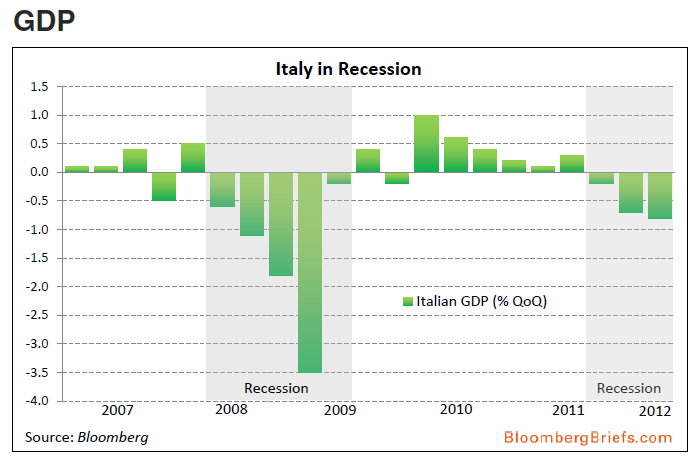

Italy, Europe’s third-largest economy, has contracted for 11 quarters since 2007. GDP fell 0.7 percent in the second quarter of this year; the IMF expects output to decline 1.9 percent in 2012 and 0.29 percent in 2013. Quarterly growth has averaged zero in the past decade, compared with an average rate of 0.37 percent in Spain.

What else is troubling Italy?

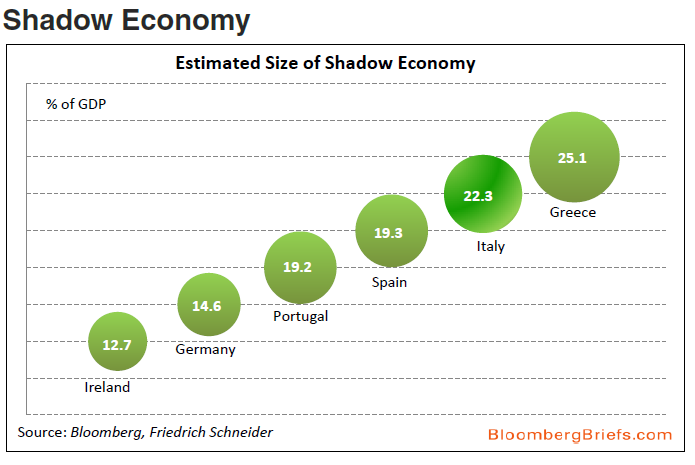

The lack of growth is being compounded by a rapidly growing shadow economy. The black market is ~16.5% of GDP; criminal activity is another 1% — for a total of 400 billion-euro shadow economy.

Click to enlarge:

All charts via Bloomberg BRIEF

More charts are after the jump . . .

~~~

~~~

What's been said:

Discussions found on the web: