David Wessel of the WSJ notes these 5 tax factoids are necessary to an intelligent debate on policy:

1. The top marginal income-tax rate went from 7% in 1913 to 92% in the 1950s to 28% with the Tax Reform Act of 1986 to 39.6% in the Clinton years to today’s 35%.

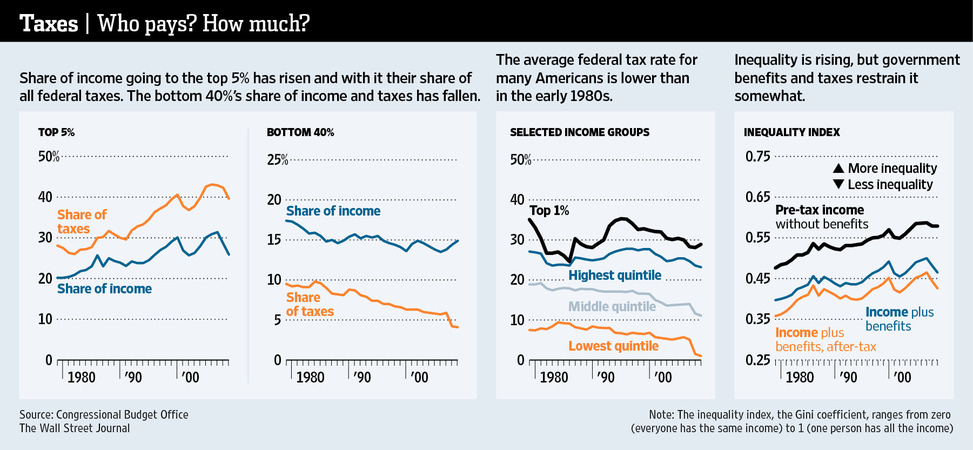

2. The top 5%, top 1% and top 0.1% of Americans have been getting a bigger slice of all the income and paying a growing share of federal taxes.

3. Average tax rates have come down for everyone. On average, the tax bite on the rich is bigger—except for those whose income mainly comes from capital gains and dividends.

4. The share of taxes paid by the bottom 40% of the population has been shrinking along with their share of income.

5. The tax system narrows the gap between economic winners and losers, but not enough to stop the gap from widening.

Discuss . . .

Source:

The Numbers Inside a Hot-Button Issue

DAVID WESSEL

WSJ, August 6, 2012

http://online.wsj.com/article/SB10000872396390444246904577571042249868040.html

What's been said:

Discussions found on the web: