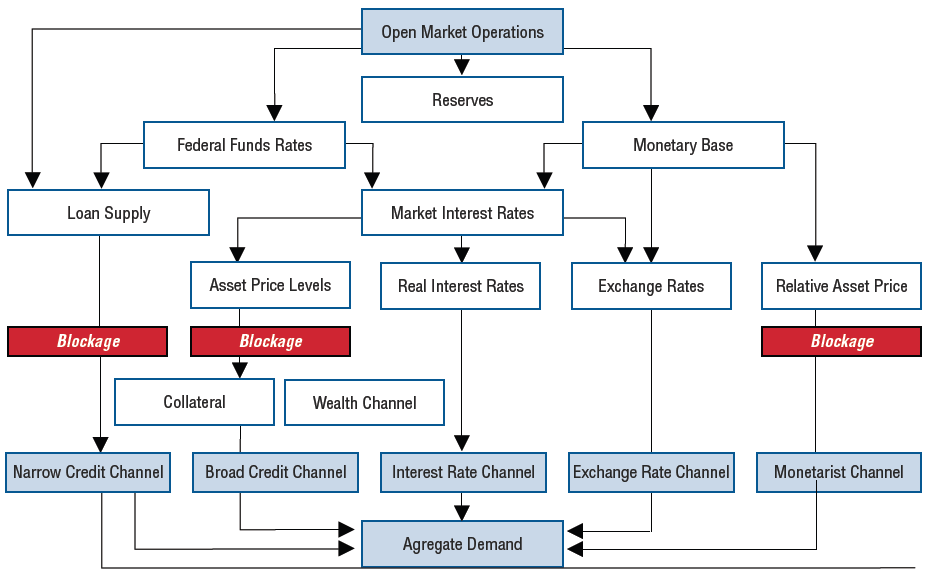

Blockages in the Monetary Transmission Mechanism

click for ginormous graphic

Fascinating chart from Joseph Brusuelas, Senior Economist at Bloomberg that details monetary blockages.

This IMO helps to explain why ZIRP’s more modest impact on the broader economy than the outsized impact we see on risk assets

Joe is my newest Friday Follow on Twitter: @joebrusuelas (Not what about getting Richard Yamarone on Twitter?)

What's been said:

Discussions found on the web: