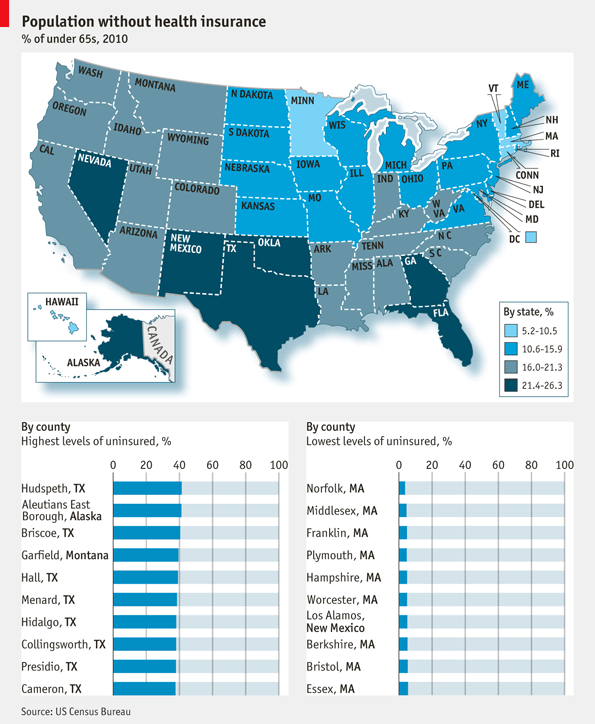

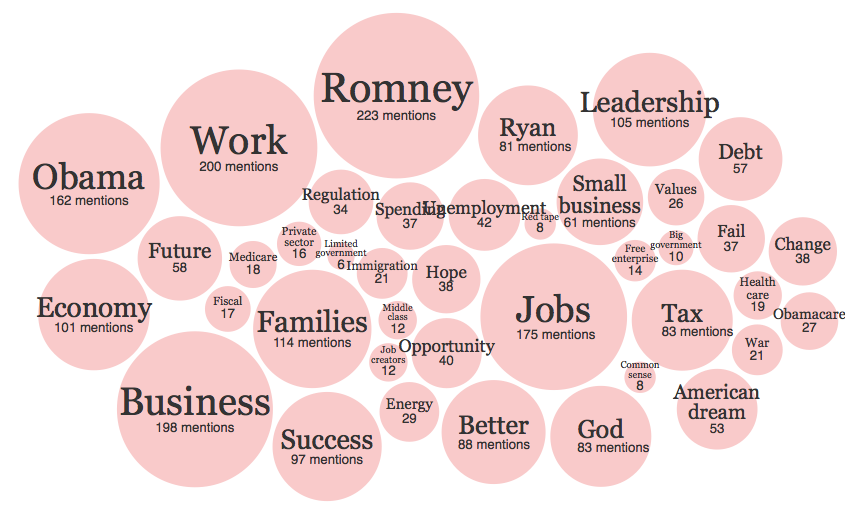

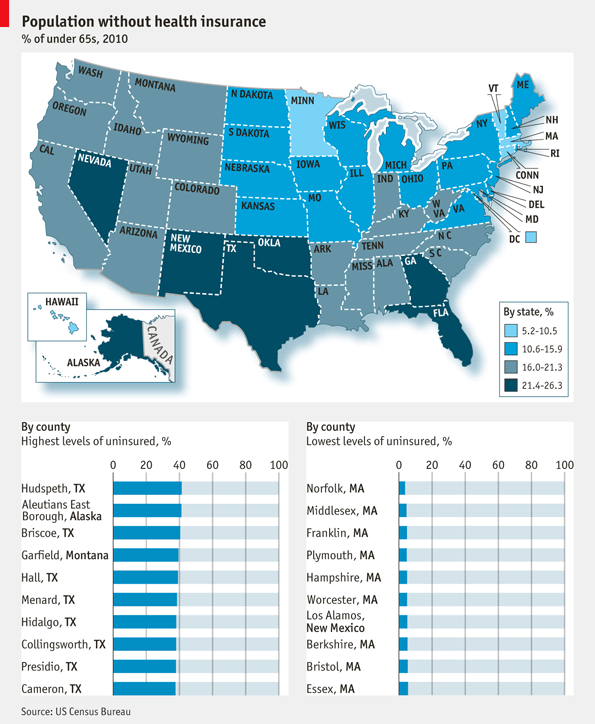

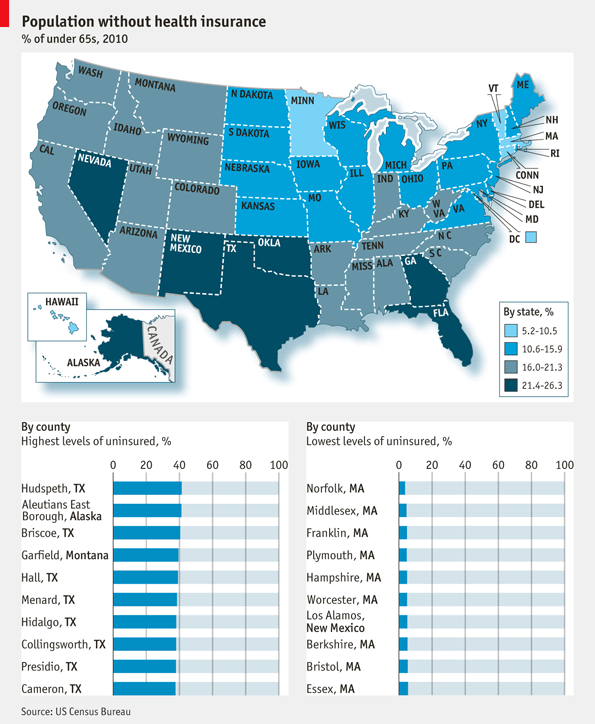

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...

Read More

The Australian finance minster states that the RBA has room to cut rates- read, please RBA, cut rates. Sounds like the A$ is going to...

Read More

Just Released: Has Household Deleveraging Continued? Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw August 29,...

Just Released: Has Household Deleveraging Continued? Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der Klaauw August 29,...

Read More

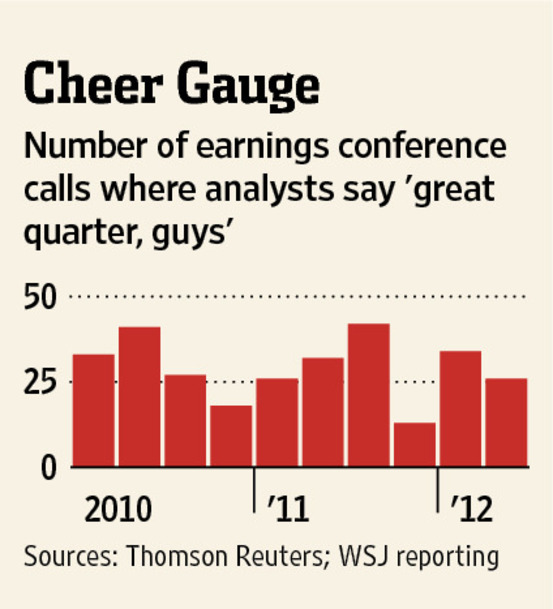

Afternoon train reading: • Adventures in tea-party cognitive dissonance: We need a new aircraft carrier group (The Economist) •...

Afternoon train reading: • Adventures in tea-party cognitive dissonance: We need a new aircraft carrier group (The Economist) •...

Read More

Frankfurt or Jackson Hole David R. Kotok August 30, 2012 Mario Draghi and most European Central Bank members will...

Read More

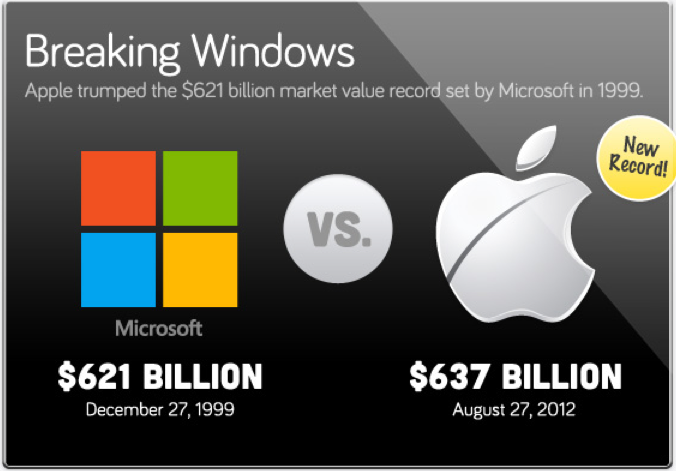

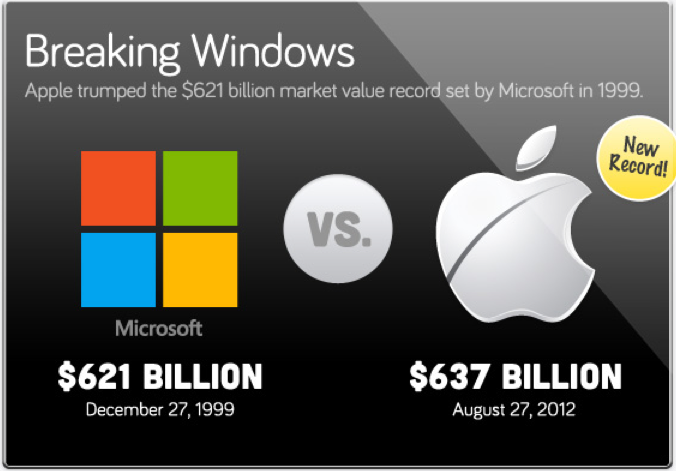

After almost filing for bankruptcy 16 years ago, Apple is now the most valuable public company in history, worth nearly $637 billion....

After almost filing for bankruptcy 16 years ago, Apple is now the most valuable public company in history, worth nearly $637 billion....

Read More

Source: The Chart Store This may be a on the bit technical side for some readers, but I think its important: Ron Griess writes...

Source: The Chart Store This may be a on the bit technical side for some readers, but I think its important: Ron Griess writes...

Read More

There are numerous examples of the federal government suspending or ignoring settled rules of law in order to quickly and effectively...

Read More

Japanese retail sales fell by -0.8% Y/Y in July (-1.5% M/M) , more than the -0.1% decline expected and the 1st decline in 8 months. With...

Read More

My morning reads are crazy negative today: • Economy Still Stuck in Low Gear (NYT) see also At pivotal moment, Bernanke low on economic...

My morning reads are crazy negative today: • Economy Still Stuck in Low Gear (NYT) see also At pivotal moment, Bernanke low on economic...

Read More

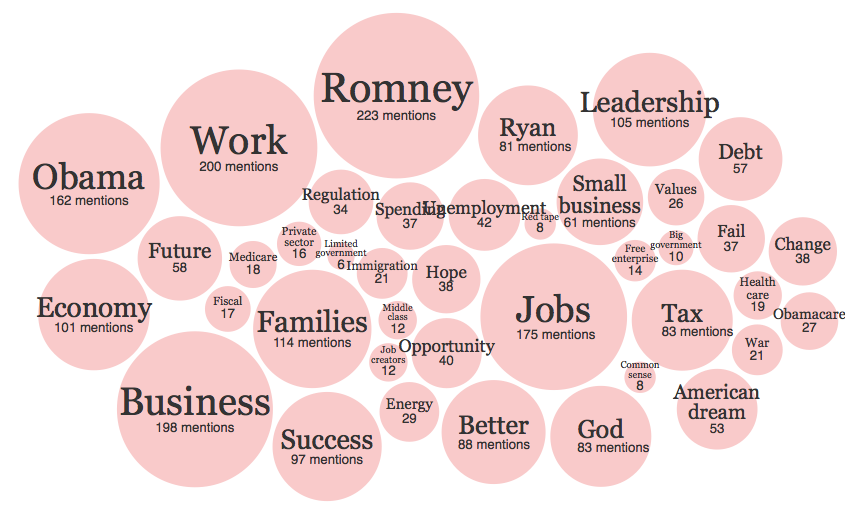

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...

Where in America do the fewest people have health insurance? We are in the thick of the political season, with one convention...