As ETFs gain popularity as an investment vehicle for retail investors, we are often asked if we should shift our focus away from mutual...

As ETFs gain popularity as an investment vehicle for retail investors, we are often asked if we should shift our focus away from mutual...

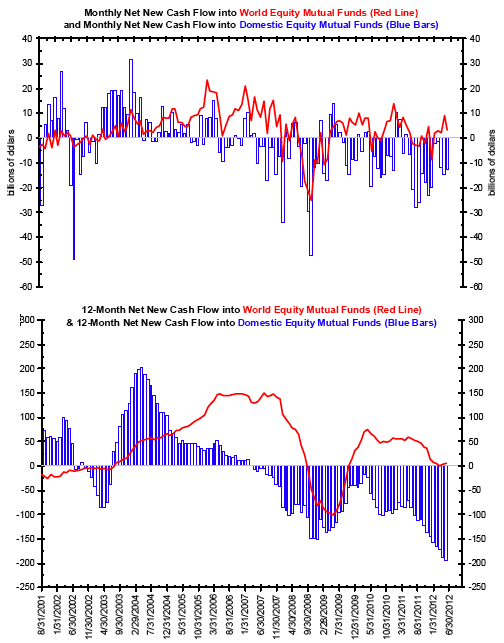

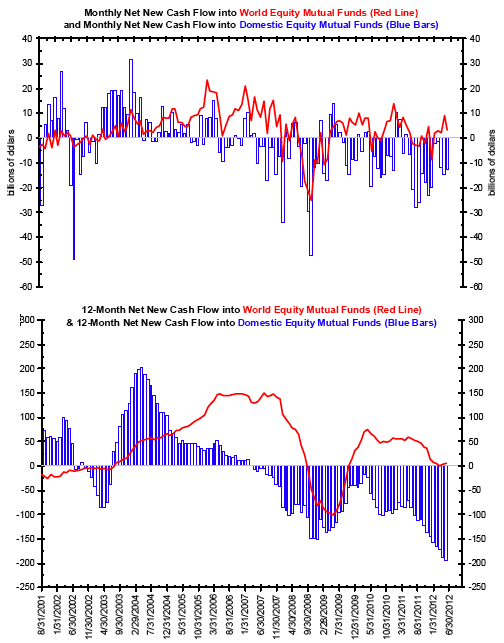

Mutual Fund Flows vs ETF Flows

As ETFs gain popularity as an investment vehicle for retail investors, we are often asked if we should shift our focus away from mutual...

As ETFs gain popularity as an investment vehicle for retail investors, we are often asked if we should shift our focus away from mutual...