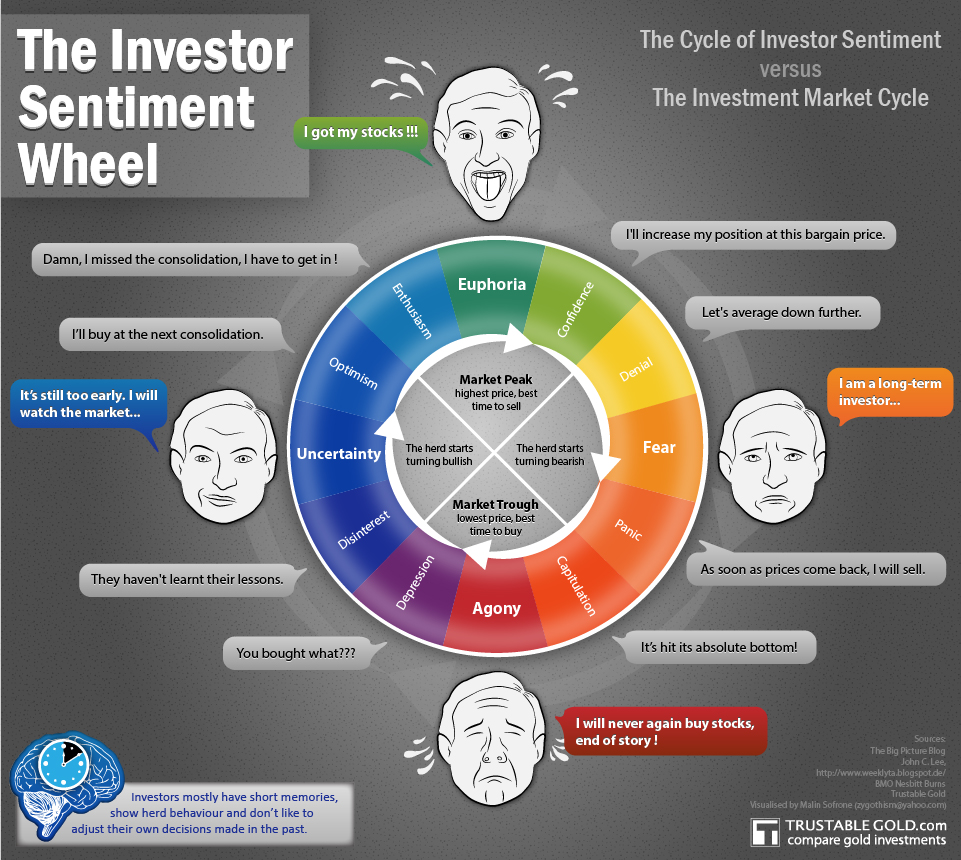

I love these sorts of graphics:

Click to enlarge:

Source: Trustable Gold

Hat tip: The Reformed Broker

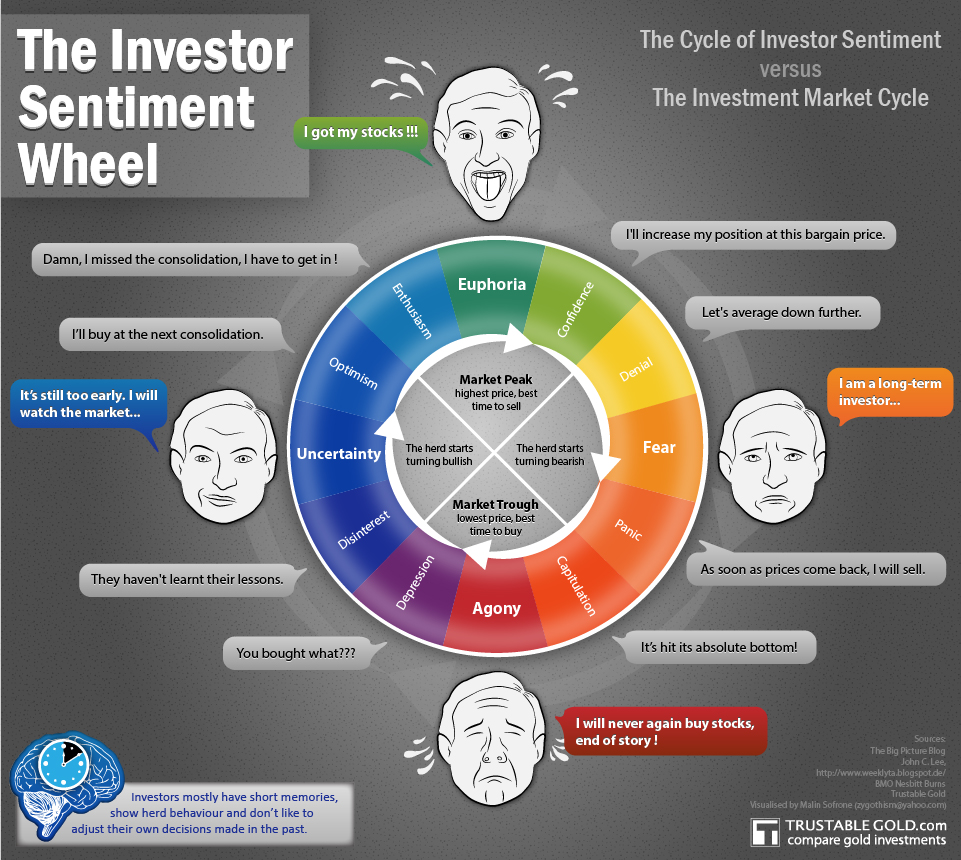

I love these sorts of graphics:

Click to enlarge:

Source: Trustable Gold

Hat tip: The Reformed Broker

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: