Some morning reads:

• In euro crisis, U.S. lessons unlearned (Washington Post)

• Why Are Morgan Stanley & Goldman Sachs Still Bank Holding Companies 4 years Post-Crisis ? (Bloomberg)

• Evil is the root of all money (Macro Mania)

• The Good News and the (Very) Bad News about Bernanke’s Speech (Uneasy Money)

• Big Banks’ $29 Billion Cookie Jar (WSJ) see also Banks Face Suits as States Weigh Libor Losses (NYT)

• Asia’s Rich Are Wary of Private Bankers (Businessweek)

• Facebook Falls to Record Low After Morgan Stanley Report (Bloomberg) see also iPhone Price Cuts Send Bond Inflation Bets to 11-Year Low (Bloomberg)

• Alarming parallels between current Middle East tensions and events leading up to WWI (Sober Look)

• Kinsley: Don’t blame the deficit (LA Times)

• 12 Scary Signs That It’s Time to Leave Your Company (Yahoo Finance)

What are you reading?

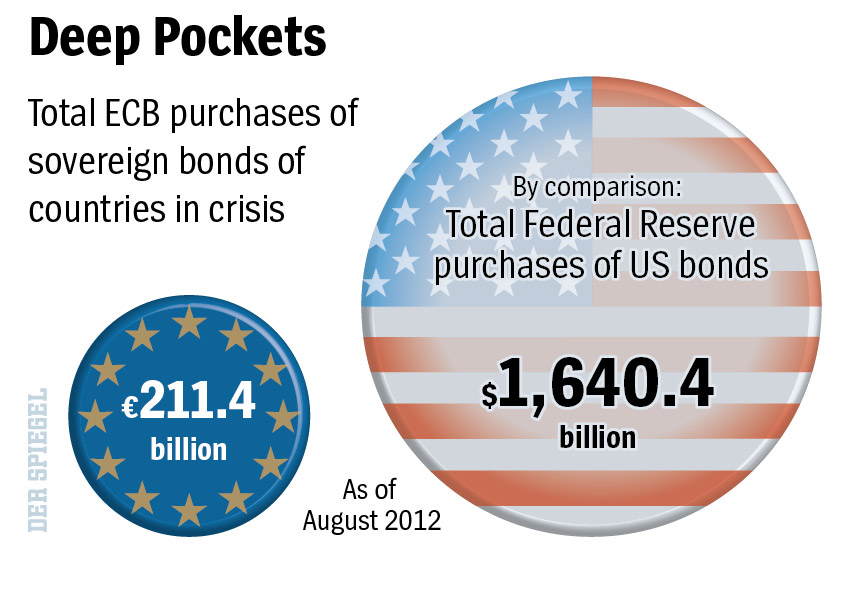

Euro Crisis versus Federal Reserve

Source: Spiegel Online

What's been said:

Discussions found on the web: