My morning reads:

• Transcript: A Conversation with Ray Dalio (Council On Foreign Relations)

• Chicago Fed laments ‘out-of-control’ algorithms (Market Watch) see also For Superfast Stock Traders, a Way to Jump Ahead in Line (WSJ)

• Today’s WTF article: A Rare Look at Why The Government Won’t Fight Wall Street (Rolling Stone)

• The Dangers of a China-Japan Trade War (The Diplomat)

• Will Dow’s gyrations determine race for White House? (USA Today) see also Who’s better for stocks: Obama or Romney? (Fortune)

• Miners Exploring the Web (WSJ)

• Best of Breed Investment Advisors (Barron’s)

• Deposit Flight From Europe Banks Eroding Common Currency (Bloomberg) see also Missed Chances Stoke Skepticism Over EU’s Crisis Fight (Bloomberg)

• A One-Stop-Shop for Innovators (US Department Of The Treasury)

• ‘Red State Socialism’ graphic says GOP-leaning states get lion’s share of federal dollars (Politi Fact) see also Number of the Week: Top 20% of Earners Take Home 51% of All Income (WSJ)

What are you reading?

>

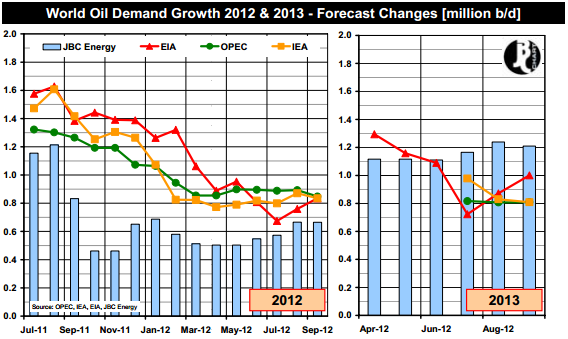

Slumping trade growth – and more oil Jedi mind tricks?

Source: FT.com

What's been said:

Discussions found on the web: