My reads to start your week:

• Searching for a Speed Limit in High-Frequency Trading (NYT)

• The growing risk of shorting China stocks (FT Alphaville)

• Fed Stuck at Zero Into 2015 Seen in Swaps, QE Odds Reach 99% (Bloomberg) see also Bernanke Options to Boost Growth Include Open-Ended QE (Bloomberg)

• The Bailout: By The Actual Numbers (Pro Publica)

• Technology Stocks With Record Dividends Send Bearish Signal (Bloomberg)

• Bigger Than Countrywide? Bribes To Lawmakers Coordinated By The Mortgage Bankers Association (Republic Report)

• Good News from Europe? Eh. (Barron’s) see also Euro Crisis Faces Tests in German Court, Greek Infighting (Bloomberg)

• Wells Fargo Mistakenly Cleans Out Retired Couple’s Home Twice (Yahoo Finance)

• The GOP convention negative bounce: a final look (Princeton Election Consortium) see also Republicans Losing Election Law War as Campaign Ramps Up (Bloomberg)

• Call It as You See It: The correct approach to statistical modeling (NYT)

What are you reading?

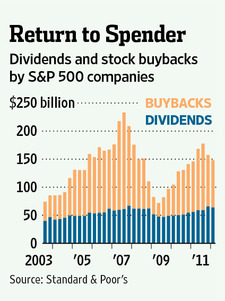

Bad Timing on Buybacks

Source: WSJ

What's been said:

Discussions found on the web: