Some fascinating items to start your Sunday:

• Farrell: Recession, more taxes no matter who wins — Obama or Romney, stock market loses 20% by 2016 (Marketwatch)

• Caught between Euro and Dollar (FT Alphaville)

• Cuban: What Business is Wall Street In ? (Blog Maverick)

• Q-Infinity and Beyond! (Cognitive Concord) see also What the Fed Move Means (WSJ)

• C.E.O.’s and the Pay-’Em-or-Lose-’Em Myth (NYT)

• How American Democracy Became the Property of a Commercial Oligarchy Posted (HuffPo)

• How Paul Ryan Convinced Washington of His Genius (The New Republic)

• The Cloud Factories Power, Pollution and the Internet (NYT) see also The Internet? We Built That (NYT Magazine)

• New York Observer: The Cranky Wisdom of Peter Kaplan (The New Republic)

• Quackery is on the rise (New Scientist)

What are you eating for brunch?

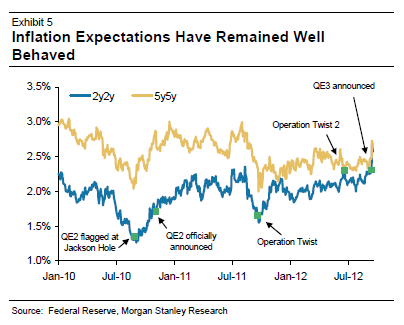

Inflation expectations have remained well behaved

Source: Morgan Stanley

What's been said:

Discussions found on the web: