My afternoon train reading:

• Plunge in Goods Orders May Restrain U.S. Expansion (Bloomberg)

• Are financial advisers worth their fee? (Market Watch)

• Credit Swaps – A Travesty of a Mockery of a Sham (CFO)

• WTF? Fidelity’s stock funds eclipsed by bond and money market assets (Reuters)

• The “dividend tax” cliff approaches: Implications for stocks (Musings on Markets)

• Cellphones Are Eating the Family Budget (WSJ)

• Why Twitter Is Already Bigger Than Facebook (Forbes)

• Apple-Google Maps Talks Crashed Over Voice-Guided Directions (All Things D) see all Apple had over a year left on Google Maps contract, Google scrambling to build iOS app (The Verge)

• How the brain filters bad news (Guardian)

• Hilarity ensues: My Name is Joe Biden and I’ll Be Your Server (New Yorker)

What are you reading?

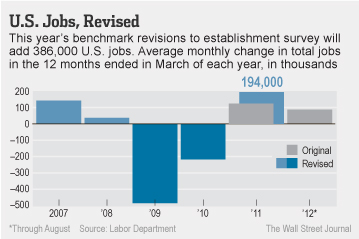

Nearly 400,000 More Jobs Added Than First Thought

Source: WSJ

What's been said:

Discussions found on the web: