Welcome back to the Jungle. Throw a coconut, and enjoy some morning reads:

• Assessing Fannie’s Past and Future (WSJ)

• At Jackson Hole, a growing fear for Fed independence (Yahoo Finance) see also Fed Moves Toward Open-Ended Bond Purchases to Satisfy Bernanke (Bloomberg)

• Why not to expect recovery anytime soon (Economist)

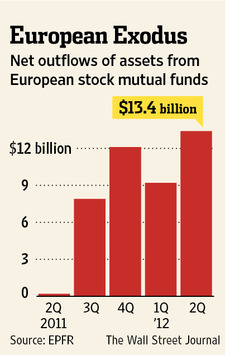

• The High Cost of Europe’s North-South Divide (WSJ) see also Money Managers Seeking Stocks to Navigate the Euro-Zone Crisis (WSJ)

• Global House Price Watch (Parkash Loungani)

• Investors lack basic financial literacy, study finds (CS Monitor)

• Federal government push to collect on student loans amid bad economy fuels growth in filings (Palm Beach Post) see also Young and without a future (Washington Post)

• Verdict Shows Samsung Needs to Copy Apple Design Culture (Bloomberg)

• Does Inequality Stunt Economic Growth? (Toppling Inequality)

• A Watershed Moment for Real-Time Fact-Checking (American Journalism Review)

What are you reading?

Money Managers Seeking Stocks to Navigate the Euro-Zone Crisis

Source: WSJ

What's been said:

Discussions found on the web: