My morning reads:

• What would have happened if you bought SPX the day before the 9/11 attacks? (MarketWatch)

• Rational astrologies (Interfluidity)

• Europe: Less-Rosy Reality (WSJ)

• Is US economic growth over? Faltering innovation confronts the six (VOX) see also Soros: Germany’s heading into depression (MarketWatch)

• Black Swan Farming (Paul Graham)

• Financial regulation isn’t fixed, it’s just more complicated (Guardian) see also Big Banks Hide Risk Transforming Collateral for Traders (Bloomberg)

• Are You Better Off? Take a Look at the Stock Market (Bloomberg)

• Jingle Nation: Can’t Get You Out of My Head (Slate)

• New iPhone: Carrier Cash Cow? (WSJ) see also New iPhone Redesign to Sell 10 Million Units Within Weeks (Bloomberg)

• 9/11: The Deafness Before the Storm (NYT)

What are you reading?

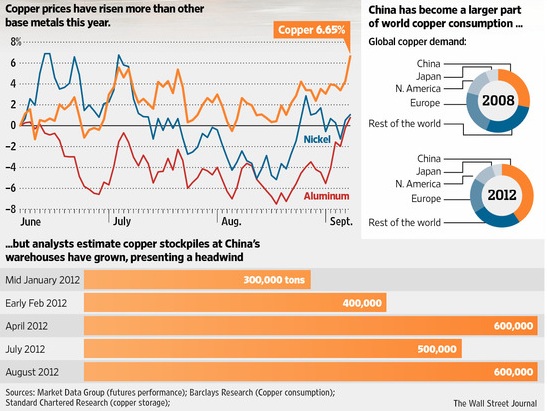

Copper Surplus Presents Puzzle

Source: WSJ

What's been said:

Discussions found on the web: