Source: Bloomberg

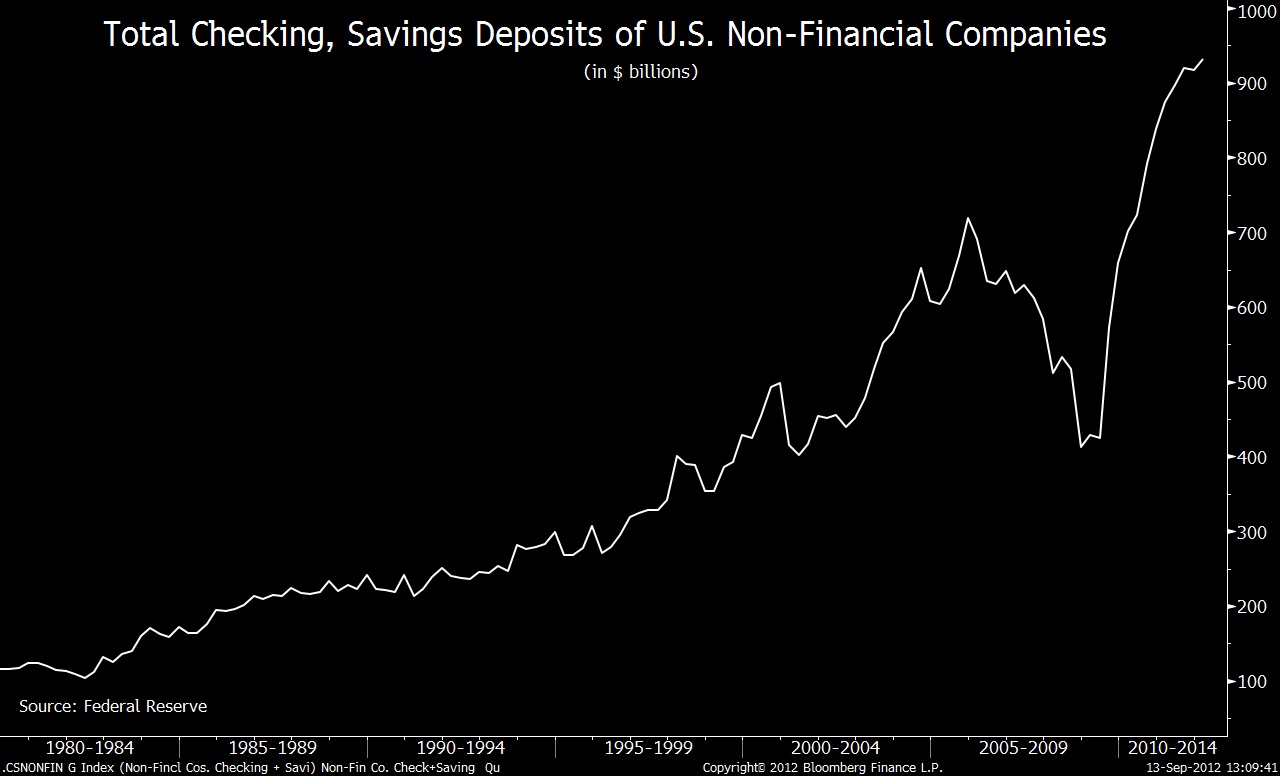

U.S. non-financial companies held a record $931 billion of checking and savings deposits as of March 31, according to the Federal Reserve flow-of-funds reports. Deposits more than doubled from June 2009, when the latest recession ended, as the economy grew 6.3 percent.

Its a bit of the Recency effect — Cash is rising as companies guard against the risk of another slump, with management looking back towards the 2008-09 crash.

Checking accounts held 40 percent of non-financial companies’ deposits at the end of the first quarter, and the other 60 percent was in savings. Deposit figures at the end of the second quarter will be included in the Fed’s next flow-of- funds report, due Sept. 20.

Source:

By David Wilson

Bloomberg

September 13, 2012

What's been said:

Discussions found on the web: