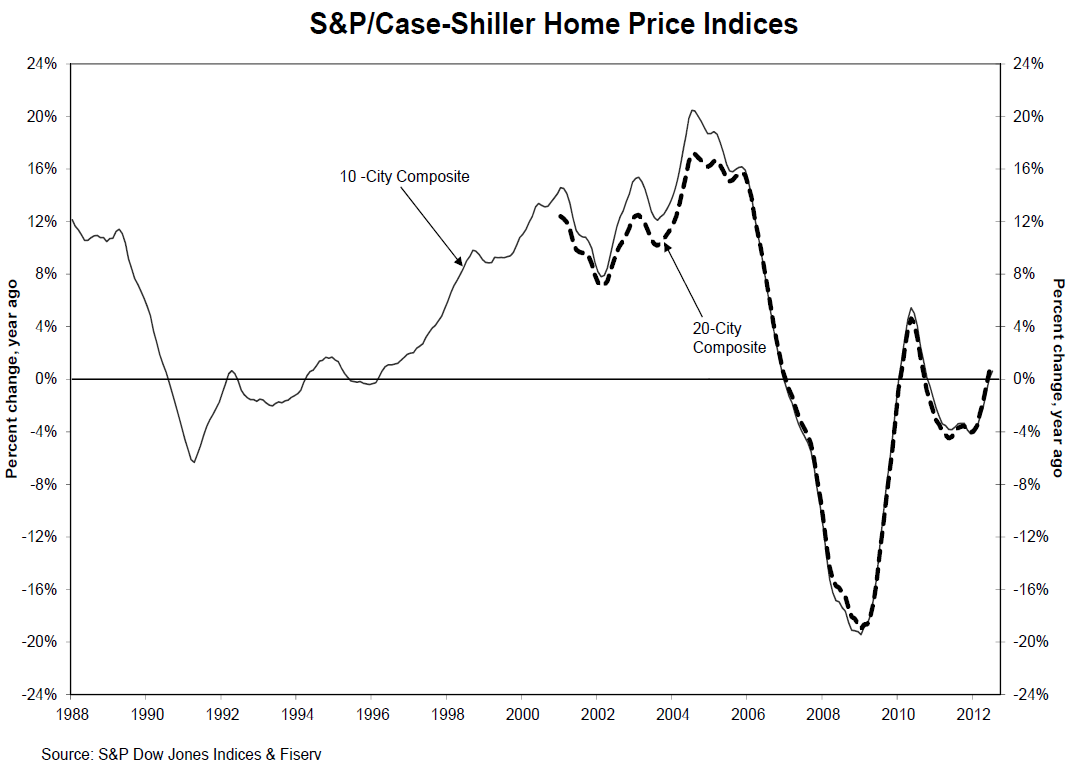

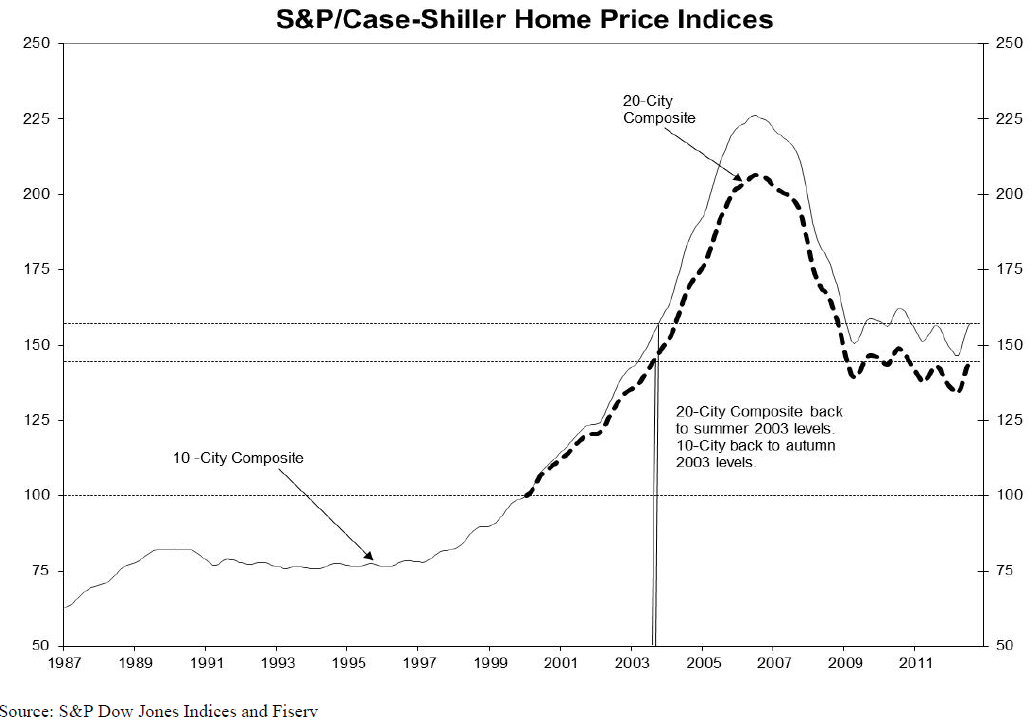

Here is the latest S&P/Case-Shiller Home Price Index data through July 2012. It shows:

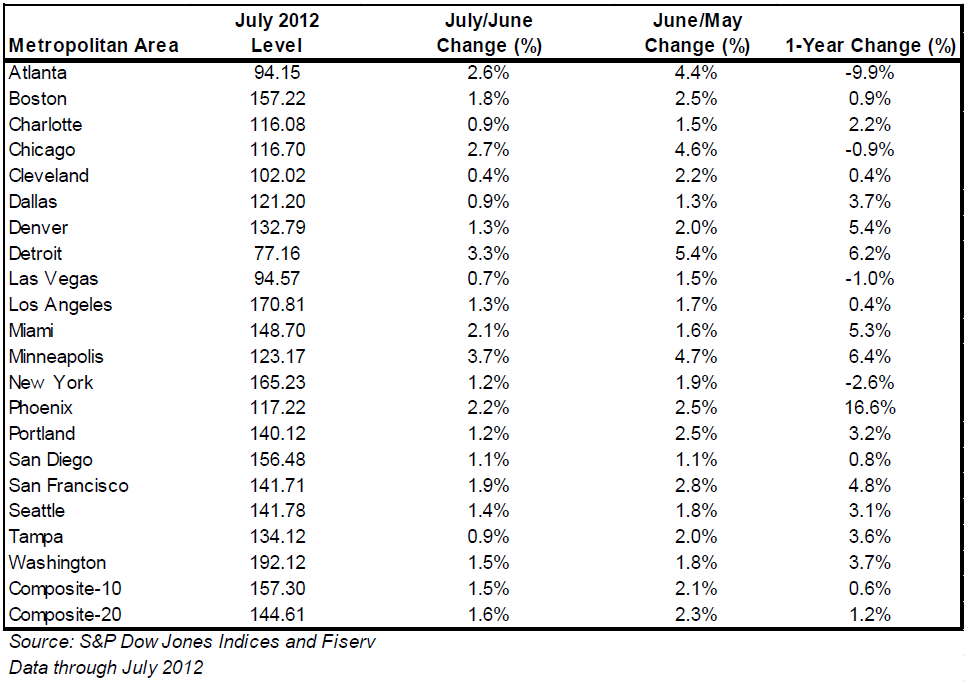

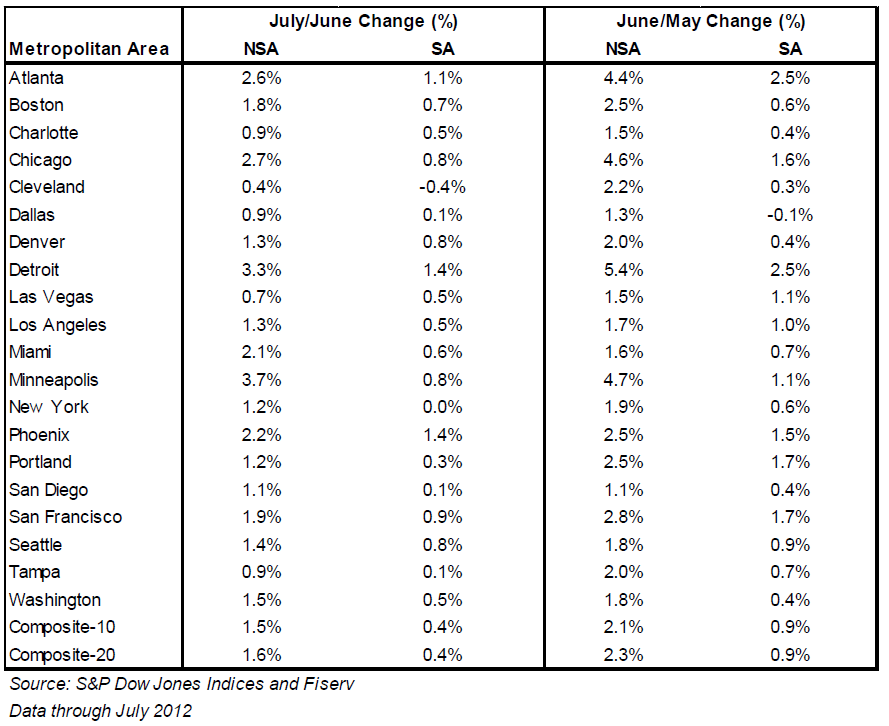

“Average home prices increased by 1.5% for the 10-City Composite and by 1.6% for the 20-City Composite in July versus June 2012. For the third consecutive month, all 20 cities and both Composites recorded positive monthly changes. It would have been a fourth had prices not fallen by 0.6% in Detroit back in April.

The 10- and 20-City Composites posted annual returns of +0.6% and +1.2% in July 2012, up from their unchanged and +0.6% annual rates posted for June 2012. Fifteen of the 20 MSAs and both Composites posted better annual returns in July as compared to June 2012. Dallas and Washington D.C. saw no change in their annual rates; and Cleveland, Detroit and New York saw their rates worsen in July, with respective returns of +0.4%, +6.2% and -2.6%. After nine consecutive months of double digit annual declines, Atlanta finally improved to a -9.9% annual rate in July 2012, but still the worst among the 20 cities followed by S&P Dow Jones Indices.

Click to enlarge:

More charts after the jump.

˜˜˜

˜˜˜

Source:

S&P Dow Jones

Indices, Press Release

Home Prices Increase Again in July 2012

According to the S&P/Case-Shiller Home Price Indices

New York, September 25, 2012

What's been said:

Discussions found on the web: