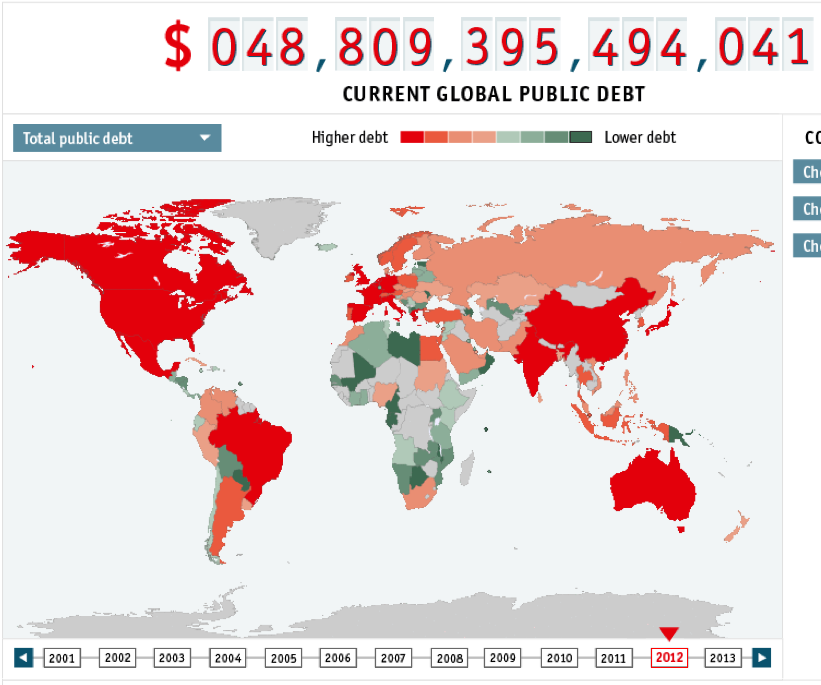

Well done map/analytics from the Economist on total amounts and distribution of Global Debt. You can see various depictions of this by year, by country comparisons, per capita or as a % of GDP.

click for updated debt clock

Source: the Economist

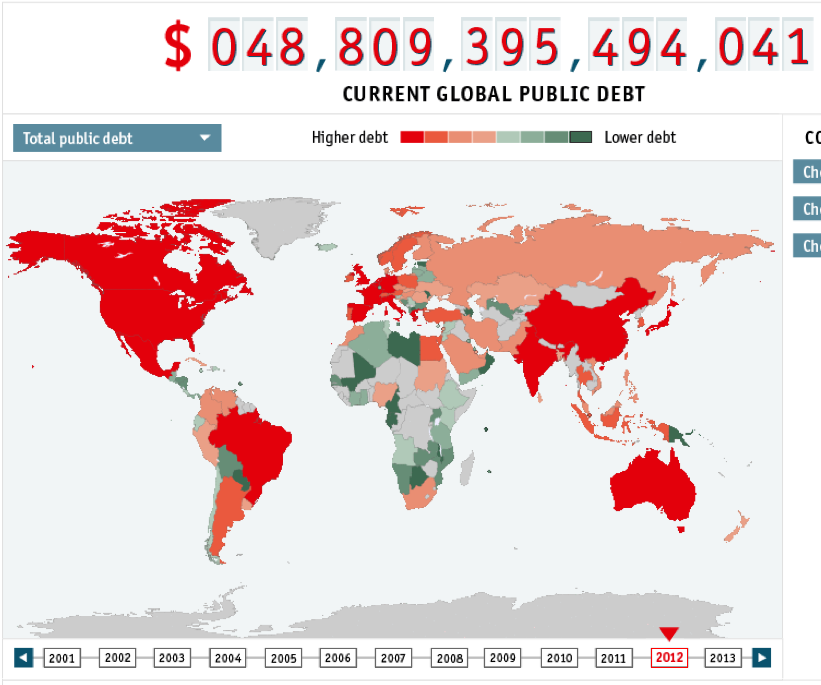

Well done map/analytics from the Economist on total amounts and distribution of Global Debt. You can see various depictions of this by year, by country comparisons, per capita or as a % of GDP.

click for updated debt clock

Source: the Economist

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: