We have pointed this out before, but its worth repeating: As Merrill Lynch pointed out earlier this week, “the link between inflation and gold is very limited.”

The correlation between Gold and Inflation is not what most people believe it to be. This variant belief could be significant in light of the most recent QE.

Here’s Merrill:

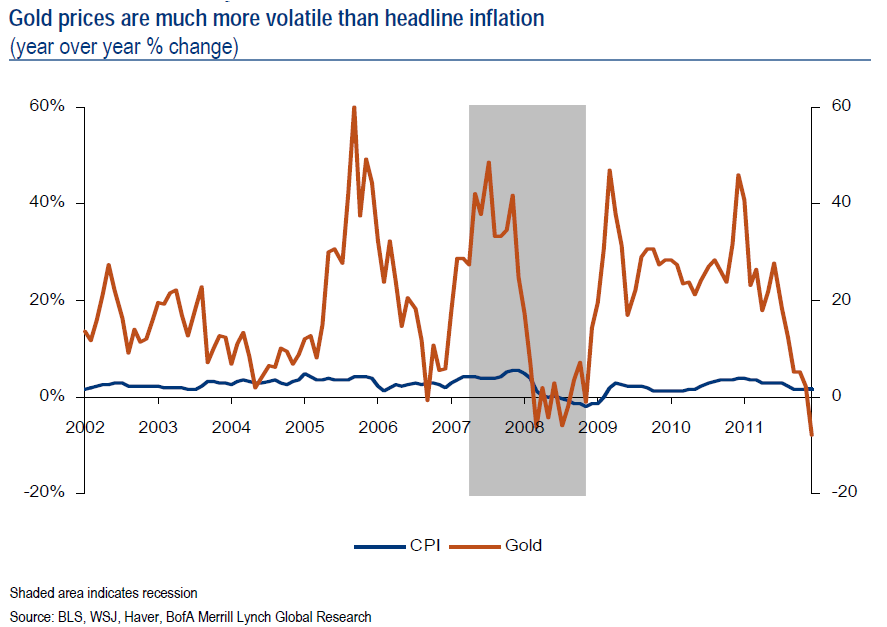

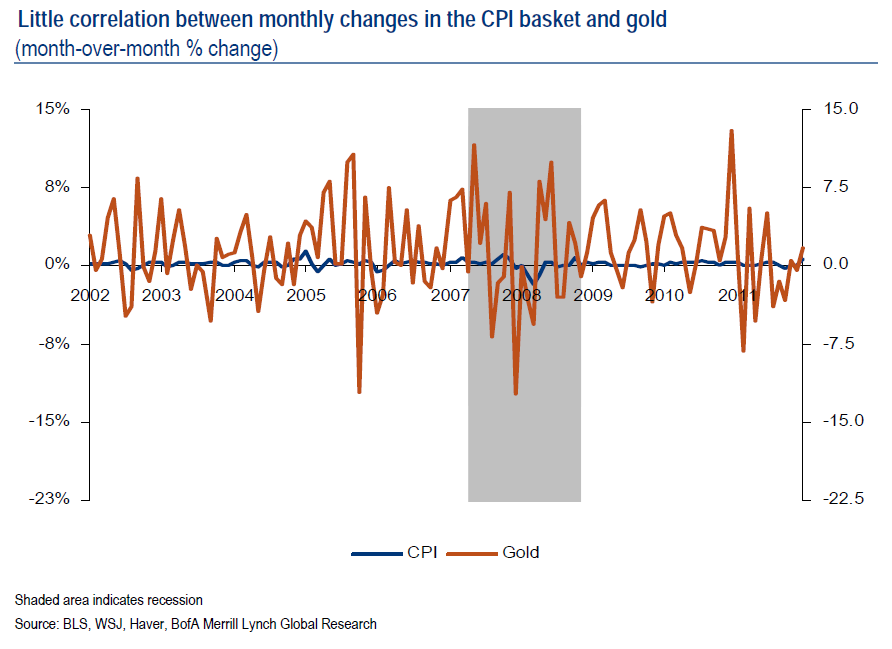

Opened-ended QE is causing some investors to worry that inflation will get out of hand. That has helped drive gold prices higher, as investors look for places to hedge against a potential rise in inflation. [See charts above]

First, gold is not part of the CPI bundle, so a movement in gold will not impact inflation. Second, gold is not a good predictor of inflation. As the nearby charts illustrate, gold prices are much more volatile than headline inflation. Finally, with the correlation between gold and inflation on a yoy basis of just 0.42 and on a month-over-month basis of 0.11, gold is not a great hedge against inflation. Investors would be better off owning TIPS if they are looking for protection against a potential rise in inflation.

This is worth paying attention to in the world of QE ∞.

Source:

BofA/Merrill Lynch

September 17, 2012

Morning Market Tidbits

What's been said:

Discussions found on the web: