CNBC – Most Hated Stock-Market Rally in Years Goes On

The most hated stock market rally in years continues. S&P 500 hits multiyear high — anger and frustration hit multiyear highs. (Read more: Stocks Near Highs, Nasdaq Up 2%; Vix Near 16) S&P 500 at 4.5-year high, Healthcare and Consumer Discretionary (mostly retail and home builders) at historic highs. Markets led by Financials, Materials, Energy, and Industrials. How can this be, my trading friends keep asking me? The economy is mired in sub-2 percent GDP growth. Mario Draghi downgraded the GDP outlook for Europe, not just for 2012, but also for 2013. How can the markets be at new highs? It will still be two steps forward, one step back. Ultimately you still have to make a decision: are you in or out of the market based on Europe?Right now, the market is saying that Europe is turning from a headwind to a potential tailwind. By the way: we are in a strange position. Right now strategists expect the S&P to be LOWER at the end of the year than it is now. The consolidated strategist forecast for the S&P 500 is 1,425, according to S&P Capital IQ. The S&P is at 1,430 midday. Even the strategists have been too conservative.

Comment

Click to enlarge:

Comment

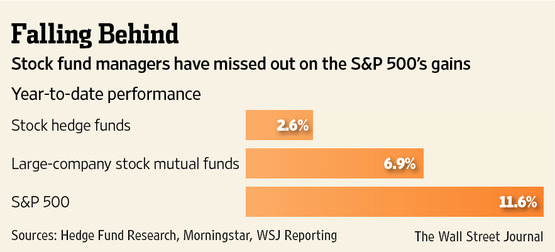

Many assume this is a hated rally because so many managers have underperformed, as shown below. As we noted last January (here and here), 2011 was an unchanged year for the S&P (no price change with a total return of 2.1% thanks to dividends). However, it was a terrible year for money mangers beating this benchmark. 84% of managers did not beat the S&P 500.

This underperformance by most managers is nothing new. It is a continuation of a trend that started in 2010. As we wrote last January:

When told of the bad performance detailed above, market pros instinctively assume these managers made a bad market call. They were too bearish as the market rallied or too bullish as it declined. However, the data does not support this theory. First, there was no market call to miss this year. The stock market is essentially unchanged, so neither the market bears nor bulls made a bad call. Second, in looking at the data day by day, there is no relationship between the direction of the market and these funds’ performance. Quite simply, they performed poorly in both rallying and declining markets. Finally, this poor performance extends beyond equity managers. As a group, macro managers, fixed-income managers, commodity managers and international managers also had a sub-par year. Not everyone can be right, but it is unusual to see so many be wrong.

In a free market system, money is supposed to be efficiently allocated to good ideas or companies while being denied to poor ideas or companies. Most money managers are not concerned with the overall trend of the market or macro themes. Instead, they are focused on each company’s fundamentals. Both long-only and long/short managers will construct their portfolios via an exhaustive company-by-company selection process.

In today’s highly correlated world, company specifics take a back seat to macro considerations. All that matters is risk-on and/or risk-off. Unfortunately this makes the capital allocation process inefficient. If the average stock is 80% correlated to the S&P 500, then bad ideas rally on risk-on days while good ideas suffer on risk-off days, causing a mispricing of assets. If the capital allocation process is inefficient, then the financial sector will suffer and the economy will struggle. That is exactly what is happening as the last six quarters have seen real GDP grow less than the economy’s perceived “potential” of 2.5% and financial firms have struggled to the point that they continue to seek out Warren Buffett for capital injections.

Statisticians like to say that correlation does not imply causation. So what is the cause of this high correlation? In short, the extreme moves of central banks and governments are being done on a scale unprecedented in modern financial history. It is not central bank/government intervention that is new, but rather its pure scope and size.

James Grant of Grant’s Interest Rate Observer calculates that the total fiscal and monetary intervention during the Great Depression (September 1929 to July 1933) was equal to 8.3% of GDP. That was enough to pay for the indelible images in our memories of WPA work camps, FDIC insurance to stop bank runs and government-run soup lines. During the Great Recession (December 2007 to June 2009) government intervention was 29.9% of GDP – three times larger than the stimulus seen during the Great Depression when taken as a percentage of GDP.

Simply, the actions of people like Ben Bernanke or Mario Draghi matter far more than any specific fundamental of a company. It’s as if every S&P 500 company has the same Chairman of the Board that only knows one strategy, resulting in a high degree of correlation between seemingly unrelated companies.

Massive central bank/government involvement in markets risks returning us to a de facto centrally planned economy. Every time the Federal Reserve opens a swap line, the ECB hints at another program to stem the crisis, or successful American money managers wonder if the Federal Reserve could directly buy Italian bonds, the central banks/governments are trading a short-term fix that raises all boats, even the bad ones, for an even more inefficient capital allocation process. Winners must be rewarded and losers must fail. High correlations among markets leading to poor performance are an indication that this is not happening today and it is hurting the economy.

The Wall Street Journal – More Gains, Even More Pain

Summer Rally Puts the Hurt on Defensive Hedge- and Mutual-Fund Managers

It was the rally that left many fund managers behind. Stocks jumped nearly 10% over the summer, defying the expectations of many hedge- and mutual-fund managers who had bet on a decline. They saw a multitude of headwinds from Europe’s woes to the slowing U.S. economy and sluggish corporate earnings. Now, those defensive fund managers are facing what’s known in Wall Street lingo as the “pain trade”: having to buy stocks just to avoid being left in the dust. The longer stocks hold the summer’s gains, the more deeply the pain could be felt, forcing fund managers to start buying. That, in turn, could give stock prices another leg up and potentially generate a virtuous circle for the stock market and even more pain for those on the defensive.

Source: Arbor Research

For more information on this institutional research, please contact:

Max Konzelman

max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: