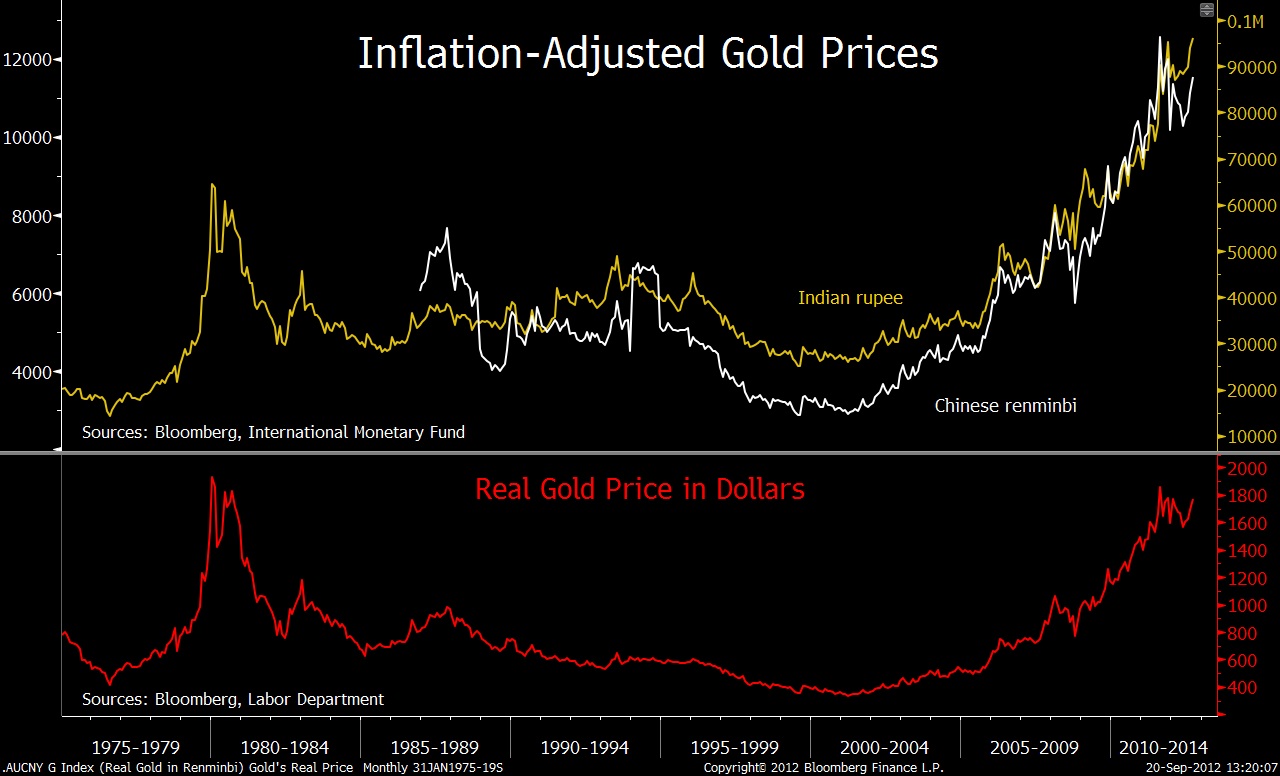

Click to enlarge:

Source: Bloomberg

Is Gold cheap? Pricey? Somewhere in between?

I have a hard time answering that question because I have no frame of reference. With equities, I could look at earnings and/or dividends, sales, book value, etc. to determine relative valuation. With bonds, interest rate, credit rating (and whether its callable) give me some insight into the value.

I have none of that with gold. (Note valuation doesn’t tell me whether to buy it or not, only whether its cheap or dear).

Bloomberg’s David Wilson looks at another standard to value gold: The historical standards for the world’s two largest buyers, China and India. Today, the price of gold for immediate delivery has risen to records in the Chinese renminbi and Indian rupee after accounting for each country’s inflation. (The caveat is gold is priced in dollars).

Wilson references a recent study by Claude B. Erb and Campbell R. Harvey of Gold Prices and valuation:

“Gold objects have existed for thousands of years but gold has only been an actively traded object since 1975. Gold has often been described as an inflation hedge. If gold is an inflation hedge then on average its real return should be zero. Yet over 1, 5, 10, 15 and 20 year investment horizons the variation in the nominal and real returns of gold has not been driven by realized inflation.

The real price of gold is currently high compared to history. In the past, when the real price of gold was above average, subsequent real gold returns have been below average. As a result investors in gold face a daunting dilemma: 1) seek inflation protection by paying a high real gold price that almost guarantees a decline in future purchasing power or 2) avoid gold and run the risk of a decline in future purchasing power if inflation surges.”

Fascinating stuff . . .

Sources:

Bloomberg

by David Wilson

September 20, 2012

The Golden Dilemma

Claude B. Erb, Campbell R. Harvey

Duke University Fuqua School of Business/National Bureau of Economic Research (NBER) Revised August 3, 2012

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2078535

What's been said:

Discussions found on the web: