My morning reads:

• Why your house is worth more (or less) (Washington Post)

• Neuberger Berman showed how to survive a Wall Street meltdown (Fortune)

• Sheila Bair, in new book, faults Obama and Bush advisers during financial crisis (Washington Post)

• Judge Rakoff delivers enormous gift to MBS bond insurers, noteholders (Reuters)

• Comparing the Job Losses in Financial Crises (Economix)

• A time of hoarding and inflation fears, 1930s edition (FT Alphaville)

• Fed Helps Lenders’ Profit More Than Homebuyers (Bloomberg) see also ROSENBERG says Housing Recovery Is Doubtful, And Won’t Help The Economy (Business Insider)

• Measuring iPhone demand (Asymco)

• Your body clock: The Peak Time for Everything (WSJ)

• Did “Louie” kill the sitcom? (Salon)

What are you of atoning for?

>

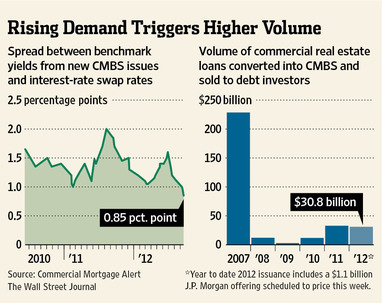

Debt Rally Is Welcome News

Source: WSJ

What's been said:

Discussions found on the web: