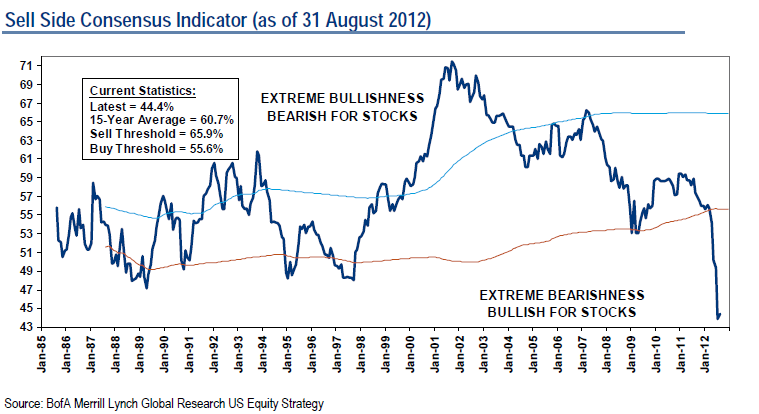

In support of the argument that much of Wall Street is underinvested, consider the chart above. (We showed this last month as well). It not only asset managers, but analysts as well who are not all that enamored with equities.

As I have been asserting since 2009, this is the most hated rally in wall street history. It appears that lack of enthusiasm continues to be a source of fresh energy.

Source:

BofA/ Merrill Lynch

Sell Side Indicator

September 04, 2012

What's been said:

Discussions found on the web: