Last week, we looked at 140 years of Equity Yield vs US Bond Yield.

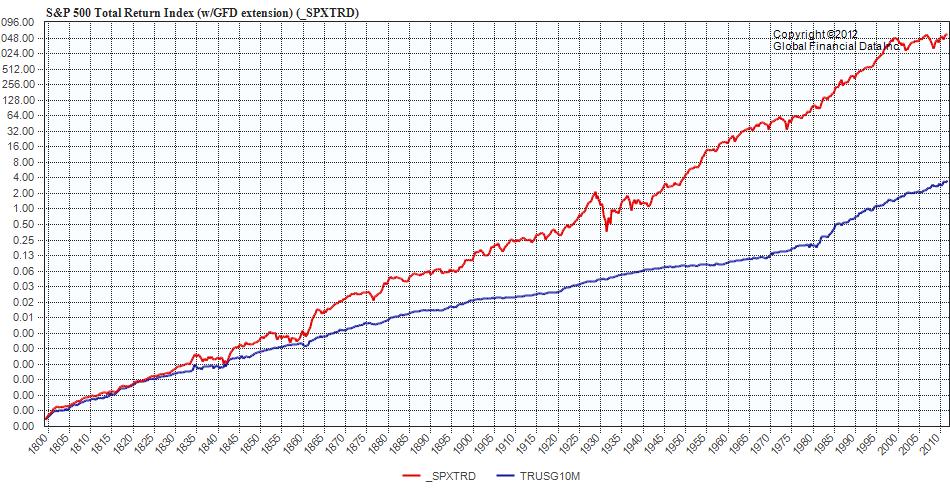

A people inquired what the total return would like of the S&P500 with dividends reinvested) compared to 10 year US bond with coupon reinvested. Global Financial Data generated the chart below, creating an approximate SPX and 10 Year over that entire period.

After two centuries, its no contest. Stocks actually do beat bonds — for the really really really long time.

Click to enlarge:

Source: Global Financial Data

Thanks, Ralph !

Ralph Dillon rdillon@globalfinancialdata.com

www.globalfinancialdata.com

What's been said:

Discussions found on the web: