My Sunday Reads:

• Better Off Than Four Years Ago? — The Lehman Edition (WSJ)

• MERS: State court ruling deals blow to U.S. bank mortgage system (Reuters) see also Argentines Turn Cash Into Condos in Miami (NYT)

• NYSE Data Violations Extend U.S. Exchanges’ Reputation Woes (Bloomberg)

• Who Wants to Be a Billionaire? (Vanity Fair)

• Jim Chanos: From Romney’s dog to Ryan’s run, one thing is clear: this election is bullshit (The Guardian)

• Do Tax Cuts Lead to Economic Growth? (NYT)

• Kass: What to Do When You’re Wrong (TheStreet.com)

• The Lonely Redemption of S. B. Lewis, Eccentric Genius of Arbitrage (NYT)

• Cautious Moves on Foreclosures Haunting Obama (NYT) see also Housing’s Fortune Depends on Apartment Living (WSJ)

• How Michael Jackson Made ‘Bad’ (The Atlantic)

What are you reading?

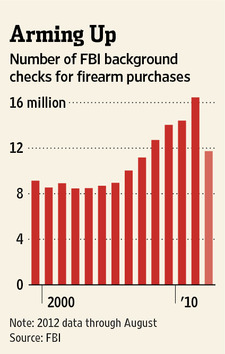

Gun Sales Hinge on Obama Re-Election

Source: WSJ

What's been said:

Discussions found on the web: