Zor and Zam

By Grant Williams

September 17, 2012

For A FREE Subscription to Things That Make You Go Hmmm… Click here »

| “They met on the battlefield banner in hand. They looked out across the vacant land. And they counted the missing, one upon one, None upon none. The war it was over before it begun.Two little kings playing a game. They gave a war and nobody came. And nobody came. And nobody came. And nobody came.”– The Monkees, Zor and Zam |

||

| “A central bank has this wonderful ability that no other player in the market has when it says ’I’m going to do whatever it takes,’ and everyone believes that. In the end they may do nothing. It restores confidence. It’s the idea of multiple equilibria, and when we know that we are in the good equilibrium, in the end action is not needed.”– Panicos Demetriades, Central Bank Governor, Cyprus | ||

Contents

THINGS THAT MAKE YOU GO HMMM

Why Merkel Wants to Keep Greece in Eurozone

Shadow Bankers Vanishing Leave China Victims Seeing Scams

Spanish Debt, Bank Borrowings Soar to Highest in Decades as Home Prices Fall by Most Ever While GDP Shrinks

ECB’s Demetriades Says OMT Program Is Decisive Step Forward

Waiting for Rajoy

Xi Jinping Mystery Echoes Back to China’s History

Era of ‘Jobs-Targeting’ Begins as Fed Launches QE3

Wave Hello to Japan’s Next Disaster

CHARTS THAT MAKE YOU GO HMMM

WORDS THAT MAKE YOU GO HMMM

AND FINALLY

Things That Make You Go Hmmm…

Carl Sandburg died six months after I was born.

He won three Pulitzer prizes; one for his biography of Abraham Lincoln and another two for the poetry that made him famous, and his face was claimed to be one-third of the inspiration for that of E.T. by none other than the film’s director himself, Steven Spielberg (the other two unlikely members of that triumvirate were Ernest Hemingway and Albert Einstein).

In 1936, Sandburg wrote an ode to America that he called “The People, Yes,” which spread over an astounding three hundred pages and ultimately became the inspiration for an entire generation due to just one line amongst the thousands that comprised the work.

“The first world war came and its cost was laid on the people.

The second world war — the third — what will be the cost.

And will it repay the people for what they pay?…

The little girl saw her first troop parade and asked,

‘What are those?’

‘Soldiers.’

‘What are soldiers?’

‘They are for war. They fight and each tries to kill as many of the other side as he can.’

The girl held still and studied.

‘Do you know … I know something?’

‘Yes, what is it you know?’

‘Sometime they’ll give a war and nobody will come.'”

That last line was seized upon in the 1960s by what my grandfather would no doubt have called “hippy slackers” as they searched for both an identity and something around which to rally to express their opposition to America’s involvement in Vietnam.

The line also gave rise to a movie titled “Suppose They Gave a War and Nobody Came”—which starred Tony Curtis—and has been the source of thousands of variations in the years since Sandburg committed it to paper. It was also used in the song “Zor and Zam” by the Monkees, a track from their fifth album “The Birds, The Bees & The Monkees,” which was released exactly nine months to the day after Sandburg’s death.

For several months now, one of my biggest fears has been that QE3 could turn out to be the death knell for policy effectiveness over markets as I have watched government bonds get bid up ahead of the event and seen equities float to within touching distance of their all-time highs on drastically reduced volume.

It has been clear that many equity market participants are on the sidelines due to fears over the condition of the global economy—remember the good old days when that was how you judged whether to buy stocks, not purely on whether more free money was coming—which has left the playing field to the fast-money crowd who have been trading paper back and forth waiting for the inevitable 10-15% bump that markets were bound to receive in the wake of the certain additional Quantitative Easing on the part of the Fed. That’s an awful lot of certainty in an uncertain world.

When that glorious day came, they would dump their shares on the incoming buyers and waltz off into the sunset with their government-gifted profits.

My fear is this:

Suppose They Eased Some More and Nobody Came?

What would happen if a massive dose of additional stimulus had minimal effect? What then for Draghi? Bernanke? King? Jordan? The guy whose turn it is that week to be governor of the Bank of Japan?

What then?

Well, after this past week’s events, we are about to find out if my fears are valid or if they will be swept away on a fiat tide.

After the recent Jackson Hole Shrimpfest (™Bill Fleckenstein), the level of confidence that surrounded the likelihood of further easing at the September FOMC meeting ratcheted higher again in the wake of the chairman’s prepared remarks—most notably this section:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month.

The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

Fed-watchers had become convinced that Bernanke was ready to announce another bond-buying program as the US economy continued to stagnate and the stubbornly high unemployment number refused to cooperate. What he actually gave them was something extraordinary—the QE party of a lifetime. Unlimited money printing until further notice.

It has been clear to all but the most blinkered optimist or the most staunch believer in the competence of politicians and the sanity of central bankers that the endgame has, for some time now, been money printing on a scale unprecedented in human history.

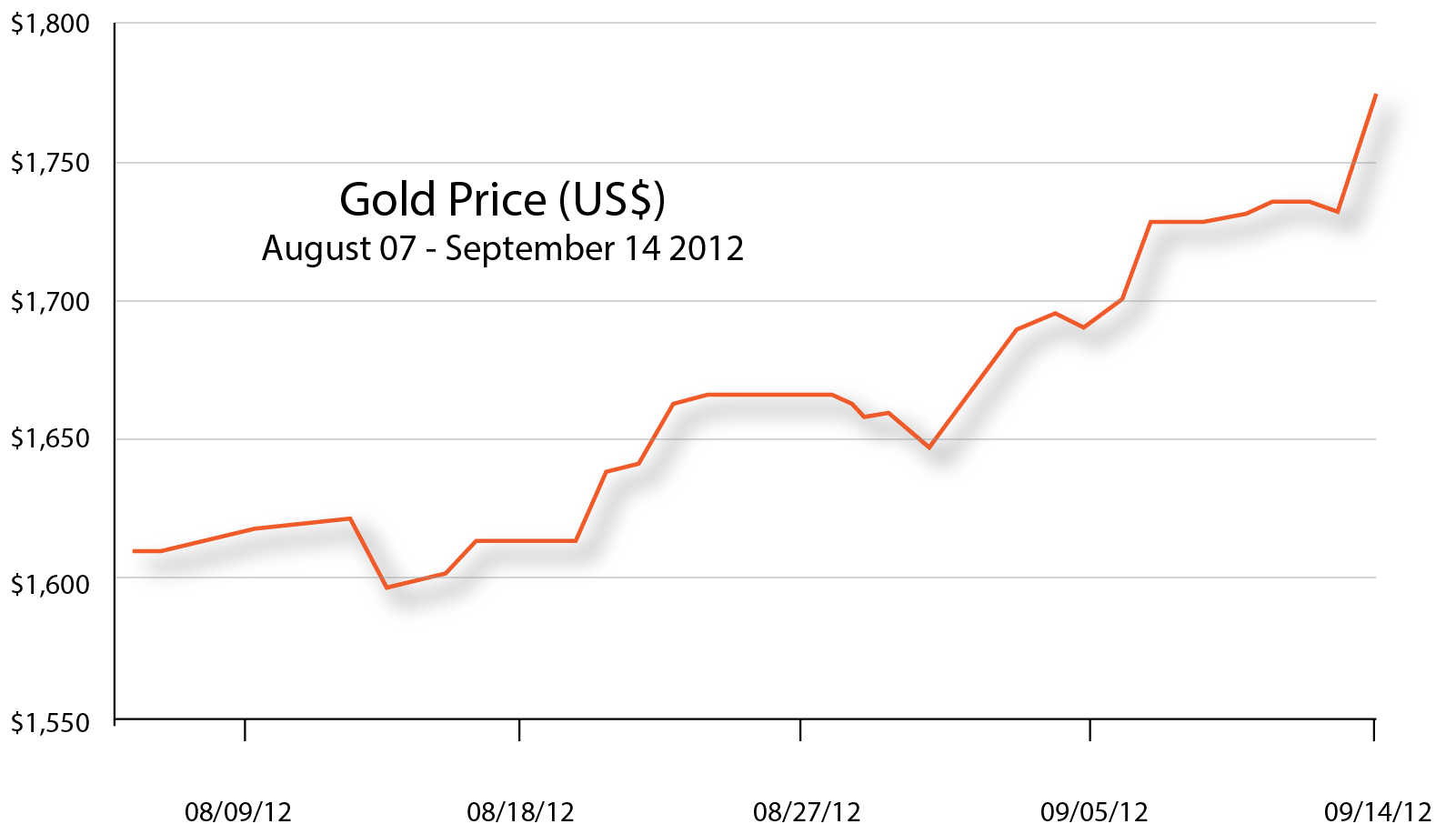

I knew it, many of you knew it, and, recently, clearly, gold knew it.

Source: Bloomberg/TTMYGH

The fact that we are here is, in some ways, a blessed relief because we can finally start to see what the denouement actually looks like and get to the part where the real healing begins, but to do that we have always had to reach the point where the markets took away the printing presses from central bank heads. This week’s announcement brings that day a lot closer, and I fear the speed with which it is now approaching is immensely troubling.

QE1 was announced in a blaze of publicity back in March of 2009, and the effect was both dazzling and immediate.

Bond prices soared and, though the equity market took a little time to digest the ramifications of free money and see it for what it was—the all-clear siren—it soon got the joke, and the S&P500 began a remarkable ascent, which has continued largely unabated from that day to this.

However, as the chart below demonstrates, after the initial leap in bond prices, reality set in somewhat and the selling of bonds to the Fed began in earnest (white line). That selling continued unabated until the day QE1 expired, at which point the market, ever the quick study, began buying again in anticipation of QE2. Once QE2 was announced—Bingo! bond prices fell once again as the greater fool Fed again declared themselves a stand-up buyer.

Source: Bloomberg/TTMYGH

The end of QE2 brought the same rinse/repeat cycle as is evident from the chart, but Operation Twist finally saw bond prices moving steadily higher throughout the length of the program.

Was this because the Fed’s action was finally gaining traction? Certainly, the fact that they are extending the program until the end of the year at the rate of $45 billion per month would indicate they believe the answer to that question to be in the affirmative. The reality, though, is somewhat different.

Put simply, investors are terrified.

Terrified about Europe, terrified about the obvious slide into a global recession, terrified about the all-too-obvious slowdown in China and soon to be terrified about the US fiscal cliff (once they realize it is a problem and it isn’t going away). It is that terror—and the Pavlovian response to it—that has driven them into bonds as we have discussed before in these pages (TTMYGH, June 12, 2012). QE3 will float equities higher because it is highly inflationary, and, as long as one doesn’t value them looking forward (I know, right? Crazy idea), equities are actually reasonably fairly priced (though more of that shortly). But bonds?

As I made my way through the terminal at La Guardia airport this morning on my way to Newfoundland (boy, it’s a long way from Singapore), my eyes alighted on the cover of the weekend edition of the Financial Times. The main headline read “Central Bank Action Lifts Gloom,” which was marvelous to see, of course, but it was the subheading that really got me thinking.

Beneath the headline in smaller-point type were the words “Confidence Buoyed In US And Europe.”

Now, for a long time, this whole process has been seen by central bankers and politicians as being largely a confidence game—the logic being that, as long as confidence could be restored to financial markets, then investment and growth were both certain to follow. The means by which that was to be effected was essentially a public-sector backstop to private-sector debts.

If enough of the excess leverage that had been built up during the Greenspan-fueled credit binge that began around the turn of the century could be ringfenced by making it the responsibility of the taxpayers of the world (“…in the short term, of course. Eventually it will be sold back at a profit—trust us”) instead of the banks that had been instrumental in generating it in the first place, then that missing confidence would return, lending would begin again in earnest, growth would be resurgent and a painful deleveraging/recession/depression* could be miraculously avoided.

*delete according to taste

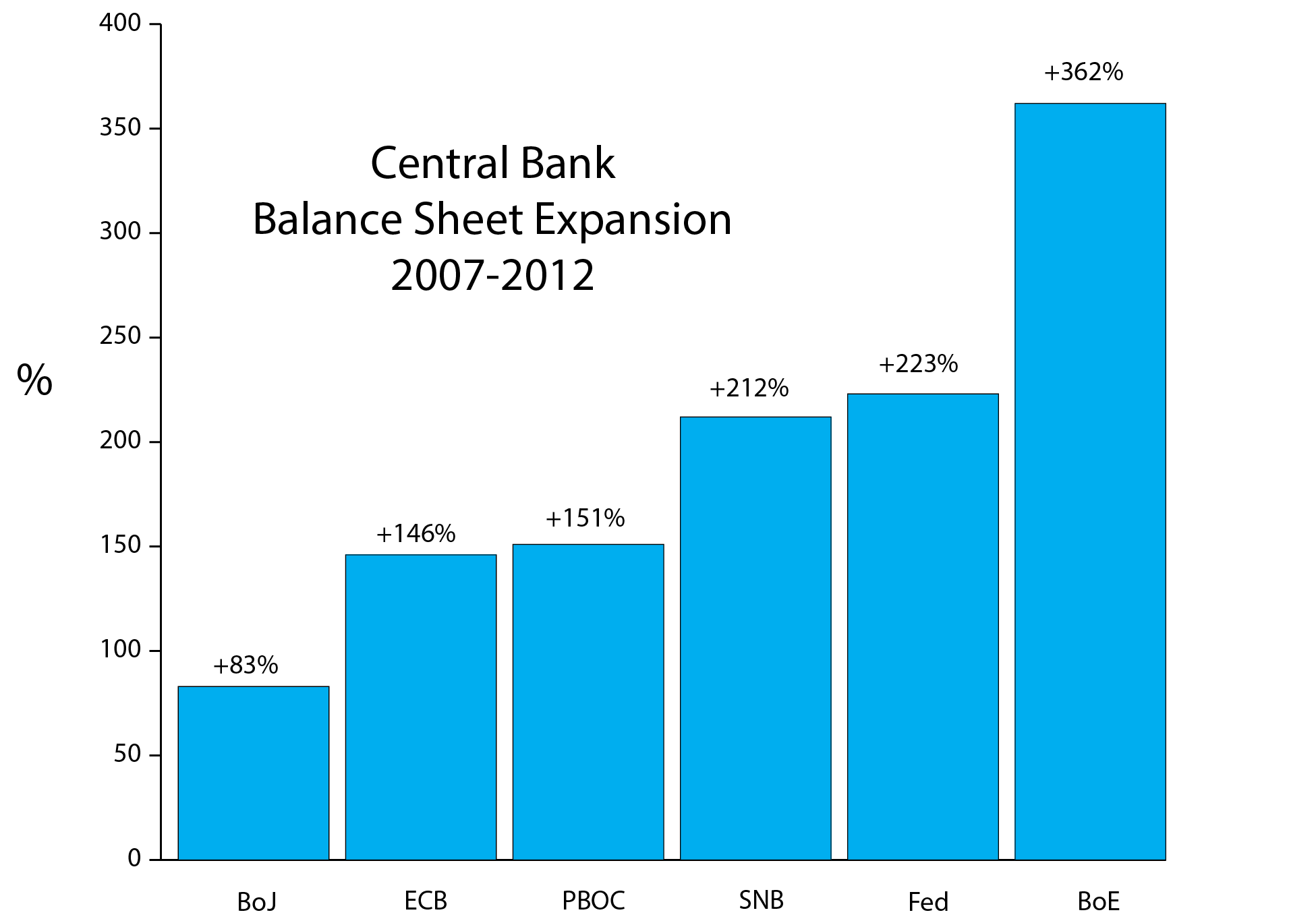

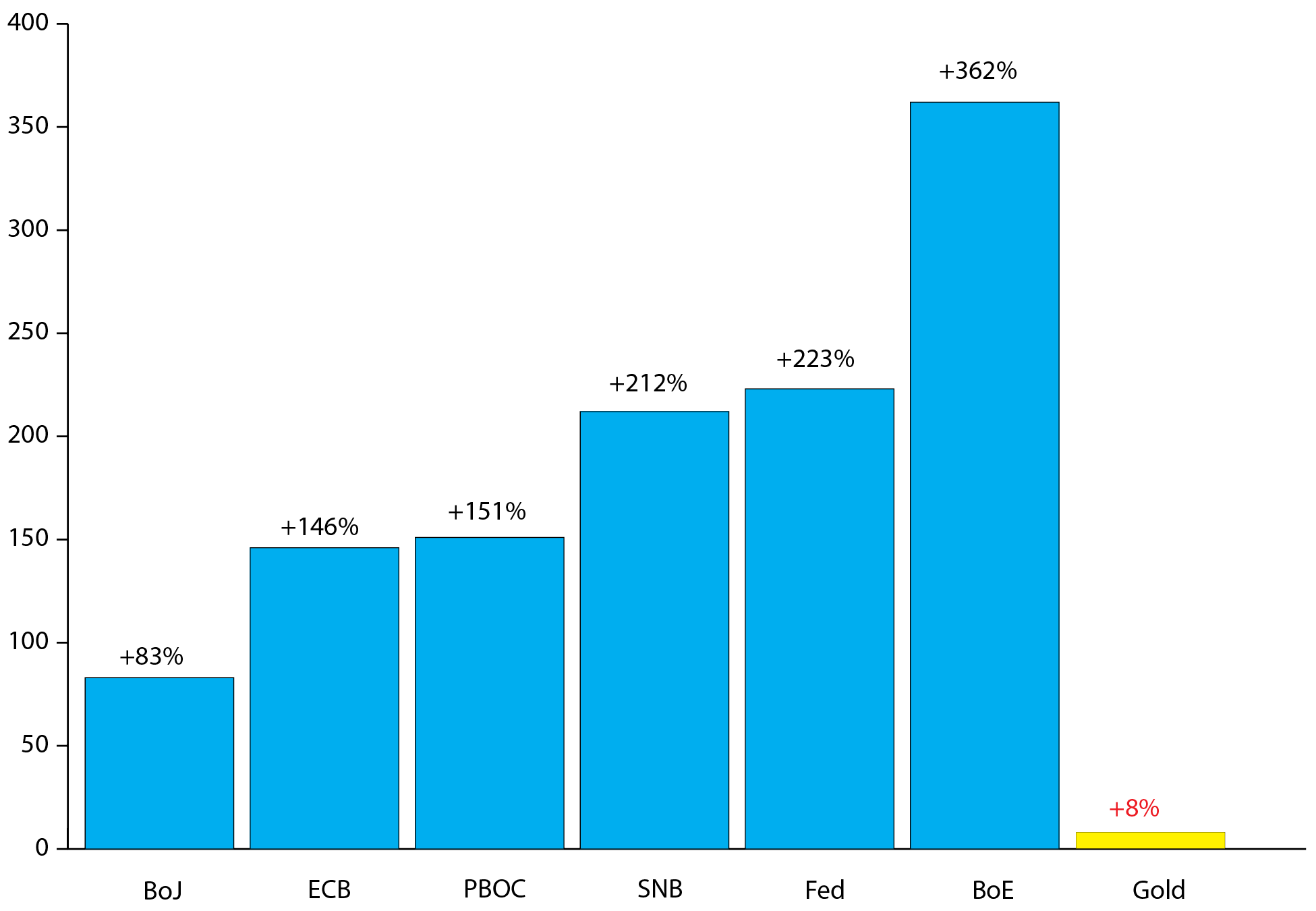

They certainly gave it the old college try as the chart below, which shows the expansion in central bank balance sheets since 2007, demonstrates:

Source: central banks/TTMYGH

But a funny thing happened on the way to redemption: growth slowed, and even stopped, in certain dark corners of the world’s economy, and the sheer incompetence of many of the world’s “leaders” (yes, Eurocrats, I’m looking at you) meant that after dozens of summits at which short-term “fixes” were triumphantly announced only to be proven woefully inadequate and painfully divisive, confidence not only in the economy itself but in the ability of those elected to shepherd the world through the storm to the sunlit uplands beyond proved impossible to bolster.

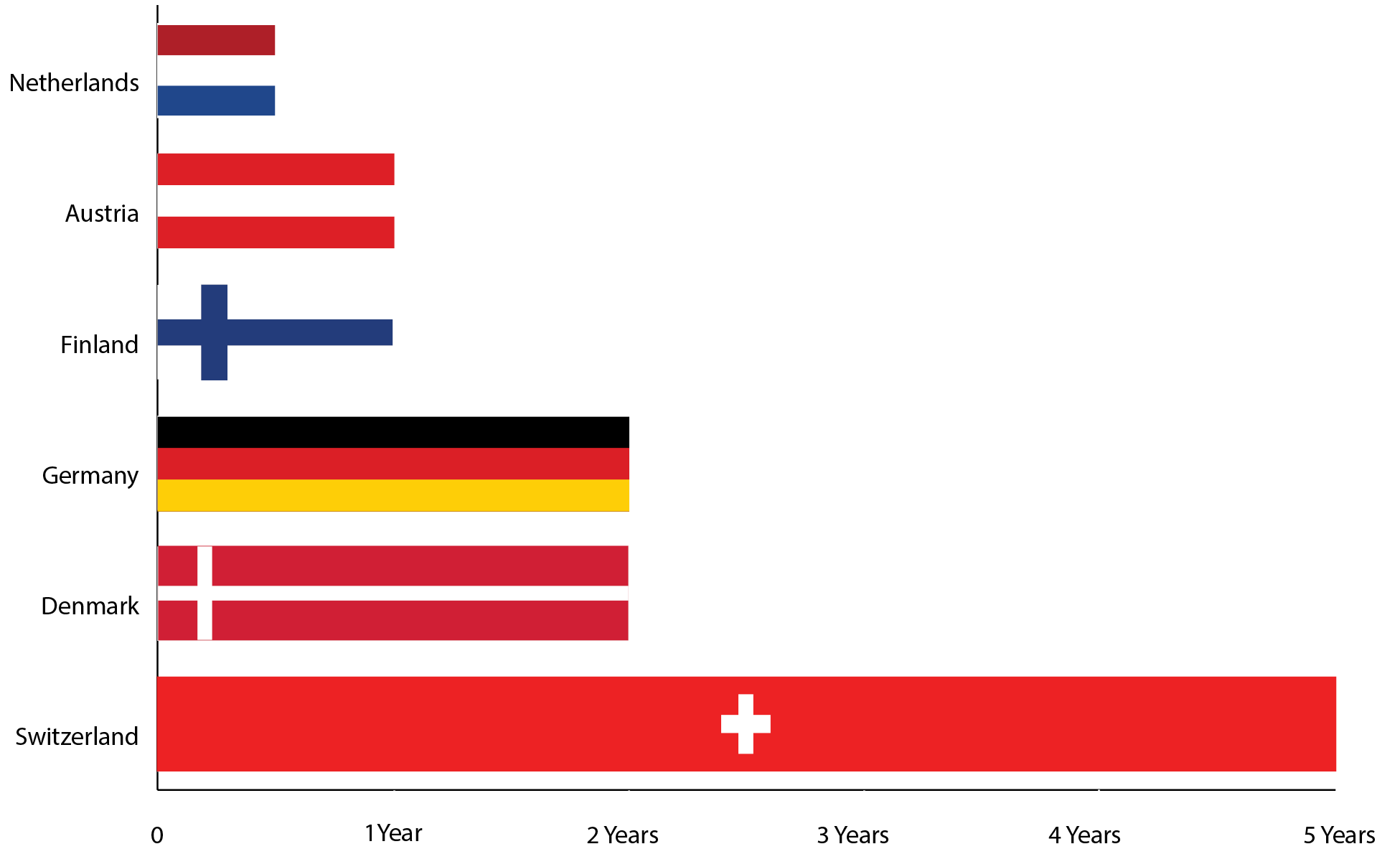

How badly was that confidence shattered? Well, for starters there were recently six countries—all of them European and therefore fully exposed to the ramifications of the slow-motion splintering of the Eurozone—that were able to borrow money from a terrified public at negative interest rates.

Source: Bloomberg/TTMYGH

The Netherlands (days ahead of a general election that, at the time, had the potential to put their membership of the Eurozone in jeopardy), Austria and Finland were all able to borrow money from investors at negative rates, as were Denmark (European in geographical terms but, like the UK, steadfast avoiders of being chained to the euro) and Germany.

Yes, Germany—which, in an almost perfect illustration of the degree to which sanity has been suspended in Europe, would bear almost 30% of the brunt of all the costs associated with a messy break-up of the euro, not to mention their €750 billion in Target2 claims—was seen as a safe haven for those looking to avoid the pitfalls of PIIGS debt and could borrow money for up to two years at negative rates of interest. Based on the assumption that, with the current situation being what it is, the Eurozone is more or less guaranteed to reach its eventual defining moment within that two-year period, that is a staggeringly short-sighted place to put one’s money. But, hey, maybe it’s just me?

Now, of course, there are reasons why people would want to own German sovereign debt (the need for good collateral and the hope that bondholders will be repaid in Deutschemarks should the implosion finally happen—good luck with that, by the way—amongst others), but still…German government bonds? At negative rates? Really, guys?

The elephant in the chart above is, of course, Switzerland.

Mighty Switzerland and its 7.9 million citizens generating $344 billion in GDP (making it the world’s 38th-largest economy), which has become the safe haven EVERYBODY wants a piece of, so much so that the SNB can now borrow money at negative rates out to five years.

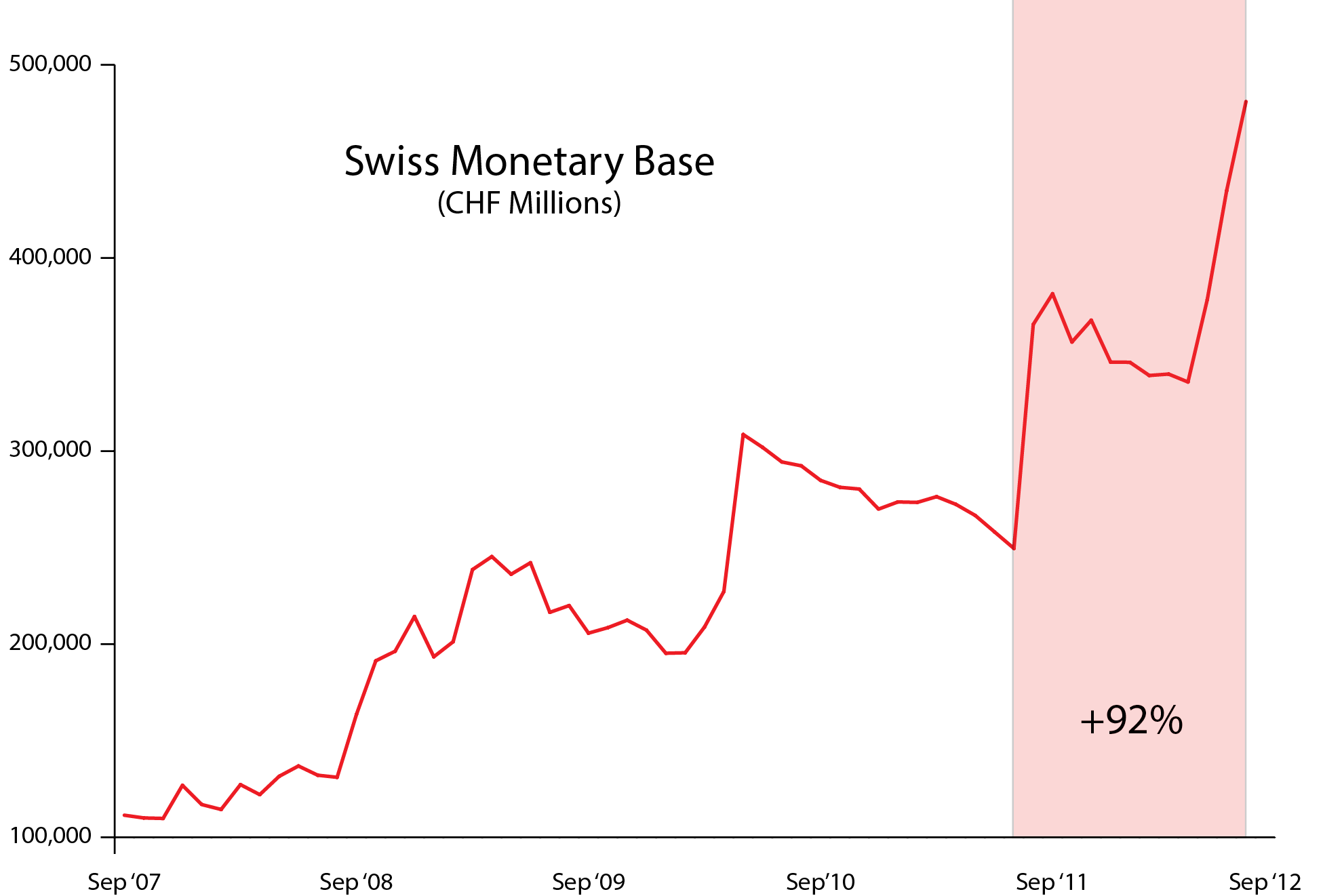

It was the desperate rush into the Swiss franc that led to the instillation last year of the peg to the euro, which made the Swiss the first country to use the “u-word.” Since then, they have steadfastly stuck to their guns, and the extent of their “success” can be seen in their monetary base:

Source: Bloomberg/TTMYGH

I guess it just goes to show you the benefits that being the only country to have never defaulted can bring you.

This month, the SNB met again, and their language had changed very little (except for the faint whiff of desperation, perhaps?):

The Swiss National Bank (SNB) is leaving the minimum exchange rate unchanged at CHF 1.20 per euro, and will continue to enforce it with the utmost determination. It remains committed to buying foreign currency in unlimited quantities for this purpose. The Swiss franc is still high and is weighing on the Swiss economy. For this reason, the SNB will not permit an appreciation of the Swiss franc, given the serious impact this would have on both prices and economic performance in Switzerland. It is leaving the target range for the three-month Libor rate unchanged at 0.0-0.25%. If necessary, it stands ready to take further measures at any time.

Methinks the Swiss doth protest too much. At some point, the determination of the Swiss National Bank will be tested by the market—but that is something for another day.

So the stage is set for a blitz of free money, and consensus is that everything will go higher—a lot higher. But what if it doesn’t?

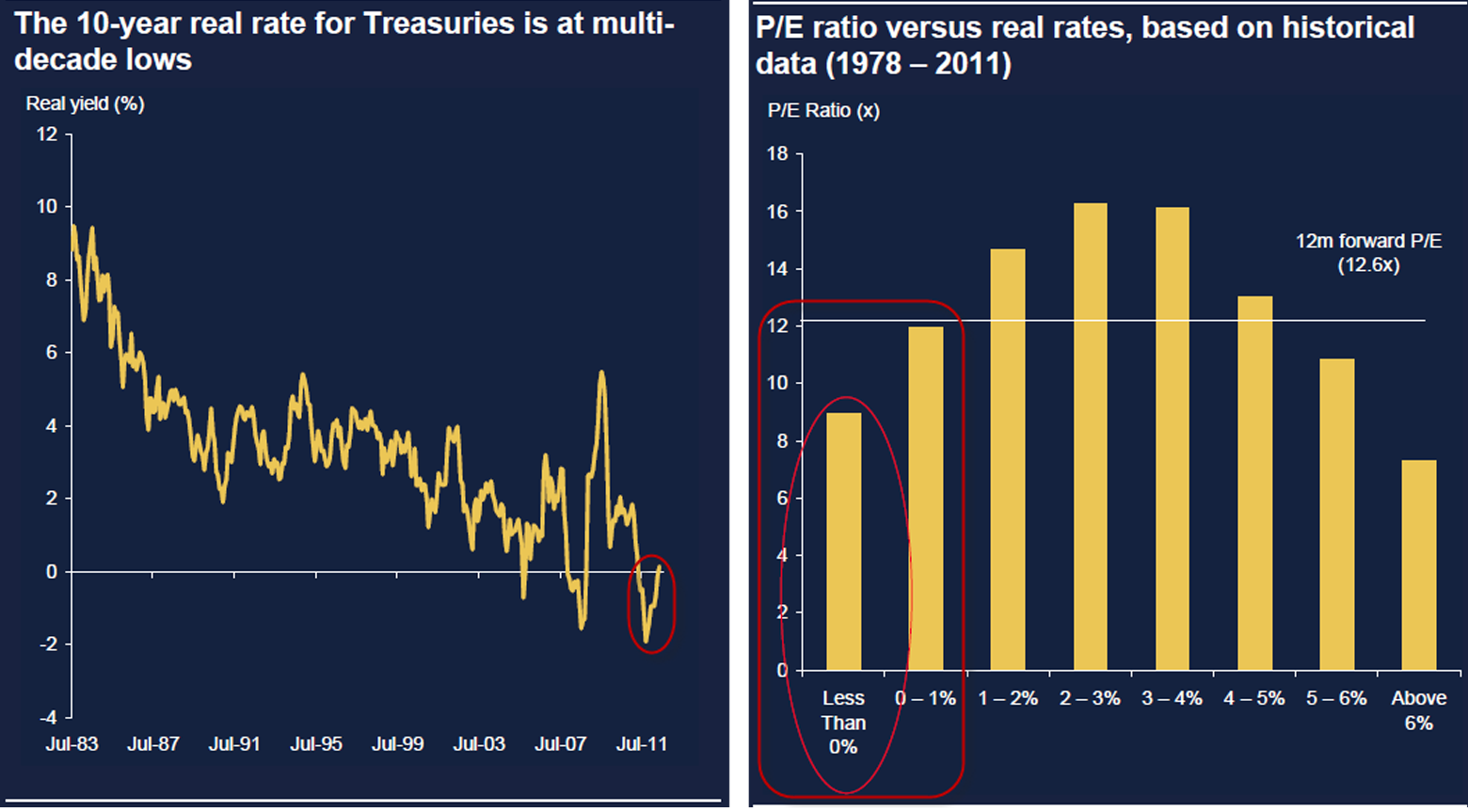

Stocks aren’t exactly cheap, as Morgan Stanley pointed out recently:

(via Zerohedge): … with real rates this low (and staying low for a few more years yet) current P/E multiples are extremely high and even on a long-run empirical basis, hope remains excessive at 22xShiller P/E versus an average 16x. Remember, a long-term investment is a short-term trade gone bad. But it seems for now that you buy because you’ll always be able to sell it back higher to the next smarter dumber greater fool.

The charts used to back up the assumption are compelling:

Source: Morgan Stanley/Zerohedge

In essence, with real rates at current levels, P/E ratios ought to be sub-10 as opposed to the 12.6x the S&P500 currently trades on.

Bonds are trading on valuations that scream “bubble” based purely on their notional levels alone. Take the time to look into the balance sheets underlying them, and I defy anyone to complete the following sentence:

Government bonds offer good value for investors because…

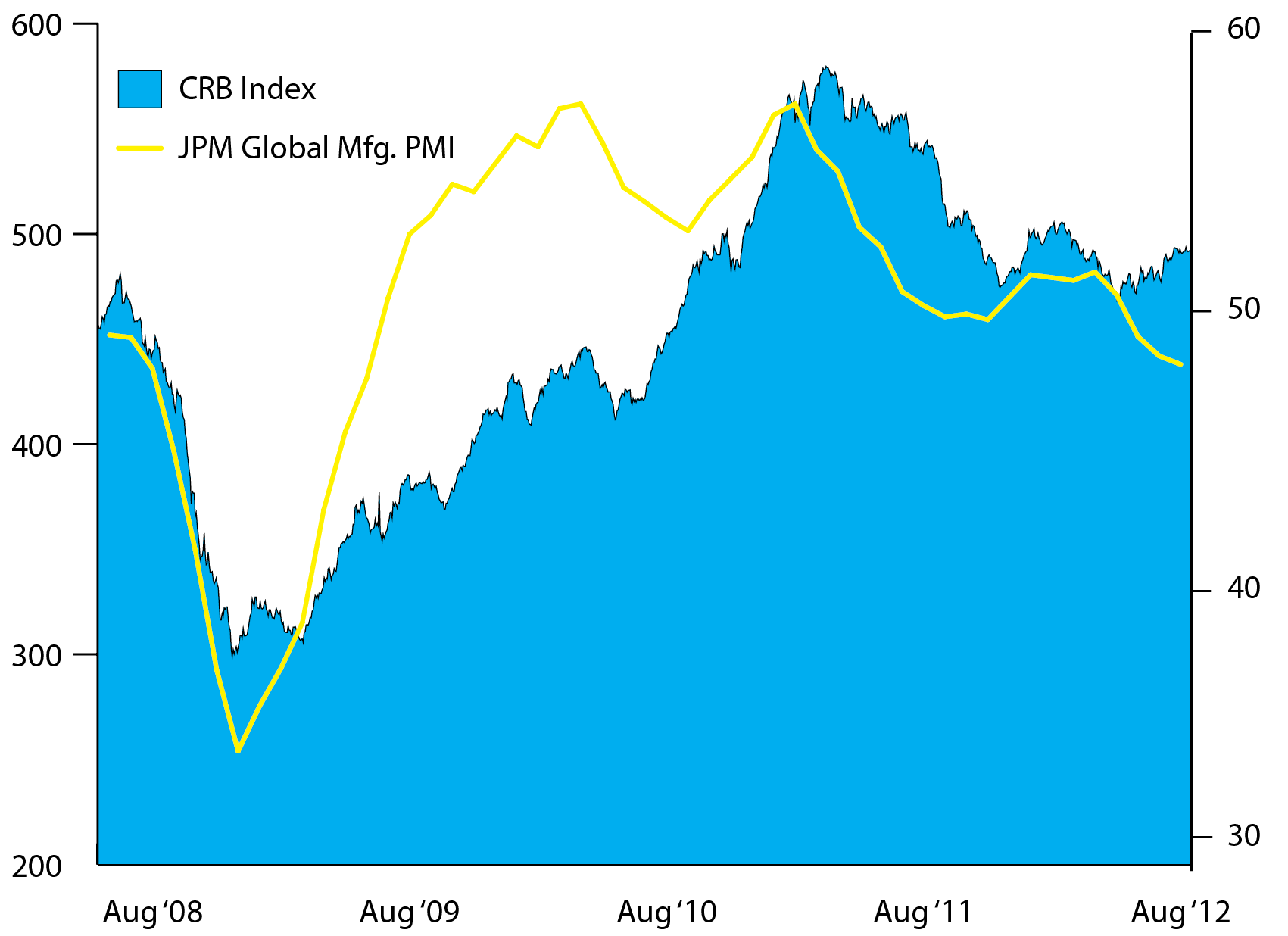

Which leaves commodities, the lifelong barometers of both inflationary pressures and economic growth.

Based on the data emanating from Europe, the US and China in recent months, one would be hard pushed to argue that the world is heading anywhere but into a coordinated recession. Historically, that would have meant trouble for industrial commodities and particularly oil, but, worryingly as the chart below suggests, the commodities complex (represented here by the CRB Index) looks to have bottomed a few months back (when it became apparent that further QE was on its way), and on last week’s news, it took another leg higher. At the same time, the JPMorgan Global Manufacturing PMI index has slipped below 50 and is heading worryingly in the opposite direction.

Source: Bloomberg/TTMYGH

The last thing the world needs if it is heading into a global recession is commodity prices being driven sharply higher through stimulus that is, shall we say, a little overzealous.

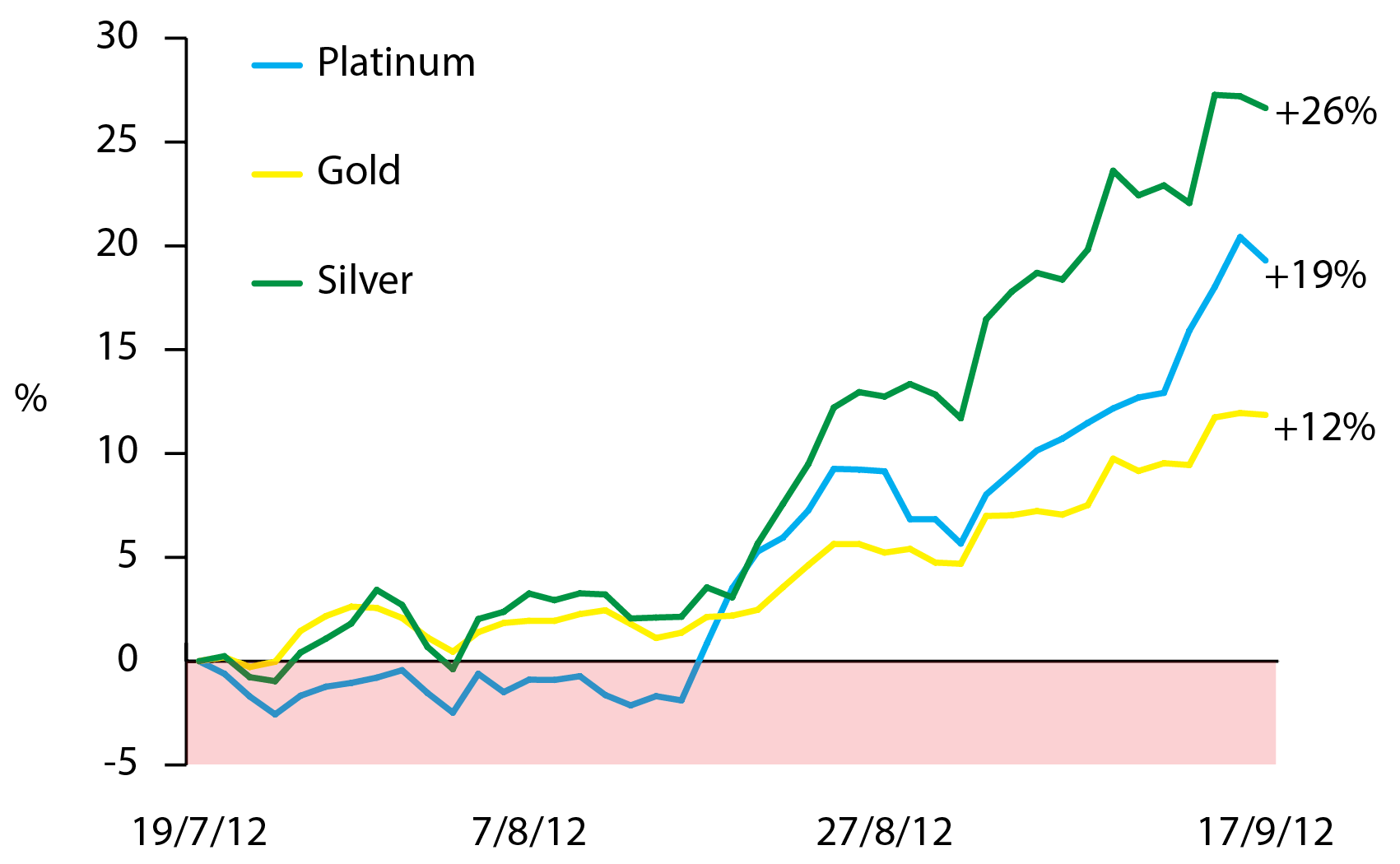

Which brings us to the precious metals.

The real winners from the unlimited funny-money era into which we stepped last week will be the monetary metals, and their performance over the past eight weeks is likely a harbinger of things to come:

Source: Bloomberg/TTMYGH

Whether equity markets continue their rally for a little while longer (which I fear may not be the case), they do not offer value at these levels based on the economic conditions of the world in which we live right now. Government bonds are in a bubble (they are also a giant Ponzi scheme, but more of that in a future TTMYGH), so regardless of the extent of central bank intervention, eventually mathematics will get the better of them, industrial commodities will be pulled in both directions by the forces of the economic slowdown and the massive inflationary pressures that QE will bring to bear, and that leaves only the precious metals complex offering any kind of shelter from the storm.

To finish things off, we’ll revisit the chart from earlier in this piece that shows the massive expansion in the monetary bases of global central banks, only this time, by way of a little perspective, we will add in the expansion of the world’s supply of gold during the same period:

Source: Central Banks/WGC/TTMYGH

Beware the assumption that QE3 is one endless party, folks. After all:

Suppose They Eased Some More and Nobody Came?

Until next time…

On a housekeeping note, I am in Newfoundland this week to speak at the Resource Investors Forum in beautiful St. John’s, and from here I am heading to Seattle and then Atlanta (go figure). Consequently, the chances of me having time to write next week are roughly the same as the chances of Bernanke raising rates before 2020…

I’ll be back in a couple of weeks. In the meantime, I hope you like the new format of Things That Make You Go Hmmm…

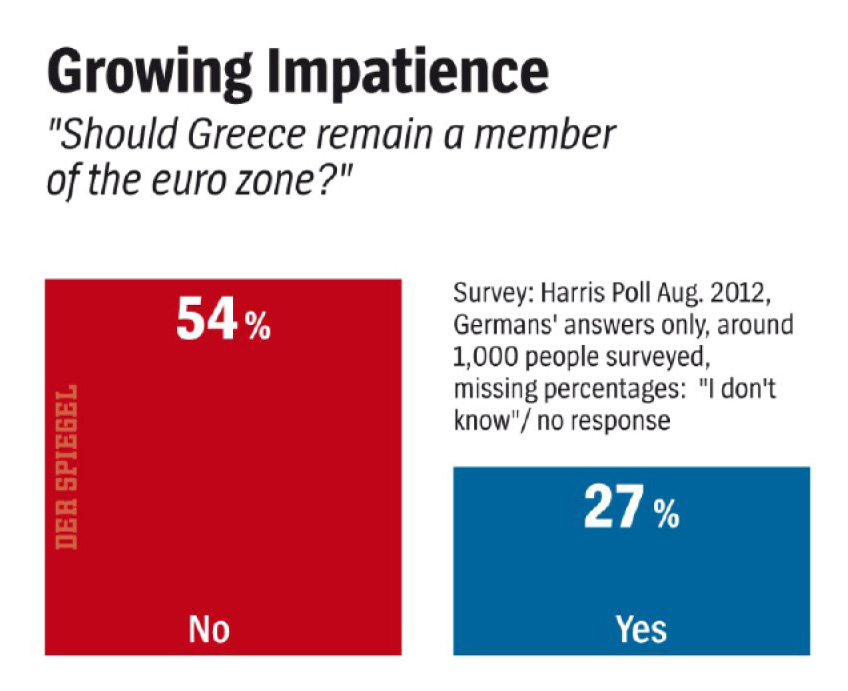

Angela Merkel has made a surprising U-turn in her policy on Greece. The German chancellor now wants to stop Athens from leaving the euro zone at all costs—even if it means massaging the figures in the upcoming troika report. For the German leader, it is essential to avoid the consequences of a Grexit before national elections next year.

Mantras are short, formulaic phrases that are repeated over and over for meditative purposes. They can be spoken, sung, whispered, recited mentally or even written down and eaten.

The German chancellor has recently opted for the spoken variety, which is the conventional form. Angela Merkel’s mantra consists of a short German sentence. It translates as: “We are waiting for the troika report.” She repeats it whenever the opportunity arises—such as two weeks ago, when Greek Prime Minister Antonis Samaras visited Berlin.

Source: Der Spiegel

One doesn’t need to be a rocket scientist to see through Merkel’s maneuver: The chancellor wants to buy time. She hopes to calm the general public and the notoriously nervous financial markets through meditative repetition—and ultimately create the impression that it actually matters what the troika finds out during its mission to Greece.

But it doesn’t. In reality, Merkel has already made up her mind. After long hesitation, she has sided with French President François Hollande and the European Commission. The report from the troika—which consists of the European Commission, the International Monetary Fund (IMF) and the European Central Bank (ECB) and which departed on its fact-finding tour last week—will undoubtedly conclude that Greece can remain in the euro zone.

If that happens, more money can flow again into the debt-ridden Balkan nation this fall. If the chancellor has her way, though, there will be no third aid program for Greece, which would have to be approved by the German parliament, the Bundestag.

Merkel’s newfound determination to rescue Greece is a remarkable U-turn for the chancellor. Until recently, Merkel was prepared to drop the country if it failed to meet its commitments. But she now regards a Greek departure from the euro zone as entailing too many risks.

In the Chancellery in Berlin, officials fear that such an outcome could trigger a domino effect like the one caused by the Lehman Brothers bankruptcy in September 2008. At the time, the collapse of the New York investment bank plunged the entire global economy into chaos. In Germany alone, the economy shrank by 5 percent and hundreds of thousands lost their jobs.

But the political costs are also too high for Merkel. If Greece withdrew from the euro zone, her advisers fear that this could mean that it would eventually be necessary to create a common “debt union” to stabilize problem countries like Italy and Spain. It would be a paradoxical situation: Germany would take a hard-line approach with Greece, but might subsequently have to accept jointly issued euro bonds, which German voters widely oppose.

*** der spiegel / LINK

To live out his retirement years, He Zhongkui was counting on steady income from an investment that promised interest payments five times higher than what he could earn in a Chinese bank.

Now He, a 62-year-old former municipal official in Wenzhou who rides a rusty bicycle, is cutting back on food and gasoline, having found himself one of a growing number of victims of China’s nebulous world of shadow banking. A “friend,” who he said had been paying him 2,400 yuan ($379) a month after He gave him one-third of his 600,000-yuan life savings to invest in real estate, suddenly disappeared. So did the payments and principal.

“I called, but the number was no longer in existence,” said He, who worked for the Water Resources Bureau in Wenzhou, a city of 9 million people on China’s east coast. “I went to his home, but nobody was there. I was even invited to his daughter’s wedding, for heaven’s sake. It was all a scam.”

China’s slowest economic growth in three years and a slumping property market, where many so-called shadow-banking investments are parked, are squeezing millions of Chinese who have invested the money of friends and acquaintances chasing higher yields to honor those payments. The slowdown also is putting pressure on the government to rein in private lending to avoid a spate of defaults that could increase the number of victims and lead to social unrest.

The shadow bankers are now disappearing, committing suicide or reneging on agreements, leaving thousands of victims in their wake. In the first half of the year, more than 58,000 lawsuits involving disputes over 28.4 billion yuan in private lending were filed in Zhejiang province, where Wenzhou is located, up 27 percent from the same period in 2011 and the most in five years, according to the provincial supreme court. One-fifth of the cases were in Wenzhou, where authorities have set up a special court to handle the surge.

Private-lending victims nationwide filed more than 600,000 lawsuits valued at 110 billion yuan in 2011, an increase of 38 percent from the previous year. In the first half of 2012, the number of filings rose 25 percent to 376,000, according to People’s Court, a newspaper run by China’s Supreme Court.

In Wenzhou, an export hub where almost 90 percent of families have taken part in underground lending, more than 100 people have fled, committed suicide or declared bankruptcy since August 2011, and at least 800 lending brokers have gone bankrupt, Xinhua News Agency reported in May. Home prices there declined 16 percent in July compared with a year earlier, the fifth consecutive monthly decline, according to the National Bureau of Statistics of China.

“It’s time for payback for the unchecked growth of China’s shadow-banking activity,” said Yao Wei, a Hong Kong-based economist at Societe Generale SA, who estimates that as much as 2 trillion yuan of underground lending may default eventually. “The risks are culminating, and part of the system is doomed to collapse. On the flip side, this gives policy makers an opportunity to put in place oversight for a sector that should have been regulated a long time ago.”

*** bloomberg / LINK

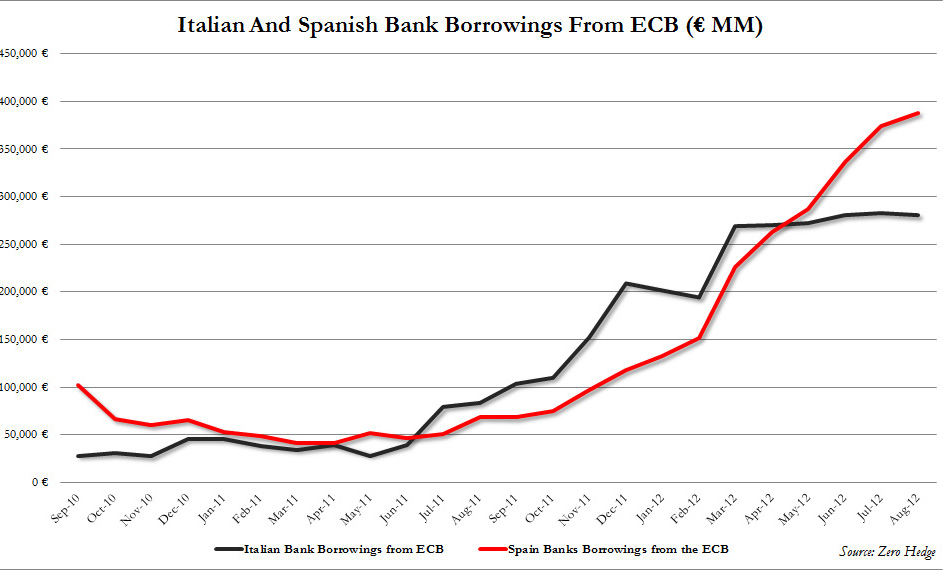

If only the Fed or ECB could print another Spain with the same facility that they engage in currency destruction (and make no mistake: yesterday’s “open-ended” Fed easing is today’s ECB “open-ended” intervention, is tomorrow’s BOJ, is Sunday’s PBOC, etc.), now might be the time. Because things in Spain, no matter what one is told, are getting progressively worse. The reason: on one hand the continuing surge in regions and total debt, both of which jumped in Q2, on the other hand Spanish bank borrowings from the ECB soared to €389 billion in August, a new record, and up from €376 billion, just as TARGET2 liabilities rose to a new record of €429 billion as well, explaining where that surge in German TARGET2 claims went, on the third hand housing prices collapsed by 14.4% in Q2, the most ever, and tying all the hands together was that the Spanish economy contracted. But please ignore the details. Focus on the important things, such as the surge in the Ibex, the S&P, consumer confidence, gold, crude, etc, however long these continue. Because unless there is such a thing as a free lunch, with every incremental injection, all Bernanke proves is that the underlying reality is far worse than what is telegraphed to the people.

Back to Spain, and its soaring debt…

Spanish government debt rose to 75.9 percent of its economy in the second quarter of the year according to figures published by the Bank of Spain.

The figure is up 9.2 percent year-on-year and is the highest ratio in at least 22 years. The total debt ascended to €804 billion ($1.0 trillion), up €99 billion year-on-year, Spain’s central bank said in a statement Friday.

Central government spending increased by 4.4 percent to €617 billion, representing 58.3 percent of GDP.

Regional government spending grew by 2.8 percent to €151 billion, equivalent to 14.2 percent of GDP, also the highest level in at least 22 years.

The most indebted region in the second quarter was Catalonia with €44 billion followed by Valencia.

Source: Zerohedge

… and its plunging homes prices:

Spanish home prices fell the most on record in the second quarter as the euro area’s fourth- largest economy shrank and a reduction in mortgage lending crimped demand for property.

The average price of houses and apartments declined 14.4 percent from a year earlier, the most since the measurement began in 2008, the National Statistics Institute in Madrid said today in an e-mailed statement. Prices fell 3.3 percent from the previous quarter.

“The data reflects a significant drop and confirms that prices haven’t bottomed out yet,” said Fernando Encinar, co- founder of Idealista.com, Spain’s largest property website. “Only homes that are heavily discounted will sell as access to credit has completely dried up for potential buyers.”

The number of Spanish homes sold declined in July for a 17th month, dropping 2.5 percent from a year earlier, according to the statistics agency. Mortgage lending fell 20.4 percent in June from the year-ago period, INE data shows.

The government has passed two decrees this year forcing Spanish banks to make deeper provisions for losses linked to real estate in an effort to push down prices and boost sales.

Spain built on average 675,000 homes a year from 1997 to 2006, more than France, Germany and the U.K. combined, according to a report by a unit of Spanish savings bank Cajamar.

*** zerohedge / LINK

European Central Bank Governing Council member Panicos Demetriades comments on the sovereign debt crisis, the ECB’s new bond-buying program and the euro-area economy.

Demetriades, who heads the Central Bank of Cyprus, spoke in an interview in Nicosia yesterday.

On the unlimited nature of the ECB’s Outright Monetary Transactions:

“A central bank has this wonderful ability that no other player in the market has when it says ‘I’m going to do whatever it takes,’ and everyone believes that. In the end they may do nothing. It restores confidence. It’s the idea of multiple equilibria, and when we know that we are in the good equilibrium, in the end action is not needed.

“Once people know that we stand ready to do it, no one will speculate against the unlimited firepower of a central bank. This is what stabilizes currencies of countries where investors know that they have that power. One wouldn’t gamble against the Federal Reserve.”

On the sterilization debate:

“There is the decision that these transactions will be sterilized. I think that discussion is overrated. I don’t think that in the current circumstances there are any risks to inflation, and in the current circumstances even if the ECB were not able to sterilize I don’t think it would make any significant difference.”

On the debt crisis:

“The OMT program that was announced last week is a major step, a very decisive step forward towards addressing the problems that arose in the last year or two. I think that the program itself is focused at removing the market distortions that essentially threatened the very viability of the currency. It will certainly help to reduce and remove those risks that are associated with events that the ECB considers unacceptable.”

On growth in the euro area:

“The way forward in terms of growth is first of all to restore confidence in the euro zone, and in itself the OMT program is going to do a lot to achieve that. So the ECB certainly is doing whatever it can to safeguard the euro. And that in itself is going to lay the foundations of growth.

“Now when it comes to the fiscal policy mix, I think there has been so far too much emphasis on austerity and not enough on growth policies. Although fiscal consolidation is necessary, it is not necessarily the best way forward to have deep cuts in public expenditure when economies are struggling for growth. I think the pace of this consolidation, the pace of austerity, the pace of these cuts, should really be such that it doesn’t create additional recession, so that it doesn’t plunge economies into deep recession. We have seen plenty of examples that, when economies are in deep recession fiscal consolidation programs go off track. It is important to have the right fiscal policy mix. We need to ring fence, for example, investment expenditures, R&D expenditures that actually underpin long-term growth. That is particularly important and that isn’t emphasized enough.”

On the interest-rate outlook:

“As you know, at the ECB we never pre-commit. Of course, there are downside risks now, and when it comes to next month’s decision we take on board all the developments and decide accordingly.

“I don’t think we are technically ready for negative deposit rates, but I don’t see that, in theory at least, as an obstacle.”

On the ECB’s new supervisory powers:

“I am comfortable with it. In fact, we are not just comfortable, but we have actually contributed to the debate and we welcome it. The banking union concept itself is good. What we need to do in the euro area is decouple sovereign risk from bank risk. For countries like Cyprus with large banking systems, it is particularly important.

“A central bank has to have powers. That’s critical for monetary union. I don’t see that as a danger. We want more European integration and that’s the way forward.”

*** bloomberg / LINK

It was designed to rescue Spain and, as a result, the euro. So why has the government in Madrid not immediately jumped into the life raft built by Mario Draghi, the president of the European Central Bank, with his bond-buying plan? The answer has a name: Mariano Rajoy, the country’s studiously enigmatic prime minister.

First, Mr Rajoy continues to pretend that Spain might not need a bail-out. “Before taking a decision we must see whether it is really necessary,” he said recently. Few Spaniards are fooled. Mr Draghi’s announcement has pushed bond yields to levels lower than when Mr Rajoy’s centre-right People’s Party won power in November. But that will not hold for ever. Spain’s economic mess—a combination of ailing banks, double-dip recession and 25% unemployment—is getting worse. Mr Rajoy’s labour and other reforms may eventually help, but in the meantime, the patient needs an emergency infusion.

Second, Mr Rajoy knows that Spaniards will find the tutelage humiliating. Polls show his government losing a third of its support in just six months. In Greece, Ireland and Portugal bailed-out governments were quickly ejected. This explains why Mr Rajoy’s government—despite a solid parliamentary majority and four more years in power—does not dare to use the B-word.

Third, Mr Rajoy claims that Spain does not need to be told what to do. He insists his government will manage to cut a budget deficit that hit 8.9% of GDP last year. And this, he tells Spaniards who have already seen €90 billion ($116 billion) of belt-tightening spread over several years, is because he himself believes in it—and not because heavyweights in Brussels or Frankfurt demand it. He will have a chance to prove this commitment on September 27th, when the budget for 2013 will be unveiled. To meet a 4.5% deficit target set by the EU, his government will have to find further savings or additional revenue of at least €20 billion. A further difficulty is that Catalonia’s demand for a revenue rebate has become harder to ignore: this week hundreds of thousands rallied in Barcelona to demand independence.

Mr Rajoy has already cut spending to the bone and increased taxes. So what is left? He has promised not to cut pensions, although they might have to be frozen, making pensioners lose in real terms as inflation and taxes eat into purchasing power. Hikes in green and capital-gains taxes are also in the offing. Portugal, which on September 7th decided to raise individuals’ contributions towards social security, has shown another avenue for increasing revenues.

Nothing changes the fact that Spain is bound for a bail-out. What will its rescuers demand? Not much more than Spain has already signed up to, according to Olli Rehn, the European commissioner for economic affairs. But the sequence of events matters. Whereas Mr Rajoy insists on being told the conditions first, Mr Rehn says a country must ask for help before these are worked out.

The biggest question concerns timing. Opponents accuse the prime minister of trying to delay the bail-out until after elections in Galicia on October 21st. It may, however, come far sooner. Much depends on what euro-zone finance ministers say at their meeting on September 14th. The inscrutable Mr Rajoy will keep everyone guessing until the end.

*** economist / LINK

When Lin Biao, China’s then heir apparent, died in an air crash more than 40 years ago, it took the Communist Party two months to inform the public.

This week’s unexplained disappearance of Xi Jinping, China’s leader-in-waiting, who has not been seen in public for 11 days, shows that, despite the country’s economic transformation, when it comes to its leaders, Beijing is as secretive now as it was in 1971, when Lin Biao died and Mao Zedong was still in power.

According to Beijing’s official version, Lin had been plotting a coup against Mao and decided to flee to the Soviet Union with his family after learning that he had been found out. His flight crashed in Mongolia, killing everyone on board. While Russian forensic evidence confirmed that he died in the crash, foreign historians continue to doubt Beijing’s explanation of a coup.

More recent cases involving senior party leaders have been handled in a similar fashion. It was not until July this year that the People’s Daily, the party’s mouthpiece, confirmed that Li Peng, at the time China’s prime minister, had been in a hospital in 1993.

Li disappeared from public view for several months that year, cancelling trips abroad and meetings with visitors. The foreign ministry had said he had a cold and was recovering. It is by now widely believed that Li had suffered a heart attack.

Keeping things secret today is much more difficult as the spread of social media has robbed the party of the power to control information.

Xi cancelled meetings with Secretary of State Hillary Rodham Clinton, Singaporean Prime Minister Lee Hsien Loong and a Russian delegation last week. He also appeared to cancel a meeting with Helle Thorning-Schmidt, the Danish prime minister, on Monday, although she herself later said no meeting had been planned.

An official account did not list Xi among the participants of a meeting held last Friday by the central military commission, of which he is vice chairman.

There have been no public appearances, news pictures or new mentions of Xi in the state media since Sept. 1, when he gave a speech at the central party school.

Although Xi’s absence from the public eye so far has not lasted as long as those of some past Chinese leaders, politicians who have disappeared previously still sent signals by publishing articles in official media or sending congratulatory messages on major occasions.

The mystery surrounding Xi has triggered a flurry of rumors on Sina Weibo, the country’s leading Twitter-like microblog, especially as it comes amid preparations for the complex once-in-a-decade leadership transition in which Xi is supposed to star.

Internet users passed round suggestions that Xi and He Guoqiang, another senior leader who was also missing from public view, had both been involved in car crashes. Another rumor was that they had both been victims of assassination attempts.

On Wednesday night, He resurfaced, appearing on state television during a visit to state publishers to promote officially-approved books. His last appearance before Wednesday had been an anti-corruption speech on Aug. 29.

*** washington post / LINK

Quantitative Easing has become banal, a fine-tuning tool like any other. It is by now drained of all drama. Even the Federal Reserve’s hawks have lost the will to resist. Five of the six critics acquiesced.

The Fed will buy a further $40bn (£25bn) of mortgage bonds each month until the jobs market improves “substantially,” and more if need be. It is open-ended. Zero interest rates will continue until mid-2015.

It is pocket-sized compared with the pace of $75bn a month in the QE heyday, or the 500 basis point rate cuts at the onset of the Great Recession. This is calibrated, not full-throttle.

Fed chairman Ben Bernanke no longer faces a banking collapse, or an imminent spiral into debt deflation. He has launched QE3 at a time when credit is expanding, M3 money is growing at 5pc, and core inflation is above 2pc. This is QE by choice. The extra juice is insurance against a clutch of nasty risks ahead: a Chinese hard-landing, deepening slump in Europe, and the looming “fiscal cliff” in the US—net tightening of 4pc of GDP if Congress lets it happen.

This is well-advised. The manufacturing ISM index in August flashed contraction. New orders were awful. The economy is close to a tipping point, and that matters for the whole world.

A study by Nathan Sheets at Barclays Capital found that once US growth drops below 1.5pc on “a rolling four-quarter basis,” it then falls by nearly 3pc over the next year. “We find that the spillovers are much larger as the US economy cuts through its stall speed, with the sensitivity of foreign growth roughly twice as large as at other times,” he said.

Yet Mr Bernanke’s main eye is on America’s intractable jobs blight—”a grave concern, not only because of the enormous suffering and waste of human talent it entails, but also because high levels of unemployment will wreak structural damage on our economy that could last for many years,” he said.

The Fed has switched to targeting jobs—not prices—sure that the headwinds of debt-deleveraging will check inflation. This is a contentious point. Minneapolis chief Narayana Kocherlakota says lack of jobs skills imply less slack than assumed—known as an upward shift in the “Beveridge Curve.” The problem is “structural.”

“Our country’s current labour market is much closer to ‘maximum employment’ than the post-Second World War data alone would suggest. Unemployment may not have too much farther to fall before inflation threatens,” he said.

Yet something is deeply wrong. The percentage of long-term unemployed has surged to 40pc, double previous recessions. The labour participation rate has fallen to a 30-year low of 63.5pc.

Headline unemployment is 8.1pc—viz 11.3pc in Euroland—but this does not count millions who have dropped out of the system. For the doves this screams “cyclical,” caused by lack of demand. “The loss to the economy is enormous,” said Nobel economist Peter Diamond. “If you leave school and can’t get a job, it hurts for years. You lose earnings for a decade.”

The arch-critics of QE have changed their tune. At first they said it would set off galloping inflation. This has not happened, though it may at some point if money velocity picks up and ignites the monetary base. They now say QE1 and QE2 failed because the economy has not fully recovered. The claim exasperates monetarists. America’s output is now well above its previous peak in late 2007, unlike Japan and most of Europe.

“QE has made a massive difference,” said Tim Congdon from International Monetary Research. “If they had not done it, we would have gone into another Great Depression.”

*** UK Daily Telegraph / LINK

Far beyond the harbour at Kamaishi town in north east Japan, the ravaged remains of its sea defences still rise jagged above the water.

Descending 63m, the breakwater had earned a place in the Guinness book of records as the world’s deepest and its presence offered the ancient steel town’s 40,000 residents visible reassurance.

When the tsunami struck on March 11, 2011, though, the five-year-old defences could not hold. The wave washed in, climbing 10 metres above sea level, levelling hundreds of homes and killing over a thousand people.

The sea wall held the water back for six minutes and reduced the height of the wave by six metres, but the protection had been an illusion.

“We thought we were at the cutting edge, but the tsunami was taller than we anticipated,” Takenori Noda, Kamaishi’s mayor, says. “The biggest lesson we should learn is not to be complacent.”

For many who follow the Japanese economy, another disaster is building. “The deficit and debt,” Kohei Otuska, a politician with the Democratic Party of Japan, says. “It’s something like an earthquake. It may come tomorrow or in 10 years, but it is coming.”

Japan’s economic problems are well-rehearsed. The world’s third largest economy has national debt of 236pc of GDP, and a budget deficit of 10pc. The UK, by comparison, is a bastion of fiscal rectitude, with national debt of 88pc and an 8pc budget deficit, using International Monetary Fund numbers.

If that was not unsustainable enough, Japan’s ageing population is piling even more pressure on the public finances.

A decade ago, social security expenditure was 12pc of GDP, it’s now 24pc. Over the same time, tax receipts have dwindled from 30pc to 28pc as the workforce has shrunk.

The system is crying out for reform, but there is political stasis.

The two main parties have agreed to balance the primary budget no earlier than 2020, having struck a cross-party deal to raise VAT from 5pc to 10pc by 2015.

It is not enough. The IMF says VAT needs to rise to 15pc and welfare reform, of pensions and medical care, is long overdue. The debate, though, has barely begun.

In Kamaishi, Shoichi Shimura, a playwright who has been leading efforts to rebuild the community, says most people believe the debt is under control. “People don’t understand the scale of the problem,” Mr Otuska concedes.

Japan has barricaded itself behind the defence of its peculiar debt dynamic—that 92pc of government bonds are owned by Japanese banks and institutions.

The arrangement shields it from immediate threat, but even there the political establishment is intent on dismantling the defences.

A third of Japan’s energy is currently nuclear generated. However, with emotions running high after the reactor meltdown at Fukushima, the government has committed to phasing that out completely by the 2030s.

The policy will drive up imports of oil, gas and coal—slashing the trade surplus savings and leaving the country exposed to international bond markets.

When it comes to political will, the UK is leagues ahead of Japan. But elsewhere, the parallels are eerie.

Both nations suffered a financial crisis that, as economists put it, left them with zombie households (UK) or zombie companies (Japan), and zombie banks.

Policy has also trodden a similar path. Rates have been cut to near zero, central banks have printed money and tried “credit easing,” governments have looked to infrastructure to cure slow growth, and there has been a rapid rise in the non-regular workforce—in the UK, part-timers and the self-employed. The young have been disenfranchised.

The only big difference, so far, has been that the UK has avoided deflation.

*** Philip Aldrick / LINK

Charts That Make You Go Hmmm…

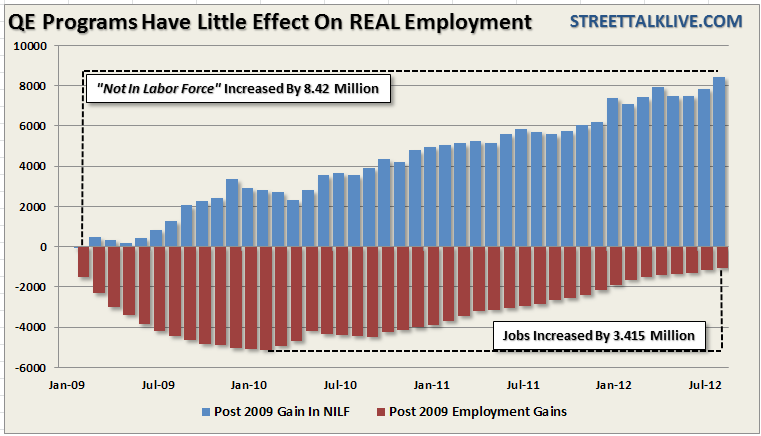

Source: Lance Roberts (via Zerohedge)

The chart above shows the net gains in employment since the beginning of 2009 as compared to the number of individuals that have moved into the “No Longer in Labor Force” category where they are no longer counted. There has been an increase of 3.4 million jobs since the lows of mass firings and layoffs post the last recession. That increase is far lower than would have been expected in any normal economic recovery. At the same time, however, more that 8.4 million individuals have just “given up looking for work” or “retired” during the same period. There is NO evidence that bond buying programs have any effect on fostering employment. However, at the current rate of individuals leaving the work force, Bernanke could likely get his wish of “full employment” in the next couple of years. Of course, economic prosperity will have deteriorated much further as the rise of the “welfare state” continues.

*** zerohedge / link

|

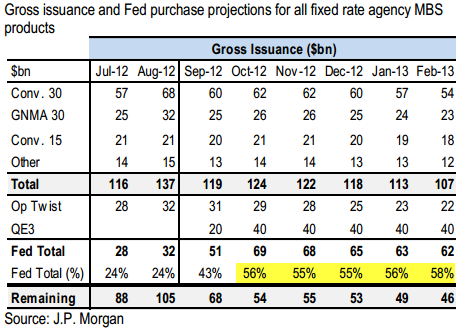

So much for shifting the US mortgage business into the private markets. Going forward, the Fed will be a buyer of more than half of all new agency MBS issued. At this point, one might as well make the GSEs part of the Fed or give the central bank a mortgage origination capability. |

| Source: Soberlook/JPMorgan |

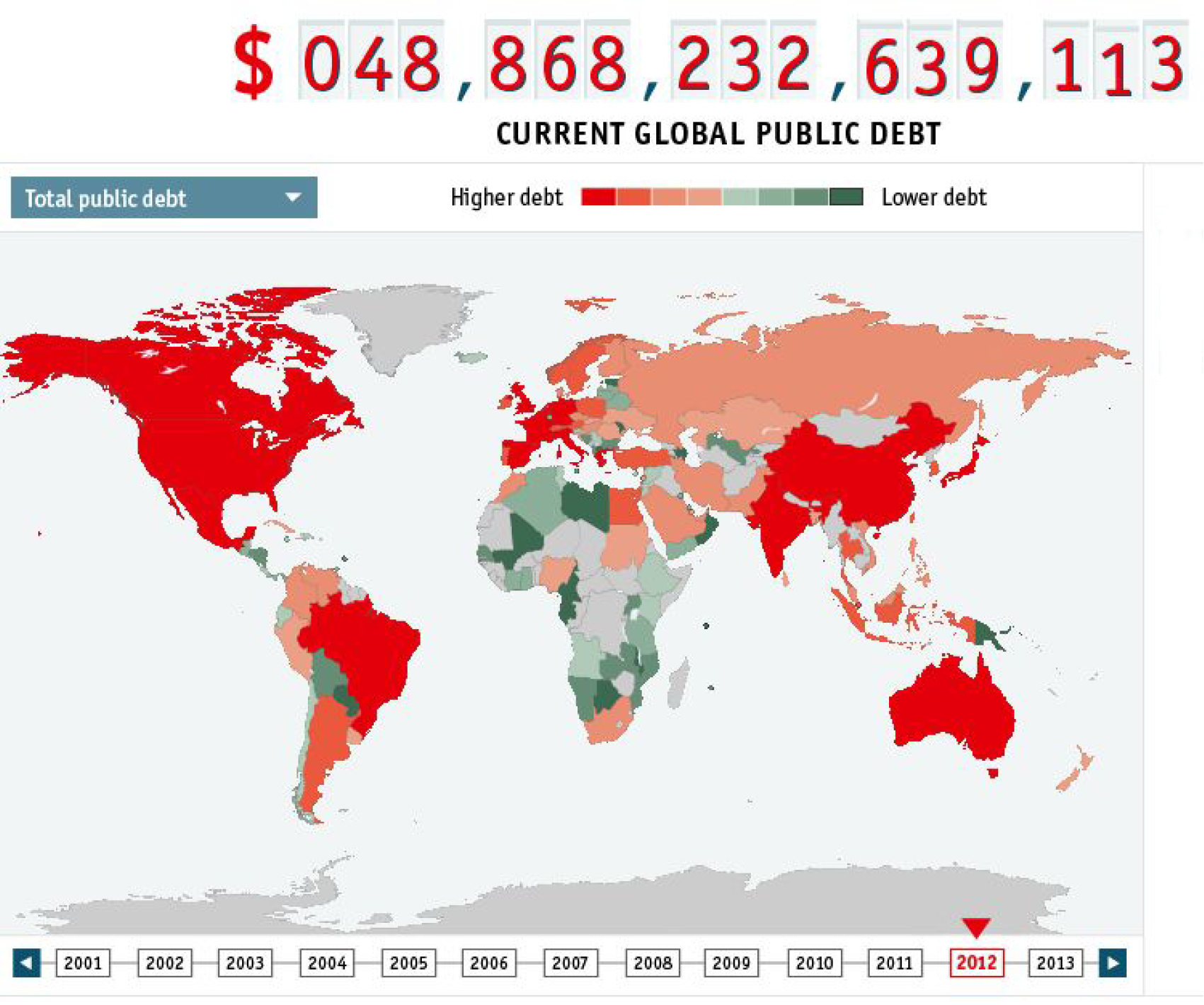

The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar to anyone who has been to Times Square in New York, where the American public shortfall is revealed. Our clock (updated September 2012) shows the global figure for almost all government debts in dollar terms.

Does it matter? After all, world governments owe the money to their own citizens, not to the Martians. But the rising total is important for two reasons. First, when debt rises faster than economic output (as it has been doing in recent years), higher government debt implies more state interference in the economy and higher taxes in the future. Second, debt must be rolled over at regular intervals. This creates a recurring popularity test for individual governments, rather as reality TV show contestants face a public phone vote every week. Fail that vote, as various euro-zone governments have done, and the country (and its neighbours) can be plunged into crisis…

*** economist / link

Source: Economist Data Bank

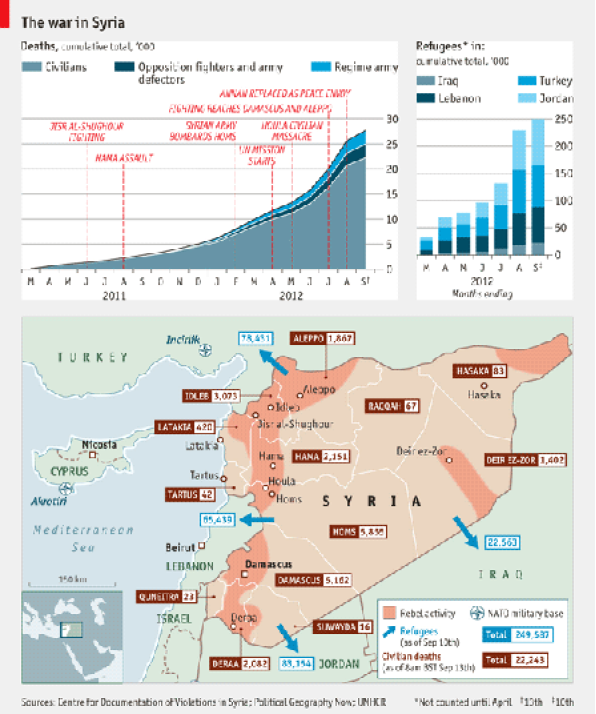

Syria’s 18-month revolution-turned-war is taking an increasing toll on the population. When opposition fighters entered the capital Damascus and the second city Aleppo in July, President Bashar Assad’s regime responded with warplanes, and the monthly death toll jumped above 3,000. August was even bloodier. Civilians in Homs, the third city and the hub of the uprising for many months, have paid the highest price, but Damascus and its restless suburbs have seen almost as many deaths, as the map shows. The Centre for Documentation of Violations in Syria, which collects the data, also counts military fatalities on both sides. These have been fairly equal: around 2,730 opposition fighters and defectors have died, compared with just over 2,800 regime soldiers. And as many people have been detained during the fighting—around 28,000—as have lost their lives. Seeing a conflict set to get bloodier, ever more Syrians are deciding to leave. As of September 10th the UN High Commissoner for Refugees reckoned 250,000 had fled across the borders, while the UN Office for the Co-ordination of Humanitarian Affairs estimates that the World Food Programme and Syrian Arab Crescent Society are giving food aid to 1.5m people in the country, the majority of them internally displaced. The true figures for both are likely to be far higher, since many Syrians choose not to register as refugees, and in the country itelf hundreds of Syrians are huddled with friends and in mosques and churches out of the reach of aid.

*** economist / link

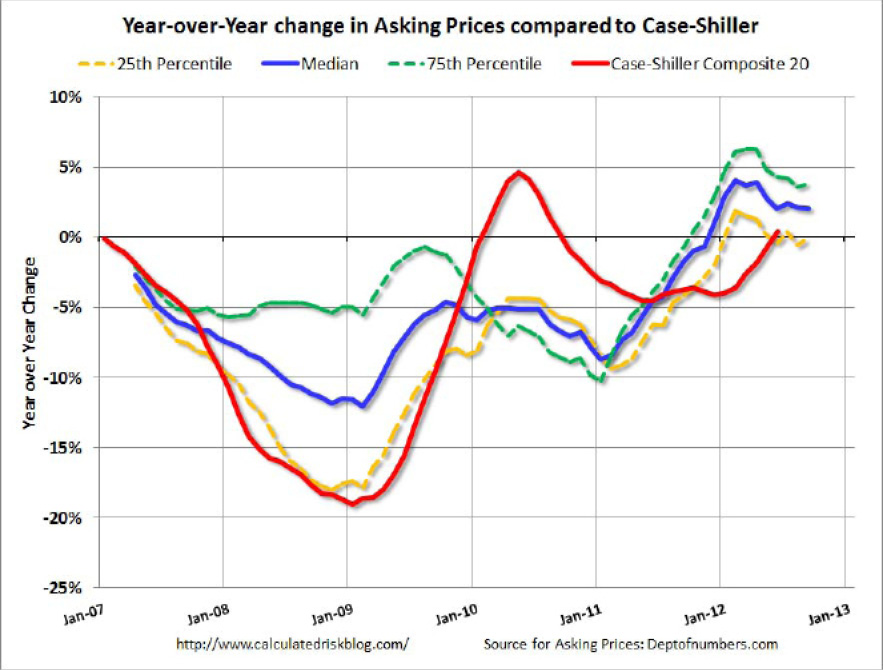

Source: Economist/Ritholtz

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit.

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now the year-over-year change in median asking prices has been positive for ten consecutive months. We have to be careful about the mix (fewer foreclosures on the market), but this suggests year-over-year selling prices will stay positive.

On seasonality, asking prices peaked in June and are down slightly over the last three months. That is a reminder that the Not Seasonally Adjusted repeat sales indexes will show month-to-month declines later this year—and the focus will be on the year-over-year change.

*** calculated risk / link

Source: Calculated Risk

Words That Make You Go Hmmm…

|

Nigel Farage returns from what I hear was a barnstorming appearance at the CLSA conference in Hong Kong, full of fire and brimstone and, when he’s in that mood, there’s only one person he’s looking for—the gentleman who sits a couple of places to his right at the ECB council chamber; poor Mr. Barosso.Over to you, Nigel. | ||

| CLICK TO LISTEN | |||

| Former Fed governor Kevin Warsh dropped into the CNBC studio this week for a little chat in the wake of the announcement of QE3. I think it’s safe to say that he’s a little unhappy with his former colleagues.”In the history of central banks, getting out is harder than getting in.”

Indeed, Kevin, indeed. (via zerohedge) |

|

||

| CLICK TO LISTEN | |||

|

The great Ray Dalio spent an hour talking to Maria Bartiromo and the audience at a CFR shindig this past week.Sit back, relax and revel in the wisdom of one of the world’s finest money managers. | ||

| CLICK TO WATCH | |||

and finally…

With the release of the new iPhone 5 supposedly set to add 0.5% to US GDP (at least according to JPMorgan), Jimmy Kimmel went out into the street to see what the public made of the “new” iPhone… CLICK TO WATCH

Hmmm…

Grant Williams

Grant Williams is a portfolio and strategy advisor to Vulpes Investment Management in Singapore—a hedge fund running over $250 million of largely partners’ capital across multiple strategies.

The high level of capital committed by the Vulpes partners ensures the strongest possible alignment between us and our investors.

In Q4 2012, we will be launching the Vulpes Agricultural Land Investment Company (VALIC), a globally diversified agricultural land vehicle that will provide truly diversified exposure to the agricultural sector through a global portfolio of physical farmland assets.

Grant has 26 years of experience in finance on the Asian, Australian, European and US markets and has held senior positions at several international investment houses.

Grant has been writing “Things That Make You Go Hmmm…” since 2009.

For more information on Vulpes, please visit www.vulpesinvest.com

*******

Follow me on Twitter: @TTMYGH

YouTube Video Channel: http://www.youtube.com/user/GWTTMYGH

California Investment Conference 2012 Presentation: “Simplicity”: Part I : Part II

As a result of my role at Vulpes Investment Management, it falls upon me to disclose that, from time-to-time, the views I express and/or the commentary I write in the pages of Things That Make You Go Hmmm… may reflect the positioning of one or all of the Vulpes funds—though I will not be making any specific recommendations in this publication.

What's been said:

Discussions found on the web: