My weekend long form article readings:

• Fed two-fer:

…..-How Much Does the Fed’s Plan Really Help Main Street? (Dealbook)

…..-Fed Move Echoes World-Wide (WSJ)

• Should the 401(k) Be Reformed or Replaced? (NYT)

• Your brain on pseudoscience: the rise of popular neurobollocks (New Statesman)

• Michael Lewis uber long profile: Obama’s Way (VF)

• Philosophy v science: which can answer the big questions of life? (Guardian)

• What Krugman & Stiglitz Can Tell Us (New York Review Of Books)

• Dell & HP together on a long road to nowhere (Gigaom)

• Rethinking ‘Junk’ DNA (NYT)

• A Critic’s Manifesto (New Yorker)

• The New New Girl: Mindy Kaling promotes herself out of The Office and into The Mindy Project (NY Mag)

What are you reading this weekend?

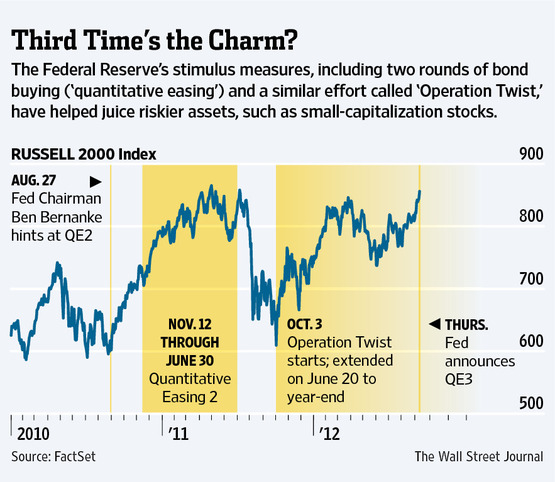

After Fed, Yield Moves to the Fore

Source: WSJ

What's been said:

Discussions found on the web: