Click to enlarge:

Source: Bloomberg BRIEF

A run of excellent charts from Richard Yamarone of Bloomberg, who notes:

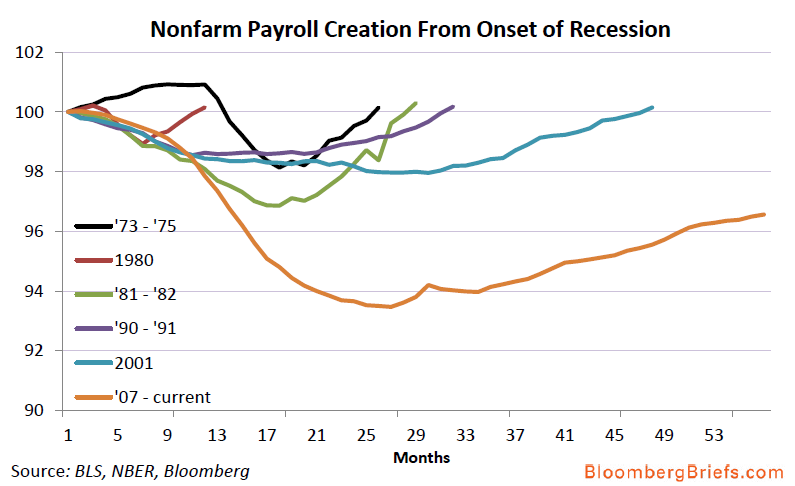

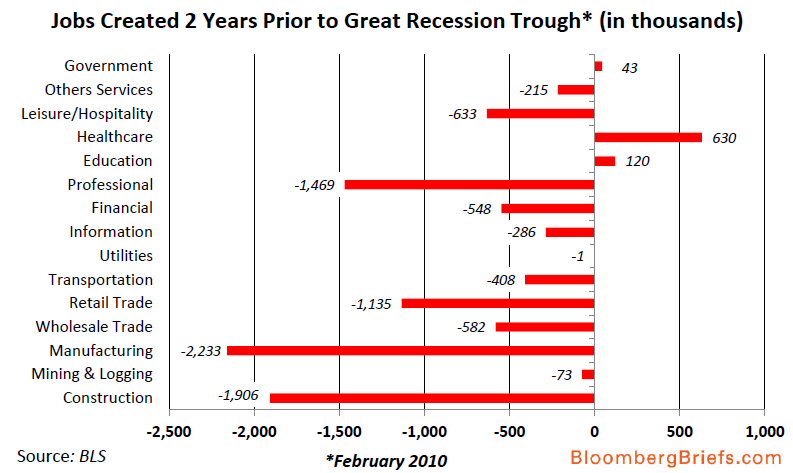

“It’s back to reality for the jobs situation; the economy added a lowly 96,000 nonfarm payroll jobs during August while the July report was revised lower to a monthly gain of 141,000 from a previously reported increase of 163,000. Investors should anticipate a similarly weak employment picture going forward as the economy is simply not advancing at a pace sufficient to engender desirable job gains. U.S. GDP advanced by just 1.7 percent in the second quarter with many top tier indicators (ISM, new orders, regional Fed surveys) pointing to a deceleration in the second half of the year.”

If you have any questions for Yamarone, please use comments and I will ask him tomorrow evening (when I stick him with the check for dinner!).

Alternatively, you can ask him yourself at The Big Picture Conference October 10th.

More charts after the jump

~~~

What's been said:

Discussions found on the web: