Very nice big macro think piece from HSBC global research, looking at the key drivers of markets, psychology, asset prices and investing:

Ten Key Trends Changing Investment Management

1. The search for yield.

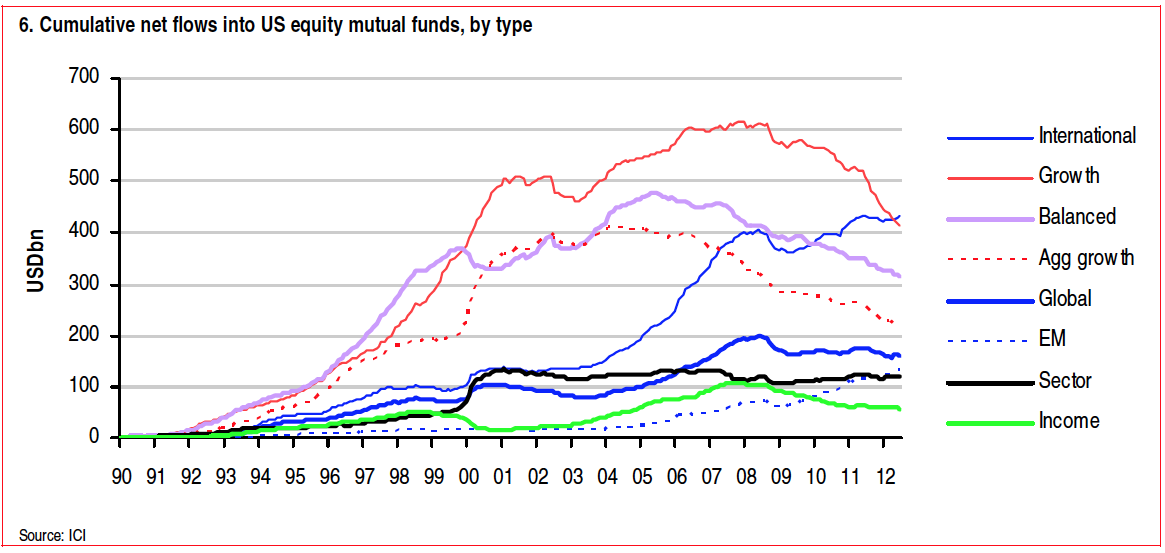

2. The death – or rebirth – of equities

3. Risk minimising strategies

4. The growth of multi-asset

5. The shift to passive

6. The relentless rise of ETFs

7. The decline of the hedge fund?

8. Harvesting the illiquidity premium

9. Where will the money come from?

10. The challenge of ESG (environmental, social, governance)

Huge amount of info on each trend — its a 50 page report . .

Source:

The 10 key trends changing investment management …and how they will affect asset prices

Multi Asset Strategy September 2012

http://bit.ly/Vjg3t8

What's been said:

Discussions found on the web: