My reads to start off the week:

• Investors seem more bewildered than blind to risks, trapped between paltry yields on safer assets and bets on a somewhat frothy stock market (WSJ)

• Investors Funneling Cash Into ETFs at Fastest Pace In Three Years (Baron’s) see also Will Halloween come early this year? (Market Watch)

• Felix: The problem with high frequency trading (Reuters)

• Cheapest Chinese Stocks Since ’97 Not Enough to Signal Rally (Bloomberg)

• Will QE3 Cause Serious Inflation? Not With Economic Prospects So Dismal. (Slate)

• Don’t call it money printing, rubiks cube edition (Alphaville)

• America’s duopoly of money in politics and manipulation of public opinion (The Guardian)

• Debates Fail to Decide Elections Amid Myth of Kennedy-Nixon (Bloomberg)

• You’re an Idiot. Statistically Speaking. (Motley Fool)

• The Who’s Pete Townshend, a reluctant rock star (CBS News)

What are you reading?

>

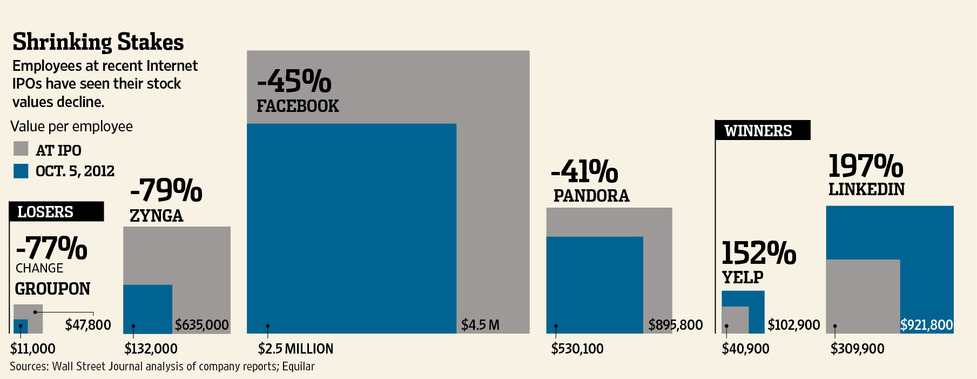

Silicon Valley’s Stock Funk

Source: WSJ

What's been said:

Discussions found on the web: