My morning reads to start your week:

• High-Speed Trading No Longer Hurtling Forward (NYT)

• Dividend stocks are investing’s holy grail (MarketWatch) see also Get Ready for the Dividend Cliff (WSJ)

• The Buyback Epidemic (The Reformed Broker)

• Lavish CEO pay doesn’t work as intended (NBC) see also Executive Superstars, Peer Groups and Over-‐Compensation – Cause, Effect and Solution (IRRC)

• Global Economy Distress 3.0 Looms as Emerging Markets Falter (Bloomberg)

• New Fed governor defends bond-buying decision (WaPo) see also Fischer Backs Fed QE3 as World ‘Awfully Close’ to Recession (Bloomberg)

• Sheila Bair: Questions From a Bailout Eyewitness (NYT)

• The Sad Story of Jack Welch in Retirement (TheStreet.com)

• US Online Ad Revenues Set Another Peak in H1, Up 14% Y-O-Y (Marketing Charts)

• Repealing Deductions Pays for 4% Tax Cuts, Study Says (Bloomberg)

What are you reading?

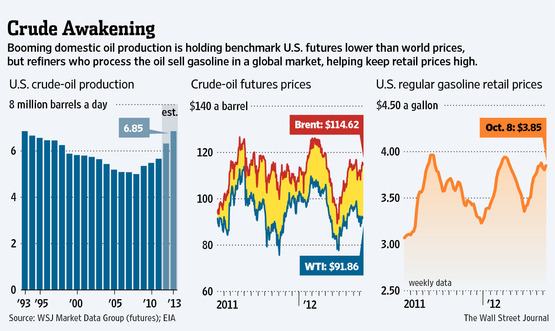

U.S. Oil Boom Falls Short of Pump

Source: WSJ

What's been said:

Discussions found on the web: