My Sunday morning reads:

• Stock investors: Don’t fight QE3 in Q4 (MarketWatch)

• Iranian Rial: Gresham’s law takes Iran (Alphaville)

• SHILLER: Housing Fever Can Work Both Ways (NYT)

• Bernanke’s QE3 Will Turn Out Better Than Japan’s (Bloomberg)

• Welch Conspiracy Theory on Jobs Data Not Tied to Reality (BusinessWeek) see also Debunking the jobs report conspiracy theories (Washington Post)

• The Internet Blowhard’s Favorite Phrase: Why do people love to say that correlation does not imply causation? (Slate)

• The Real Reason We Can’t Stop Talking About Steve Jobs (Forbes) see also Apple Critics Sharpen Their Pens, But Lack Logic (Barron’s)

• A Master of Improv, Writing Twitter’s Script (NYT) Dick Costolo was a stand-up comedian years before becoming the chief at Twitter

• Pete Townshend: The Voice of ‘My Generation (WSJ)

• O’Reilly, Stewart joust at mock debate (AP)

What are you reading?

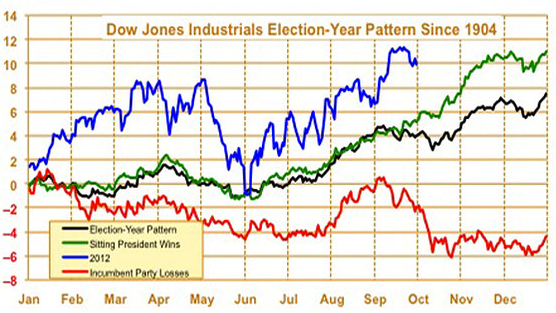

Election year bodes well for market to hit new highs

Source: MarketWatch

What's been said:

Discussions found on the web: