Some reads to start your Sunday:

• R. Glenn Hubbard: Romney’s Go-To Economist (NYT)

• Mutual fund casinos still skimming billions (MarketWatch)

• Rule #1. Surround yourself with people who are smarter than you and move out of their way (Explore)

• Surprise Jack Welch Missed Shows Better U.S. Growth (Bloomberg)

• A big shift in oil will bring price relief (Quartz)

• Law is going to be made’ in CalPERS’ challenge of Stockton – even if it leads to the Supreme Court (Financial Times)

• Inside the Obama Campaign’s Hard Drive (MoJo)

• Josh Barro: The Final Word on Mitt Romney’s Tax Plan (Bloomberg)

• The Dangers of Allowing an Adversary Access to a Network (NYT)

• Privacy Is Tough to Find on Facebook (WSJ)

What’s up?

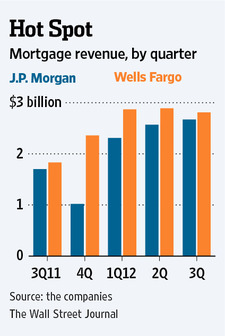

J.P. Morgan and Wells Fargo: Housing on Mend

Source: WSJ

What's been said:

Discussions found on the web: