Pull up a chair, pour yourself a cup of coffee and enjoy these Sunday reads:

• Wealthy Advised to Sell for Gains Before Unfriendly 2013 (Bloomberg)

• Is That a Ferrari in Your Portfolio? (WSJ)

• Keeping foreign talent in the US is an issue on which both sides must agree (Telegraph)

• Fort Knox, an Impregnable Monument to Security Theater (Bloomberg)

• Robots at War: Scholars Debate the Ethical Issues (Chronicle)

• Beating the Show-Offs (The Reformed Broker)

• N.Y.U. Law Plans Overhaul of Students’ Third Year (DealBook)

• The cost of Bush’s wars — comes home to haunt us (Dvorak)

• McSweeney’s: Back From Yet Another Globetrotting Adventure, Indiana Jones Checks His Mail And Discovers That His Bid For Tenure Has Been Denied. (McSweeney’s)

• 40 Things To Say Before You Die (Forbes)

What are you reading ?

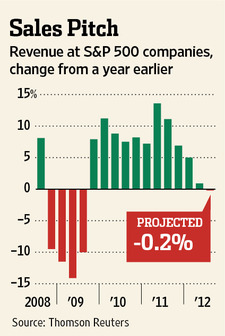

Falling Revenue Dings Stocks

Source: WSJ

What's been said:

Discussions found on the web: