My morning reads:

• Polls Show a Strong Debate for Romney (fivethirtyeight) see also Political Wisdom: A Big Night for Romney (Washington Wire)

• ‘Dumb Money’ Is Staring Most of Us in the Face (Bloomberg)

• QE3 Misconceptions And How To Profit (A Dash Of Insight) see also Why QE will fail, dissonant voices edition (Credit Writedowns)

• How Does a Currency Drop 60% in 8 Days? Just Ask Iran (The Atlantic)

• Private Equity: Rental Market’s Big Buyers (WSJ)

• Keynesian Investing: Changing Facts, Changing Minds (Psy-Fi Blog)

• Stingy Founder of ‘Genius Grants’ Was No Fan of Charity (Bloomberg)

• Fewer Computerized Trading Systems Urged as SEC Debates HFT (Institutional Investor)

• Never Underestimate Wall Street’s Ability To Overestimate Washington (Capital Gains And Games)

• The Ridiculous Business Jargon Dictionary (The Office Life)

What are you reading?

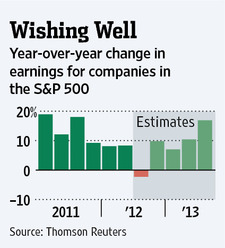

Buoyant Markets Must Navigate Treacherous Earnings Season

Source: WSJ

What's been said:

Discussions found on the web: