My afternoon train reading:

• Romney Rally: Banks, Health Care, Coal Stocks Big Winners (WSJ)

• Investors: 2nd Class Status Brings 2nd Rate Returns (Fiscal Times)

• Apartment Demand Ebbs as ‘Avalanche’ of New Units Open (CNBC)

• Jobs Report May Show a Big Surprise (WSJ)

• WTF? Broker Sent Oil Prices to Eight Month High in a Drunken Stupor (Oil Price) see also California Gas Stations Begin to Shut on Record-High Prices (Bloomberg)

• Voting with the wallet (Economist)

• Candidates Ignored Some Big Economic Issues in Debate (WSJ) see also Taking Stock of Some of the Claims and Counterclaims (NYT)

• Bank-Friendly U.S. Regulator Shifts to Revamp Reputation (Bloomberg)

• China, Robots/Automation and Unemployment (Econ Future) see also Oil Tumbles on Fears About China (WSJ)

• Map Apps to Bypass the Rivalry of Google and Apple (NYT)

What are you reading?

X

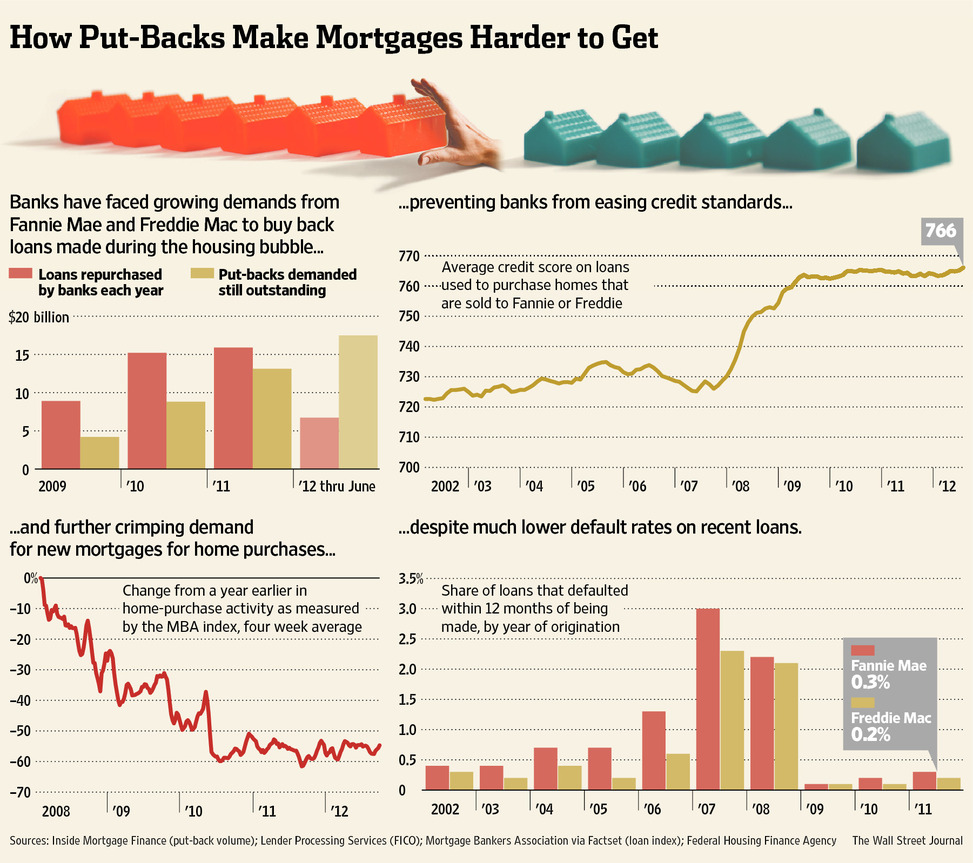

Burdened by Old Mortgages, Banks Are Slow to Lend Now

Source: WSJ

What's been said:

Discussions found on the web: