My afternoon train reading:

• A Tax to Kill High Frequency Trading (Forbes) see also It’s Time for a Tax to Kill High Frequency Trading (Naked Capitalisim)

• A tale of two VaRs (FT Alphaville)

• Phoenix Picked Clean, Private Equity Descends on Atlanta (Bloomberg)

• Global & Local Inflation (Dr.Ed’s Blog)

• Qualitative Easing: How it Works and Why it Matters (Ideas) see also QE: Buyer’s Remorse? (Tim Duy’s Fed Watch)

• 19 crazy things that only happen in China (National Post)

• A Chemist Comes Very Close to a Midas Touch (NYT)

• Earth-Sized Planet Discovered Orbiting Around Nearest Star (Wired Science) see also Two rival scientific teams are locked in a high-stakes race to discover other Earth-like worlds—and forever change our own. (Seed)

• The big music brain that knows what you like (CNN Money)

• List of unusual deaths (Wikipedia)

What are you reading?

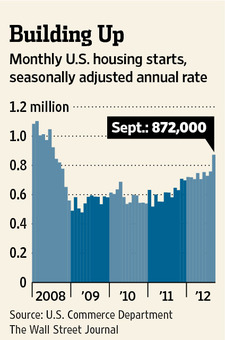

Why Housing Construction Is Rebounding

Source: Wall Street Journal

What's been said:

Discussions found on the web: