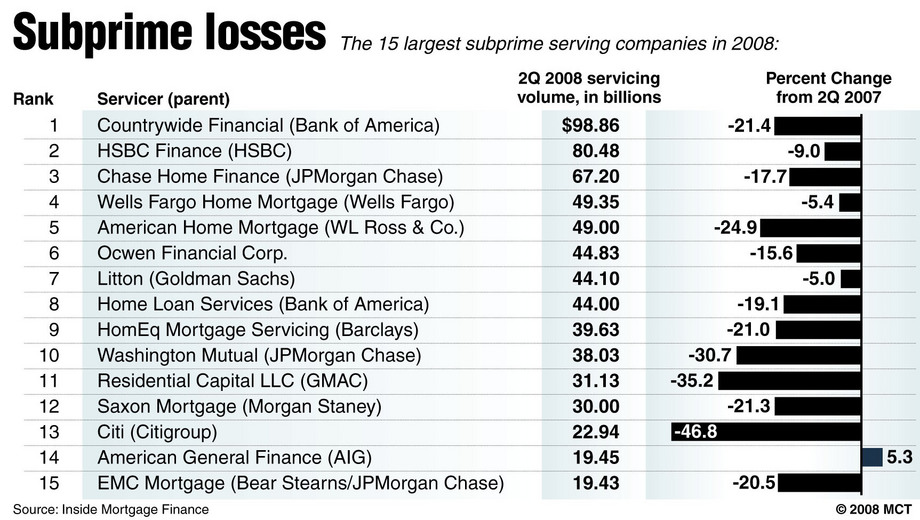

A reminder from 4 years ago today: Look who were the biggest underwriters of subprime — not Fannie & Freddie, not driven by the CRA, not Congress, but private sector banks.

The data, from the Federal Reserve Board, shows:

• More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

• Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

• Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that’s being lambasted by conservative critics.

When it comes to making policy and legislation, facts matter. Those who advocated radical deregulation refuse to accept responsibility for their actions, must find someone else to blame. Hence, the fabrications about CRA/GSEs.

I have my own lists of people who try to obscure factual reality. The confabulators and flat earthers are too costly to allow into my universe. They go on my DO NOT READ list. I suggest you do the same.

Source:

Private sector loans, not Fannie or Freddie, triggered crisis

David Goldstein and Kevin G. Hall

McClatchy Newspapers, October 12 2008

http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html

What's been said:

Discussions found on the web: