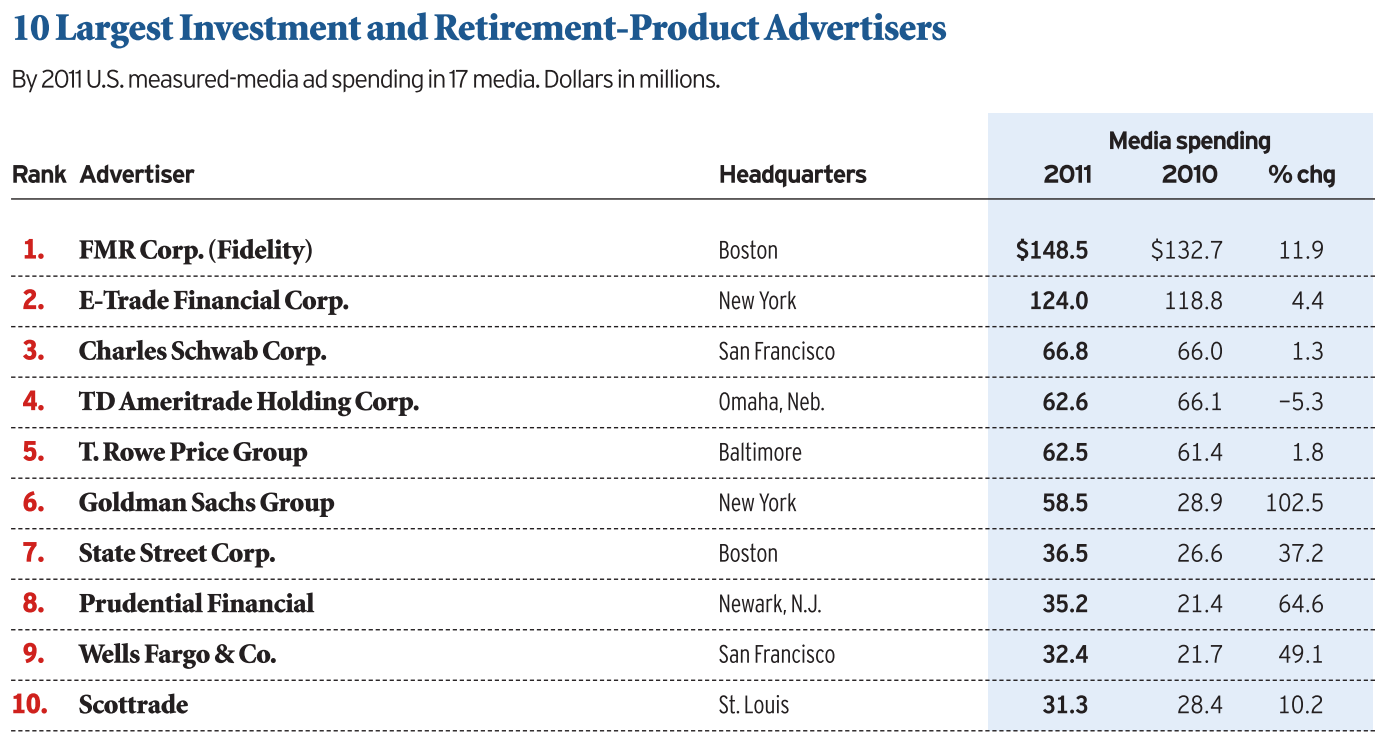

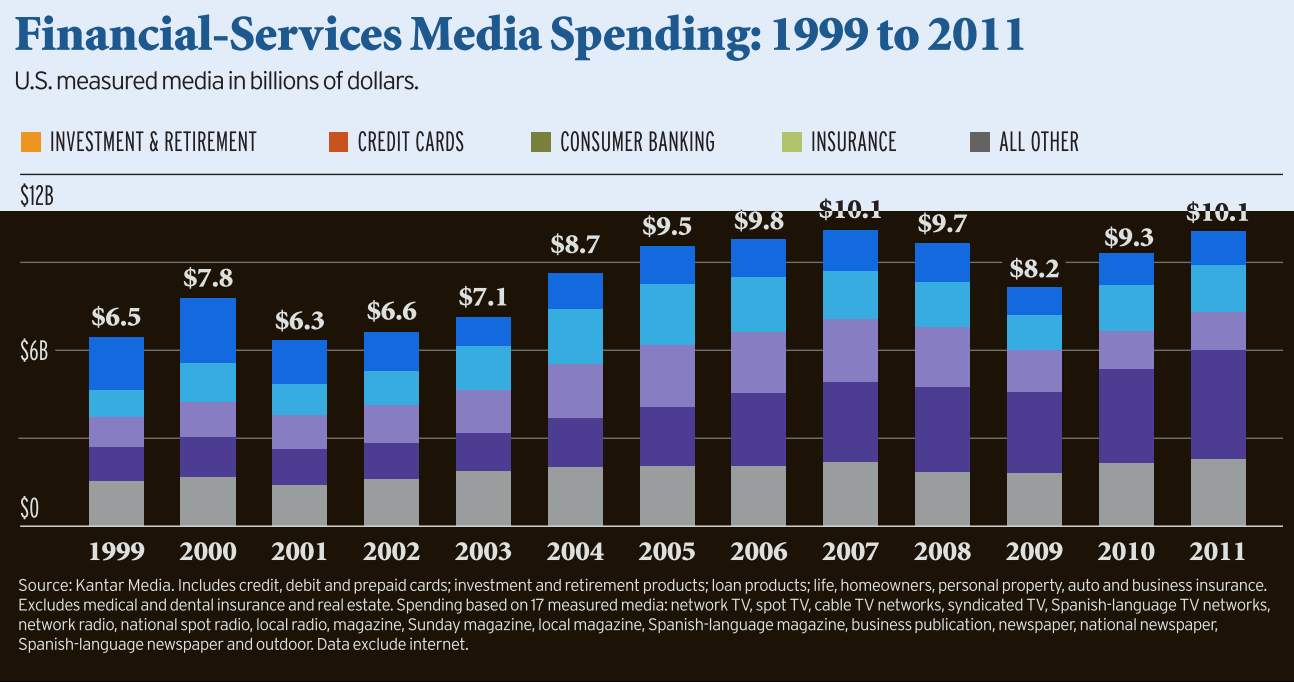

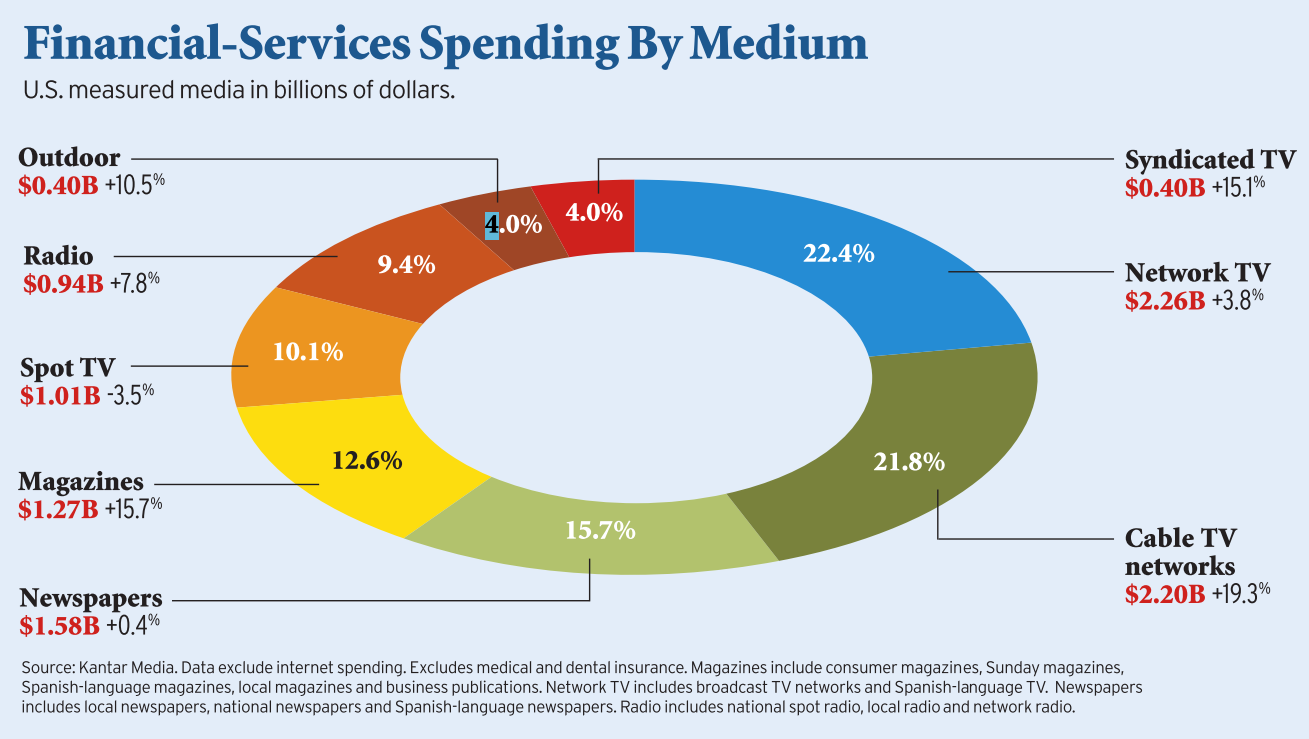

Fascinating set of data-rich charts and tables (and a worthwhile longer read) in this Ad Age report covering Biggest Ad Spenders, Fading of TV Ads, Gross Market Share, and how companies are banking on the Web.

A few select charts & tables:

Source:

Financial Services Marketing

Ad Age DataCenter, October 8th, 2012

http://adage.com/trend-reports/report.php?id=71

Download the full PDF here:

Financial Services Marketing

What's been said:

Discussions found on the web: