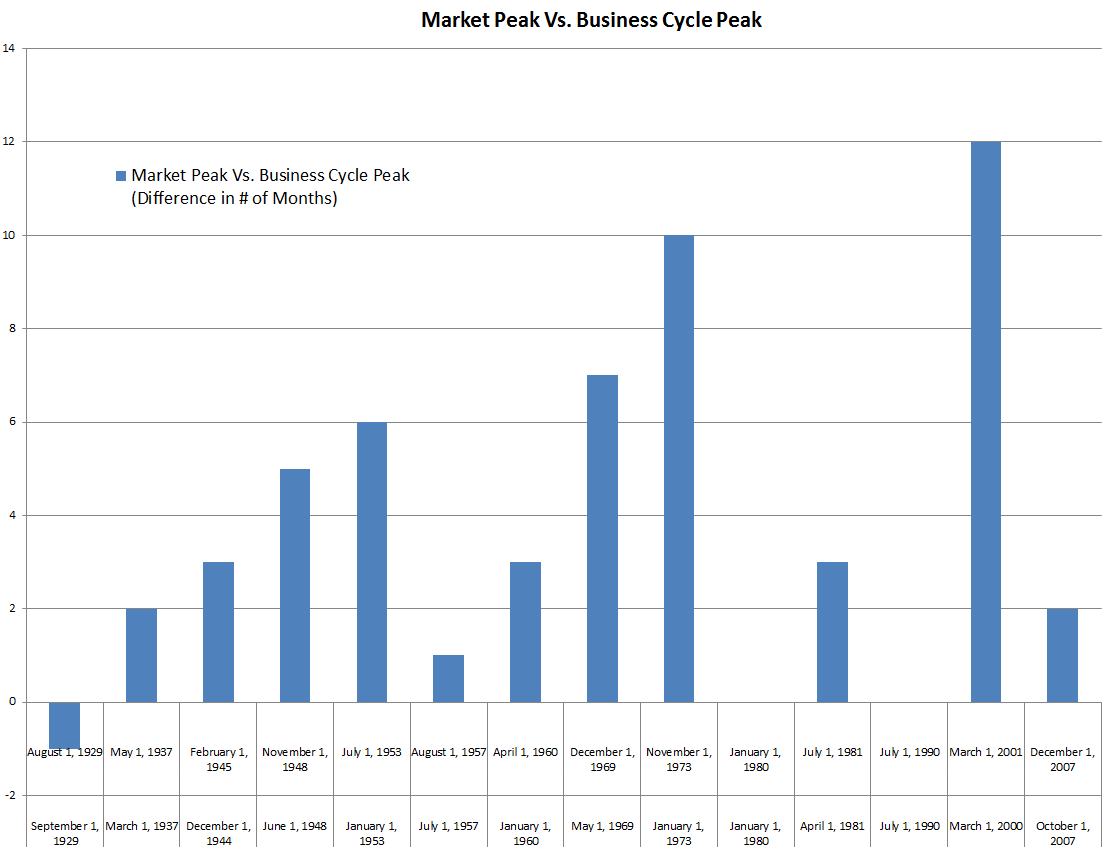

Its one of those things you hear your entire career: “Markets always lead economic cycles.” Indeed, I’ve heard this repeated most often by people saying “The markets lead the economy by 6 months to a year.”

What does the data show? It shouldn’t be that hard to figure out what the NBER peak cycle was and to plot that against market highs.

As it turns out, there have been 14 such cycles since 1929. Sometimes, the business cycle peaks before the market does. Most of the times, the market peaks out before hand — but not by as much as you might imagine. The lead has been contemporaneous a few times, or as much as 10 12 months.

The average of these 14 events is just under 3 4 months — 3.79 months.

~~~

UPDATE: We had a 1 year error in the spreadsheet for 2000 (breaking in new intern) — I fixed it and updated the chart (old chart is below)

What's been said:

Discussions found on the web: