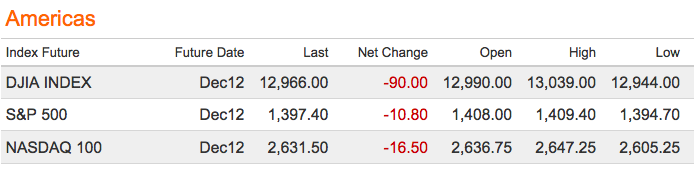

With just over half of S&P500 companies have reported, with both revenues and profits negative, according to Bloomberg. Earnings are front and center, sentiment mostly negative, revenue and profits under pressure. High profile misses from Apple and Amazon on profits last night.

In Asia, markets are lower on a no news session. In Europe, as Spanish unemployment breaks 25%. Crude Oil and Gold continue lower, suggesting future demand weakness.

The big release today is GDP, but we also will get Personal Consumption, Core PCE, U. Michigan Confidence. The earnings parade continues, with lots of major releases.

What's been said:

Discussions found on the web: