My favorite quarterly chart book is out via JPMorgan. Here are two charts to tease you — go download the entire desk here.

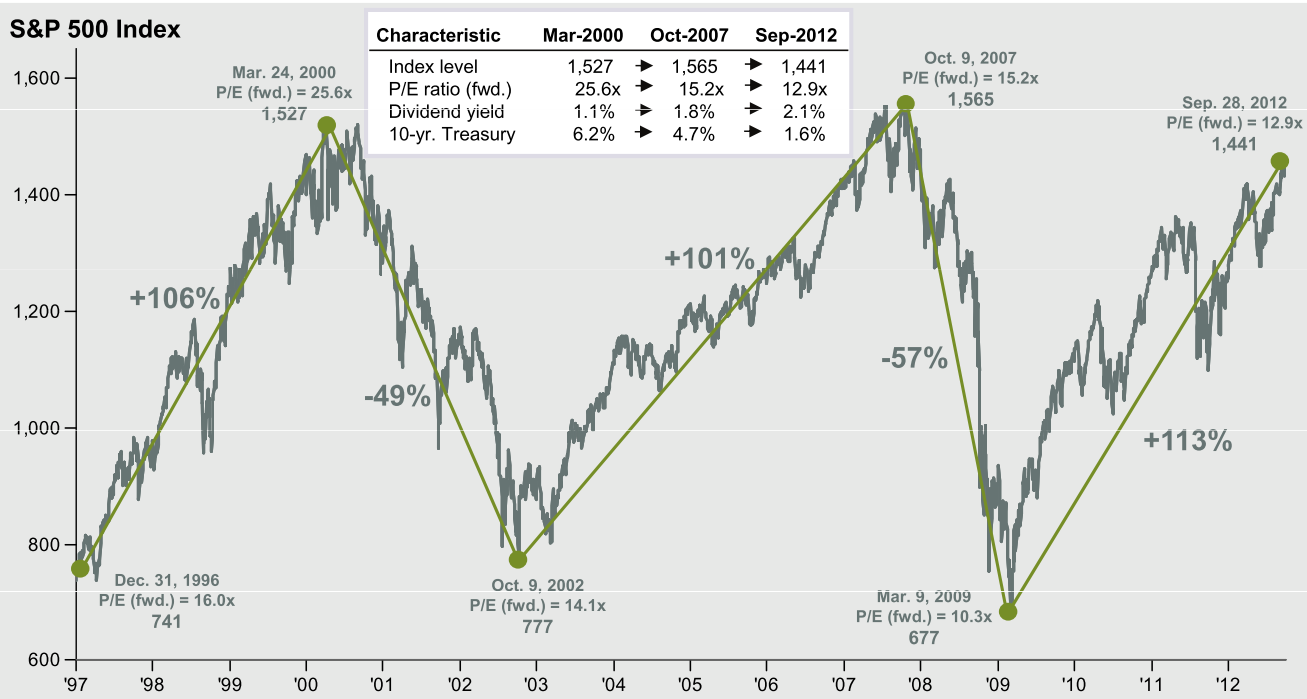

S&P500 Index at Inflection Points

click for ginormous graphic

~~~

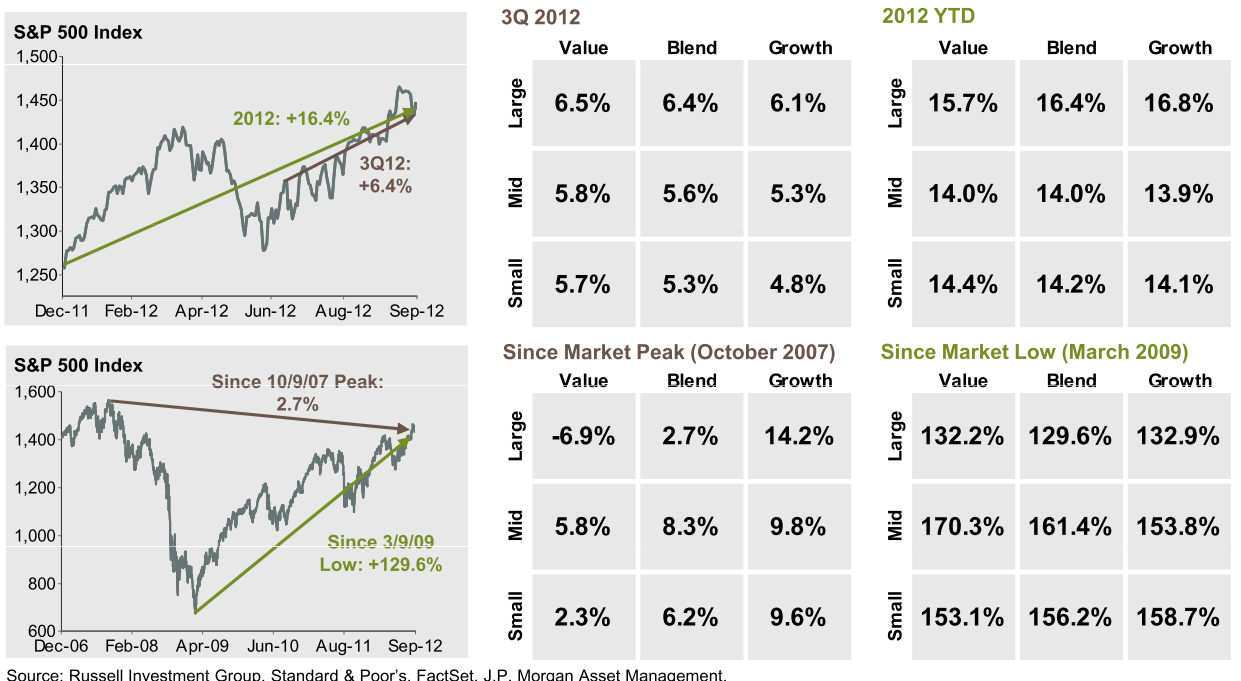

Market Returns Q3, 2012

click for ginormous graphic

Source: BLS, FactSet, J.P. Morgan Asset Management.

Chart reflects index levels (price only). All returns and annotations reflect total returns, including dividends. (Data updated as of 9/30/12).

Source: JPMorgan

What's been said:

Discussions found on the web: