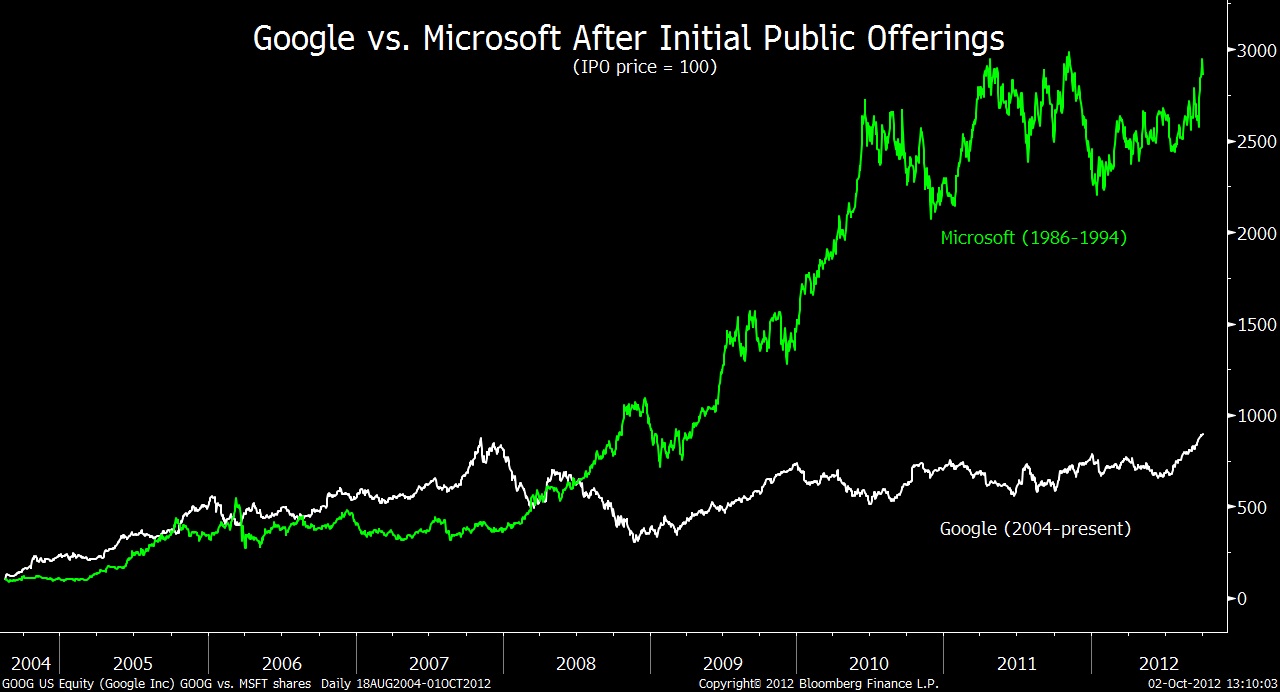

Click to enlarge:

Source: Bloomberg

Fascinating comparison between Google and Microsoft gains since their IPOs from Dave Wilson. Earlier this month, Google managed to slip past Mister Softee in terms of market cap (MSFT is now $244.8B vs GOOG $243.56B).

Microsoft Corp.’s stock-market performance during its first eight years as a public company far surpassed Google. MSFT soared about 30-fold in the 8 year period after its March 1986 IPO, peaked at more than $600 billion in cap in December 1999.

The key to long term IPO performance is initial valuation when going public. Microsoft soared about 30-fold in the same period after its March 1986 IPO. Microsoft’s market capitalization, which peaked at more than $600 billion in December 1999.

The gap in stock performance reflects a disparity between the valuation of Google, based in Mountain View, California, and Microsoft, based in Redmond, Washington, when they first sold shares publicly. Google was valued at $23 billion in its IPO, which followed a price cut and a reduction in the number of shares sold. The dollar amount was 44 times the comparable figure for Microsoft, which went public at a $519 million valuation.

Consider this when you consider what Facebook’s long term performance might look like, coming public near $100 billion valuation . . .

Source:

Microsoft Gains Ease Sting of Google Valuation

David Wilson

Bloomberg, October 2, 2012

What's been said:

Discussions found on the web: