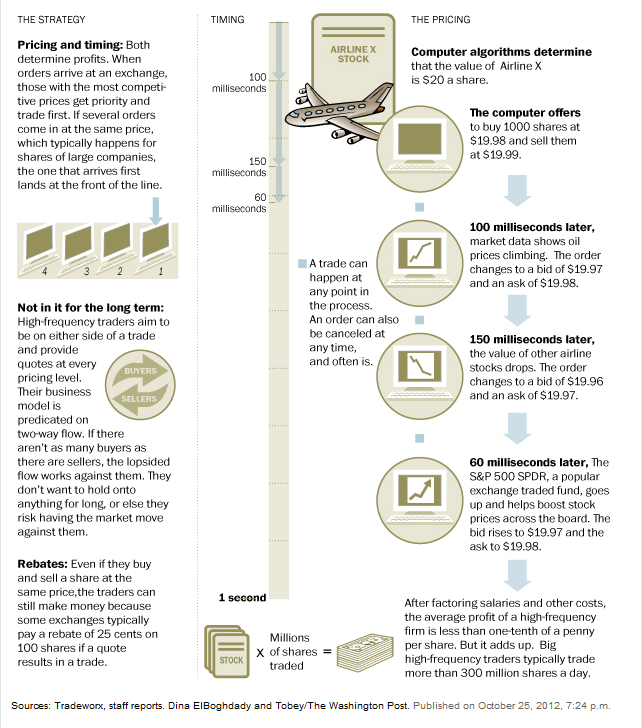

click for larger graphic

chart via WP

Source:

Is high-frequency trading a threat to stock trading, or a boon?

Dina ElBoghdady,

WaPo, October 25 2012

http://wapo.st/R3M01c

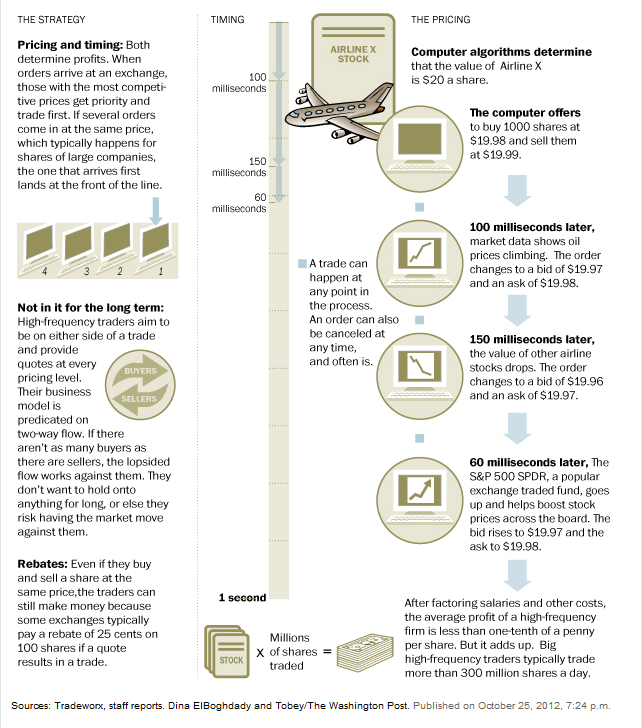

click for larger graphic

chart via WP

Source:

Is high-frequency trading a threat to stock trading, or a boon?

Dina ElBoghdady,

WaPo, October 25 2012

http://wapo.st/R3M01c

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: