My afternoon train reads:

• Bye-Bye, PCs (Barron’s)

• U.S. Stocks Top All Other Assets for First Time Since ’95 (Bloomberg)

• Countdown to change at the Fed (Market Watch)

• John Paulson Doubles Down on Real Estate (WSJ) see also Doubts About Independent Foreclosure Review Spread (ProPublica)

• When Banks Were Able to Print Their Own Money, Literally (Echoes)

• IMF’s epic plan to conjure away debt and dethrone bankers (The Telegraph) see also Will central banks cancel government debt? (FT Alphaville)

• You Don’t Work as Hard as You Say You Do (Economix)

• The Voter-Fraud Myth (The New Yorker)

• Apple Sees Schools Buoying Tablet Lead With iPad in Class (Bloomberg) see also Small iPad may be big problem for Kindle (Market Watch)

• These Pictures May Give You Nightmares About The Canada Oil Sands (Business Insider)

What are you reading?

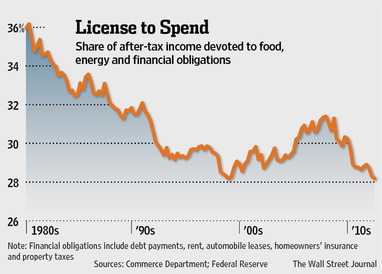

The Once-Mighty U.S. Consumer Awakens

Source: WSJ

What's been said:

Discussions found on the web: