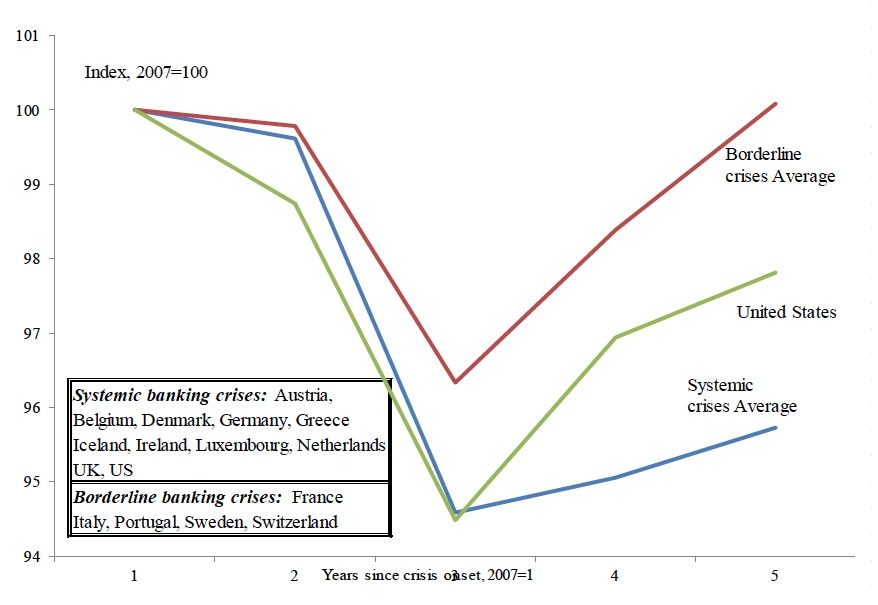

Real Per Capita GDP (levels): 2007-2011 Systemic & Borderline Crises in Advanced Economies

Sources: Laeven and Valencia (June 2012), Reinhart and Rogoff (2009), GDP per capita from Total Economy Database, Conference Board.

I have long been a fan of Reinhart & Rogoff‘s work on credit crises, going back to their December 2007 paper on major deleveraging cycles (5 Historical Economic Crises and the U.S.). That very much influenced my thinking not only in advance of the crisis hitting, but in what we should expect afterwards. Writing in advance of the crisis and recovery, R&R turned out to be more correct than anyone else covering the space.

Apparently, one of the downsides of writing THE seminal paper is watching it get bastardized for political purposes. The econ duo finally had enough of it, and published a Harvard PDF and Bloomberg column correcting the misinterpretations:

Five years after the onset of the 2007 subprime financial crisis, U.S. gross domestic product per capita remains below its initial level. Unemployment, though down from its peak, is still about 8 percent. Rather than the V- shaped recovery that is typical of most postwar recessions, this one has exhibited slow and halting growth.

This disappointing performance shouldn’t be surprising. We have presented evidence that recessions associated with systemic banking crises tend to be deep and protracted and that this pattern is evident across both history and countries. Subsequent academic research using different approaches and samples has found similar results.

What makes it particularly interesting is that these two academics decided to name names: They cited “including Kevin Hassett, Glenn Hubbard and John Taylor. Its not a coincidence that they are advisers to presidential challenger, Mitt Romney.

As an outside observer, I cannot tell if Hassett, Hubbard and Taylor are serious in what they write or merely posturing (Hassett, author of Dow 36,000, has proven himself such an enormous money loser, he is quarantined). But Hubbard and Taylor are potential CEA Chair and Fed Chair respectively, and are worthy of paying attention to.

I care much less about the presidential politics than I do the next administration’s policies.If these two gentlemen have a fundamental misunderstanding of the nature of the crisis and recovery — something that Obama’s econ team similarly suffered from — it does not bode well at all.

As the chart above (and at their paper) make clear, systemic crises and their subsequent recoveries are very different than typical balance sheet recessions. R&R named names because they disliked the way their work was being misinterpreted and misused for partisan reasons. I also suspect they are concerned that these errors may be the basis of subsequent policy decisions.

Let’s hope that whoever wins the election in November, shifts towards a reality based economics policy, rather than one based on erroneous interpretations and wishful thinking.

Previously:

5 Historical Economic Crises and the U.S. (February 9th, 2008)

Wall Street analysts and economists have this recession recovery wrong

Washington Post, July 15, 2011

http://www.washingtonpost.com/business/wall-street-analysts-and-economists-have-this-recession-recovery-wrong/2011/07/14/gIQAVRTIGI_story.html

Sources:

This Time is Different, Again? The United States Five Years after the Onset of Subprime

Carmen M. Reinhart and Kenneth S. Rogoff

Harvard University, October 14, 2012

http://www.economics.harvard.edu/faculty/rogoff/files/Is_US_Different_RR.pdf

Sorry, U.S. Recoveries Really Aren’t Different

Carmen M. Reinhart and Kenneth S. Rogoff

Bloomberg, Oct 15, 2012 6:30 PM ET

http://www.bloomberg.com/news/2012-10-15/sorry-u-s-recoveries-really-aren-t-different.html

What's been said:

Discussions found on the web: