Wall Street pays QE3 no mind

Source: Merrill Lynch

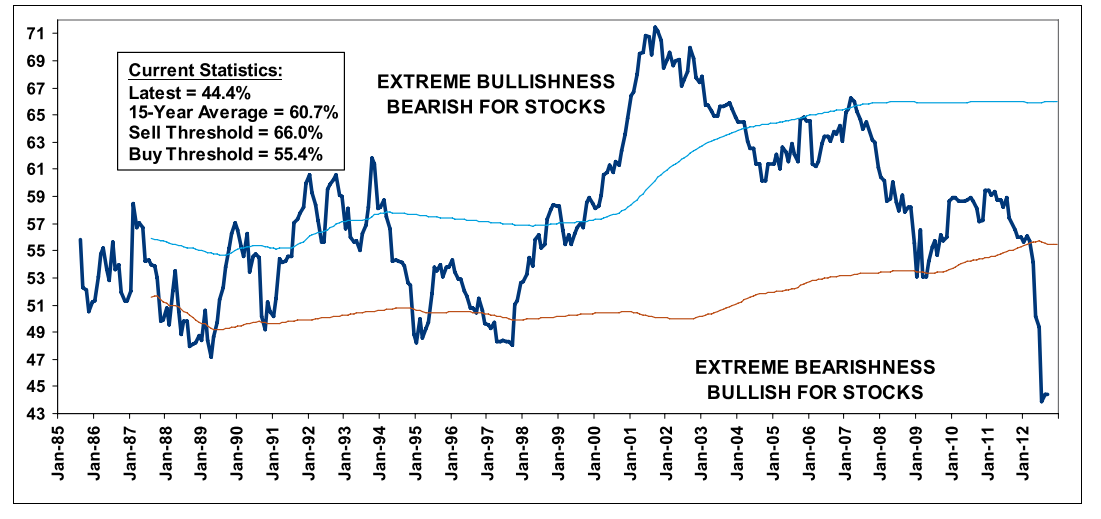

Merrill Lynch’s Equity & Quant Strategist, Savita Subramanian, notes that Wall Street is still excessively bearish, and that this remains a reliable contrarian indicator:

The Sell Side Indicator is based on the average recommended equity allocation of Wall Street strategists as of the last business day of each month. We have found that Wall Street’s consensus equity allocation has historically been a reliable contrary indicator. In other words, it has historically been a bullish signal when Wall Street was extremely bearish, and vice versa. See our November report for more details on the Sell Side Indicator.

Source:

Wall Street pays QE3 no mind

Savita Subramanian

Equity & Quant Strategy

01 October 2012

What's been said:

Discussions found on the web: