Brett Arends has an interesting article over the weekend about timing the market: It’s Time to Time the Market.

After giving the usual reasons why market timing doesn’t work, he mentions an approach that is similar to my own: Using valuation and sentiment to make tactical adjustments (Incidentally, “Tactical” is the new buzzword amongst brokers and others who are not really using it properly).

Long term, Arends argues, stocks and bonds are not cheap:

“Over the past 80 years, according to data from New York University’s Stern School of Business, bond investors have earned an average of just over 2% a year, adjusted for inflation. The only way an investor would earn anything similar over the next decade would be if inflation were negative.

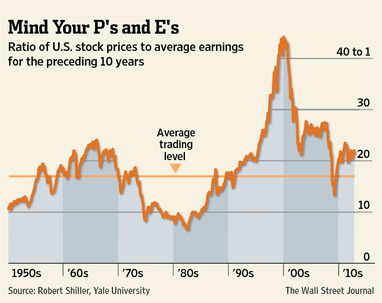

Stocks, too, seem pricey. Over the past 130 years, U.S. stocks on average have traded at about 17 times mean earnings for the previous 10 years—a measure known as the “Shiller Price/Earnings Ratio” after Yale economics professor Robert Shiller, who tracks the data. Today the market is about 22 times those earnings, a level associated with frothy markets such as 1929, the mid-1960s, and most of the period from 1995 to 2008.

Another measure, “Tobin’s q,” also suggests stocks might be in dangerous territory. Tobin’s q, named for the late Nobel economics laureate James Tobin, measures stock valuations against the cost of replacing companies’ assets. Right now the reading is 0.92, about 50% above the long-term historical average. Stock returns from these levels have usually been subpar.”

Under normal circumstances, I would have been aggressively pulling back equity exposure since, well last year. The wild card that has prevented me from doing that has been the Fed’s program of QE. Having made riskless assets much less attractive, the Fed’s liquidity fire hose has forced managers into equities beyond what is normally prudent.

Today, we are equal weight equities (we came into the year overweight equities).

The Fed’s impact on asset prices will eventually attenuate. Those of you who are playing along at home, make sure you have some set of parameters to alert you to evidence of when the Fed’s punchbowl has gone non-alcoholic so you can reduce your equity exposure substantially.

We continue to get closer to that point, but we are not quite there yet . . .

Source: WSJ

Source:

It’s Time to Time the Market

Brett Arends

WSJ, October 19, 2012

http://online.wsj.com/article/SB10000872396390443624204578060550181314438.html

What's been said:

Discussions found on the web: